Last week, I read how Davido, a global music star, jokingly asked for donations to clear his luxury Rolls Royce car from the Lagos port. That story may be an exaggeration, but it does provide a backdrop to discuss fiscal federalism in Nigeria. Fiscal federalism is the assignment of revenue collections and spending powers between the federating units.

Who gets the cash paid as import duties if Davido, from Osun State in Nigeria’s Western Region, imports a Rolls Royce into Nigeria and pays import duties? The State? The Federal Government? Who?

How much is paid to import a Rolls Royce to Nigeria?

The lowest cost of a 2021 Rolls Royce Cullinan 4 door SUV AWD comes with a manufacturer’s suggested retail price of $300,000. We summarise from the internet that Mr. Davido did upgrade his Roys Royce. Thus a rumoured price of about $500,000 is appropriate. With the exchange rate at the NIFEX of about N413.09, that’s about N206.54m

How much will Davido pay to Nigerian Customs?

According to the Nigerian Customs Service, Mr. Davido will pay an import duty of 35% plus a 5% levy charge for new luxury vehicles imports into Nigeria. The total cost will include the cost of the car, insurance paid, and Freight (CIF). Thus the imported Rolls Royce will be taxed on the car’s invoiced price, plus shipping and insurance. There will also be a 7.5% Value Added Tax (VAT) on the CIF value of the import. To keep it simple, let us assume a total cost plus shipping and insurance at $500,000.

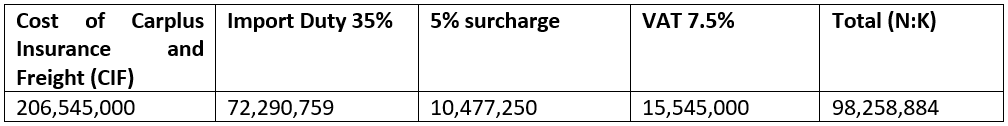

A table capturing the total costs would look like this

Table 1, Cost of Importing luxury SUV to Nigeria

Table 1. estimates a cost of about N98 million to import a Fully Built Unit (FBU) of 1 Rolls Royce Cullinan worth about $500,000 into Nigeria. However, suppose Mr. Davido had imported a Semi Knock Down Rolls Royce, intending to assemble same in Nigeria, by setting up an assembly line. In that case, he could have paid a 10% duty with no 5% surcharger. This is because the Federal government’s trade policy seeks to capture value addition in Nigeria, thus lowering imports that will lead to local job creation.

Where do the Rolls Royce revenues go?

Where does the N98 million go? The Customs revenues collected by the Nigerian Customs and the VAT collected by the Federal Inland Revenue Service (FIRS) go to the Federation account – see Infographics 1 by StatiSence

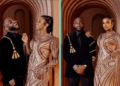

Both agencies will deduct a fixed charge for collecting taxes on behalf of the Federation from the gross revenues. The Nigerian customs deduct 7% of the gross collections, while the FIRS deducts 4% of gross VAT collections.

Infographic 1: The Flow of Revenues

Our new table will now look like table 2. A total of N6,415, 560.63 is total collections to Customs and FIRS and flows to the Consolidated Revenue Fund.

Table 2: Collections net of cost of collections

How are the revenues shared from the federation account?

How are the revenues shared from the federation account?

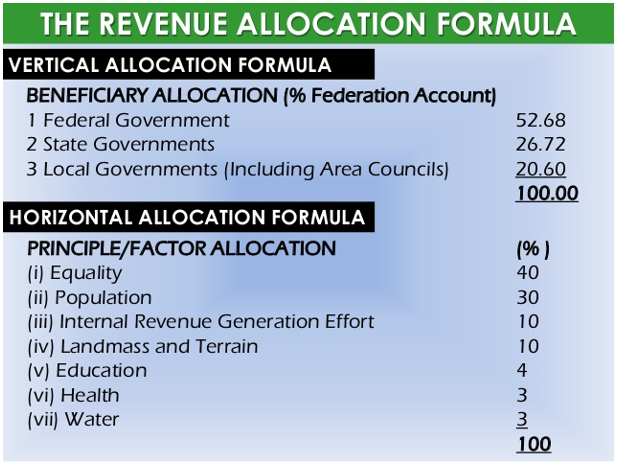

Nigeria has two lanes for revenue sharing. The Vertical formula describes how revenues are shared among the federating units of the Federal Government, the State, and Local Governments. The most recent review of this formula was in March 2004 via an Executive Order and subsequent letter from the then Minister of Finance Ngozi Okonjo Iweala.

