The Federal Government and the Nigeria National Petroleum Corporation (NNPC) Ltd on Tuesday signed a Memorandum of Understanding (MoU) of N621 billion to fund the construction of critical road infrastructure across the country.

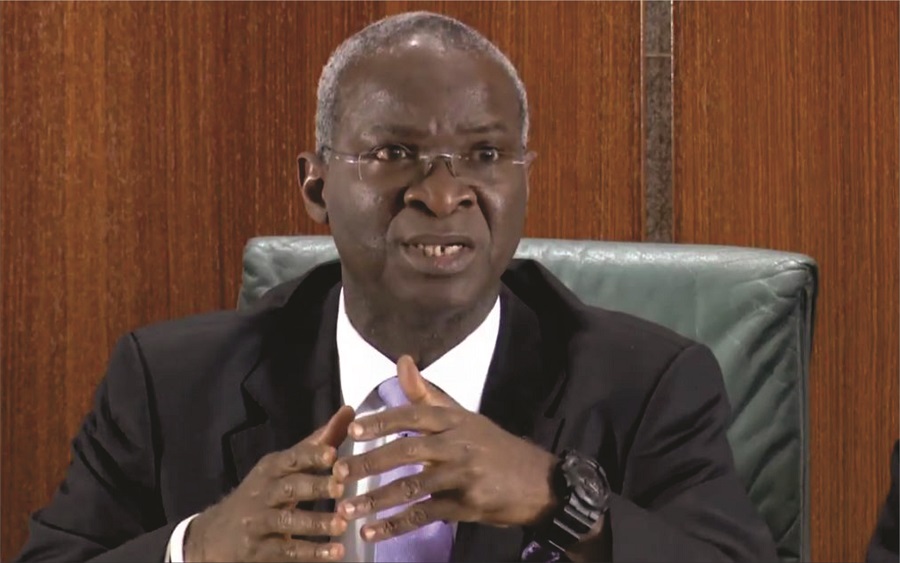

According to NAN, the MoU on tax credit was signed in Abuja by the Minister of Works and Housing, Babatunde Fashola, on behalf of the Federal Government; the Chief Finance Officer of NNPC, represented by the General Manager International Energy Relations, Mr Garba Hadejia; and the Executive Chairman of Federal Inland Revenue Service (FIRS), Mr Muhammed Nami.

The MoU on tax credit was to actualise the Executive Order 007 which ensures compliance to road infrastructure development in the country.

What the Minister of Works and Housing is saying

Fashola in his statement at the occasion said the executive order 007 was a strategic partnership with the private sector, which has been used to address the Obajano-Kabba road and the very difficult Apapa – Oworoshoki express way.

The Minister said, “Of course, when the order expired, we looked at the limitations of the existing order and recommendations were made to the president, some of which were to make the roads more diverse in their selection and another was that smaller companies could merge in groups to handle smaller roads.

‘’All of these were then factored in to the order that president Buhari signed as executive order 007 in 2019, the governance structure around it and how applications are made and so on and so forth.

“So, I think it’s important to make that clear application, because every so often when policies are made, it is misunderstood or requires further clarification, so this is not an order for one person it’s an order for all Nigerian businesses.

“We’re now seeing the oil industry sector step in very sure-footedly with over 600 billion naira to address over 21 roads that cover 1800 kilometre, that’s truly massive, it is a show of confidence by NNPC.

“We are also seeing interests in the Telecom sector, and we hope that this will carry on as a strategic expansion for private sector interest contributing to the development of Nigeria’s infrastructure.

‘’We’re also seeing interests in the Telecom sector, and we hope that this will carry on as a strategic expansion for private sector interest contributing to the development of Nigeria’s infrastructures.’’

Going further, Fashola said that a governance structure had been put in place to ensure that no contractor would ask for an increase in price and that FIRS has 5 days to certify all contractor certificates and NNPC had 30 days to pay up.

He said this had given more confidence to contractors of the assurance to get paid and urged them to mobilise their staff, equipment, supplies back to site.

Also speaking at the occasion, the FIRS boss pointed out that investment in roads was a call on using tax payers’ income tax in fixing critical road infrastructure and also to support the fact that there is a social contract between the tax payers and the government and that is what the Federal Government is doing using order 007 to give value to the tax payers money.

The Chief Finance Officer of NNPC, Mr Umar Ajiya, said the condition of the road networks in the country was affecting their responsibility of providing petroleum products across the country and so find the tax credit scheme a very important way by which the corporation can step in to support the Federal Ministry of Works in funding these road networks.

Backstory

Recall that in October 2021, the Federal Government approved the reconstruction of the collapsed Lagos-Badagry expressway and 20 other federal roads by the newly incorporated Nigerian National Petroleum Corporation (NNPC) Limited.

The Minister of Works and Housing, Babatunde Fashola, who made the announcement, said the approval which was given at the Federal Executive Council (FEC) meeting, would see NNPC take over the reconstruction of 1,804.6 kilometres-long 21 federal roads in critical conditions across the 6 geopolitical zones of the country at a whopping sum of N621.2 billion.

The reconstruction of these roads are being executed via a strategic intervention under the Federal Government Road Infrastructure and Refreshment Tax Credit Scheme with 9 of the selected projects in North-central, 3 in North-east, 2 in North-west, 2 in South-east, 3 in South-south, and 2 in South-west.