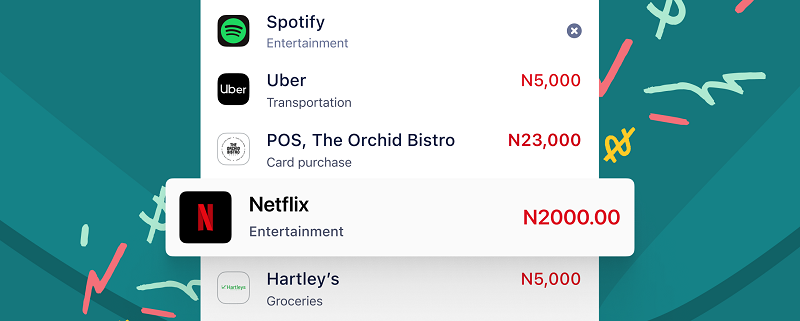

In recent times, a lot of Nigerians are finding it difficult to stream the latest music or see a movie on their favourite entertainment platforms, pay for online courses, subscribe to a service or even run promotions for their businesses online. The reason for this is not far-fetched, many financial service providers are halting card transactions on international payments. With these limitations, payment for subscriptions like Apple Music, Spotify, Google and a couple of other platforms has become difficult and has raised the obvious question, what is the way out?

The solution however is not far-fetched, as gomoney – a digital bank has successfully bridged this gap and answered the ‘obvious’ question with the provision of its virtual and physical cards. The app which takes 3 minutes to set up from your phone via the app store and play store has conveniently made payments possible again. With gomoney, it is seamless to make payments for subscriptions locally and internationally at bank rates with no extra charges. Transactions can also be paused and tracked to monitor the spending on the cards.

Let’s show you how it works. The virtual card can be created between 24 and 72 hours after completing the KYC process- where you enter your personal details and once available, takes a few hours to integrate into your account to enable you to perform international transactions and also make payments on Bolt, Uber and many other applications. The juicy part is you can own up to 3 virtual cards at once and transact with all of them.

Getting the physical card to you is dependent on your location whether you are within or outside Lagos, as it takes between 7-10 business days to be delivered to you at your doorstep for free and can instantly work for all your subscriptions and POS transactions once activated in-app. With the physical cards, you can monitor your spending with ATM and POS transactions in real-time without complexities.

In situations where users face issues during set-up, you can always reach out to their in-app support team with a 20-30 minutes response time or less depending on the traffic and an ever-ready support team rep waiting to attend to you or via email at gomoneysupport@gomoney.global. This makes it faster for you to resolve your issues.

With all that said, you should probably download the gomoney app via the Play Store or App Store and get your subscriptions sorted from the comfort of your phone without any complex registration process or bank queues.

Hello!

I tried both my Physical card and virtual cards since 20th of August and it didn’t go through. could you confirm if it’s still working?