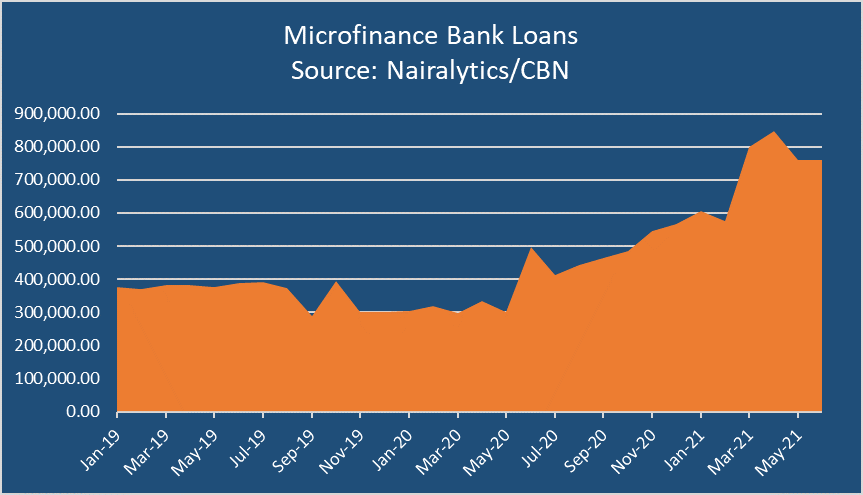

Microfinance Banks in Nigeria (MFBs) collectively recorded a total loan to the private sector of N761.4 trillion as of June 2021. This is according to provisional data from the Central Bank of Nigeria. This follows a similar contraction in February and the second in about 10 months.

The slowdown is a sign that microfinance banks’ aggressive loan growth is entering maturity phase as borrowers gobble up debt without a commensurate rise in income. Microfinance Banks have pursued an aggressive loan creation in recent years topping N567 billion in 2020 over 80% higher than what was reported in 2019. The rise in microfinance loans has been on the back of FinTech driven loan penetration to the formal and informal sector as players leverage on technology to conduct profiling, drive marketing and advertising, targeting working-class Nigerians.

However, the latest drop is the first slow down recorded this year and since we started tracking the data. In May, the CBN reported a total loan to the private sector of N761.4 billion compared to N798.3 billion in March, a 38.6% rise and the highest month on month gain since June 2020. However, April numbers were N847.6 billion, the highest on record. The central bank did not reveal the reasons for the slowdown.

Microfinance Banks do not also reveal their data.

Why this matters: A slow down in loan growth could be due to a number of reasons. However, this suggests borrowers are worried about the state of the economy and their finances. Interest rates for borrowing are also on the rise as the central bank adjust monetary policy targets to reduce the impact of negative real interest rates on risk-free government investments.