The horizontal sharing formula indicates how the revenues in the Consolidated Revenue Fund are shared according to the States and LGA, according to the principles of Equality, Population, Internal Revenue, Landmass, Rural roads, Inland Water Way, Education, Health and portable water.

Using this infographic from the Statisencet, the Federal Government will get the bulk of the import duties paid by Mr. Davido.

The federating units meet monthly under the auspices of the Federation Accounts Allocation Committee Meetings. The exact amount disbursed among the federating units from the import duties and VAT collected will look.

How much will Osun State receive?

How much will Osun State receive?

States in the Federation will get N55.18 million to share amongst themselves. How much will Mr. Davido’s home State of Osun get? Hard to tell; Nigeria’s gross allocation metrics are a mystery to me. Osun State, with 30 Local Government Areas, gets less in Gross Statutory Allocations than Zamfara State with 14 local governments, even though Osun State has a higher population than Zamfara. by VAT, however, Osun, gets more than Zamfara in gross allocation.

Perhaps Mr Davido would be better advised to do a gofundme campaign and set up a Rolls Royce assembly plant in the proposed FTZ in Dagbolu, Ifelodun LGA of Osun State. An inland port is planned for the free trade zone as well. Mr. Davido can then import Completely Knocked Down (CKD) Rolls Royce at only 10% of the import duties to the inland port, assemble, and sell. Perhaps that is a bridge too far, but for now. Hey! It’s a plan.

This article has been updated to reflect new details and correct figures…

In my opinion, this article is inaccurate and confusing on 2 levels. First, the claim that CRF will receive the total vehicle cost (200m+) is wrong. Rather only the excise duty + VAT – cost of collections goes to CRF. Second, Osun might be Mr Davido’s state of origin, but it plays no single role in the chain of economic activity. Also the wealth used to buy the car was not generated from Osun state itself, so state of origin may not be a good yardstick for suggesting who should benefit most from our taxes.

This is correct

Kindly check the figures. The cost of the car should not have been used to calculate the allocation. Rather the N98m should have been used.

In your example, import duties 35%+ 5% Surcharge + 7.5% VAT = N98,258,884 (deductible from N206 million, in Table 1)

In Table 2. Custom deduction 7% and 4% FIRS deduction should be from N98,258,884 above in Table 1.

Deductions by custom and FIRS shouldn’t be based on the total cost of vehicle and freight, because that money isn’t available to custom and FIRS to make deductions of 7% and 4% from

Your estimation from Table 2 downward is therefore grossly inaccurate and should be corrected to avoid unnecessary confusion. Thanks

Your post is apt and on point. Perfect analysis

Thank you for the detailed analysis which has improved my understanding of the revenue allocation.

It’s good you’ve updated the figures, but you may want to look at the last section where you say the states will share 55m.

Interesting and enlightening. It would be nice to know why revenue allocation to States is lopsided.

The revenue sharing in the article was calculated using the cost of the vehicle (CIF) instead of the cost of import which is what is remitted to the Government.

This calculations above are wrong, you should make them again

I sincerely like the analysis of the purchase and revenue collection of the car. That is interesting but with present scheme of things in Nigeria especially politicians reaping heavily from lopsidedness of our politics, no politicians will go into such venture instead would prefer politics of selfishness to amass wealth for them selves rather invest in such process where states and individual would reap abundantly.

I am not so much interested in the calculations and sharing hence from my opinion the writer is trying to emphasise the need for job creation in Davido’s home state and the number of people such amount of money could feed if he set up a RR plant in Nigeria.

It’s true that he made his money and has the right to spend it, but doesn’t it look more like a waste looking at the sufferings of many Nigerians?

Besides some of those folks that were quick to donate millions, may not be willing to do so for hospitals, or schools in their states.

It also reminds us how much President Buhari has lavished or squandered in overseas medical trips.

Please help me do the calculations.

You should be thanking your young man,look how much he has donated to the orphanages throughout your country. Maybe,just maybe,let’s also see how much we have done for our people at personal level. This young man at just 29 to is a blessing to your country. Do your part as well

Good content but The revenue sharing in the article was calculated using the cost of the vehicle (CIF) instead of the cost of import which is what is remitted to the Government.

Also, thank you for raising the critical point of import substitution. Irrespective of where the assembly plant is located, imagine the ‘big fishes’ in Nigeria who want to buy Rolls Royce, come together and speak to the company to set up a factory for assembling Semi Knocked Down Cars. SKDs are almost as good as the finished product, and easy to assemble. Within a few years the cars will be cheaper than fully imported cars that have 35% Custom Duty. And the factory will employ hundreds of Nigerians, generate CIT and personal tax to the government. Imagine if that happened with all buyers of new saloon cars in Nigeria……..