Life has not been easy for some Chinese multi-billionaires recently. Chinese billionaires are increasingly coming under scrutiny by their own government and the most targeted are those who have expressed anti-Communist Party sentiments in one way or the other.

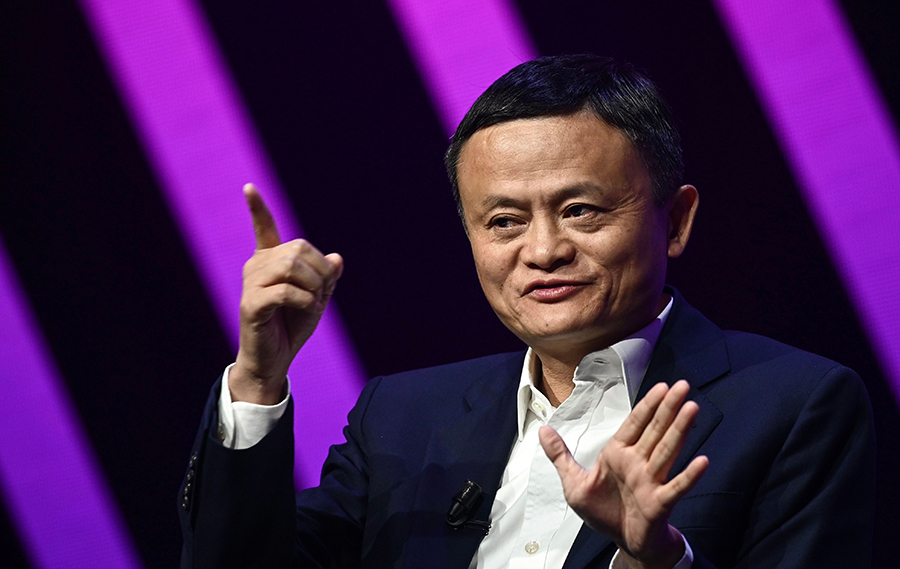

Last week, we did a story on the billionaire founder of Meituan whose company lost $16 billion worth of market valuation because he posted a historical anti-communist poem on his blog. Today, we are also reporting on how Jack Ma’s Alibaba posted a $1.2 billion loss, the company’s biggest loss in several months and its first quarterly loss since going public.

READ: Alibaba in hot water on China’s regulators probe over Ant Group

How it all started

Things were going smoothly for Jack Ma and his Alibaba Company early last year. Alibaba’s FinTech affiliate, ANT Group was even on the verge of a $35 billion Initial public offering but all hell broke loose when Alibaba’s Founder openly criticized the Chinese government.

Jack Ma criticized the Chinese government at the Bund Summit in China, an international communication platform for finance and business ideas.

READ: China’s richest man worth $94.1 billion earned a fortune from selling bottled water

These were the three key things he said:

- He said China lacked sufficient number of experts to make policies that align with development.

- He said China lacked a proper financial system and the banks in China are strongly controlled by the Government. He believes this is an old system only used by developing countries.

- He also criticized China’s regulatory bodies which he believes should be supervising and not interfering too much.

READ: Yang Huiyan: The richest woman in China who made $2 billion in 4 days

Jack Ma’s subsequent woes

After Jack Ma’s inflammatory speech, his $34.5 billion ANT Group IPO was suspended by the Chinese Government. Alibaba lost around 17% of its market value.

Alibaba was hit with a $2.8 billion fine for abusing its dominant market position.

Recently Alibaba posted a deficit of 7.7 billion Yuan ($1.2 billion) for its fourth quarter ended March.

Alibaba shares tumbled 4% in Hong Kong on Friday, down almost 33% from its peak in October.

Alibaba group is still under scrutiny by China’s Antitrust law regulators.

Jack Ma is now the 3rd richest man in China. He used to top the list.

READ: How the Chinese are taking over Nigeria’s economy

What you should know

China’s Antitrust Laws were formulated in 2007 and their primary objective is to prevent and restrain monopolistic conducts, protect fair competition in the market, enhance economic efficiency, safeguard the interests of consumers and the public interest and promote the healthy development of the socialist market economy.

In layman’s terms, it is a law aimed at taming Chinese billionaires from becoming too powerful, beyond state control.

I love what I have read.

How do I get started in investing in bamboo?