The highlight of the previous week was the monthly bond auction where the DMO sold more than its planned offer at higher rates than in March but leaned heavily on non-competitive bids. Elsewhere, financial market conditions remained tight pushing interest rates higher while the Senate nodded along to some FX loans as reserves slackened.

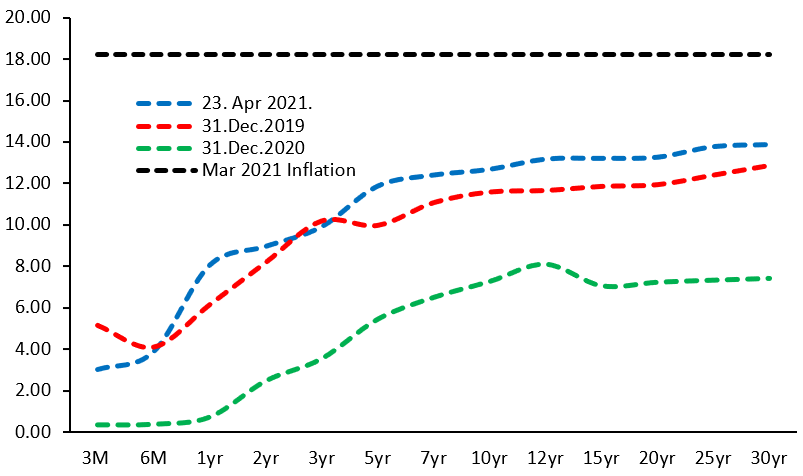

Money markets remained tight, pushing front end yields

Interbank rates receded from the elevated levels (30%) of the prior week, however, they still remained high at 15-16% levels relative to single-digit levels over Q1 2021. As such bank borrowing from the CBN’s standing lending facility (SLF) tracked higher with cumulative net exposures of NGN678billion last week vs. NGN332billion in the prior week. This suggests that the combination of an end to the era of large monthly OMO maturities in March and CBN’s switch to CRR as its default liquidity tightening tool has resulted in tighter liquidity levels across the banking system. As a result, placement rates for large institutions have pushed past the 10% mark from 0-1% at the start of 2021. This cash strain continued to underpin sell-offs across all segments of the treasury bills market: NTB yields: +19bps w/w to 4.99%, OMO bills: +52bps w/w to 7.7%, May 31 SPEBs: +36bps w/w to 6.54% as banks looked to fund their liquidity positions.

Figure 1: Naira Yield Curve

Source: FMDQ, NBS

Source: FMDQ, NBS

In the secondary market, FGN bond yields tracked higher (+15bps w/w) reflecting a re-pricing post the bond auction but the market looked a bit like some buying had returned with limited selling pressures. On the corporate space, MTN closed out on its debut Naira bond sale, clearing NGN115billion at 13% for 7-year money.

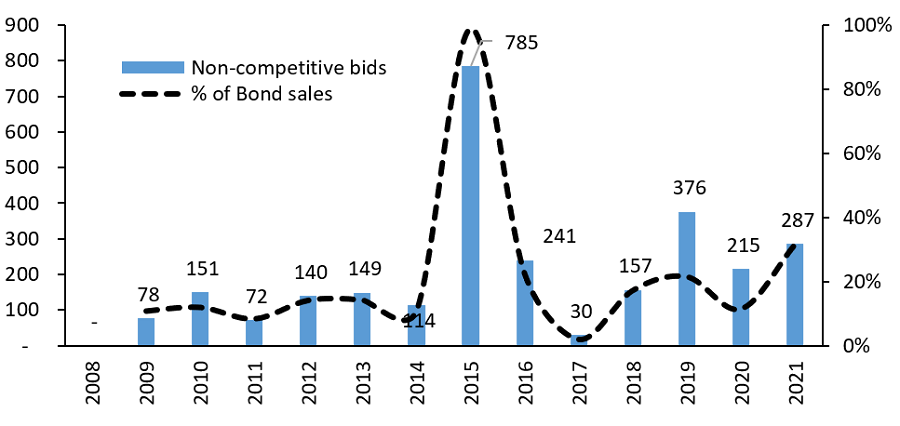

DMO relies on non-competitive bids to meet borrowing target

At the April bond auction where the Debt Management Office (DMO) had NGN150billion worth of bonds to sell, demand came in at 1.8x relative to the offer, less robust than in March (2.2x). However, the market was unaware that the DMO had lined up NGN117billion worth of non-competitive bids (78% of its offer) which it deployed to full effect, allowing a total sale of NGN274billion. The existence of the large NCBs, which were deployed to the 2027s and 2035s, implied that allocations went contrary to my expectations for over-allotment of these papers and allowed the DMO the luxury of over-allotment to the 2045s. In terms of clearing rates, the DMO, as I suspected, allowed the 2027s and 2035s rise to 12.25 and 13.34% and elected to clear the 2045s well under 14%. As I noted after January’s auction, plans to tap unclaimed dividends and dormant account balances implied that the DMO potentially has a large amount of NCBs over 2021 to meet borrowing targets. We are only in April and the YTD number is the third highest print since Nigeria commenced monthly bond auctions in 2008.

Figure 2: Non-competitive bids

Source: DMO 2021* (Jan-Apr)

Source: DMO 2021* (Jan-Apr)

FX reserves dip, Senate approves FX loans but no light on Eurobonds

After three weeks of consecutive increases, Nigeria’s FX reserves slid 0.4% to USD35.1billion. The Naira remained range-bound across most segments: Official (NGN379/$), Nafex (NGN410/$) and parallel (NGN482.5/$). During the week, the Senate approved two sets of loans: USD1.5billion (World Bank) and EUR995million from the Brazilian Export-Import Bank (BNDES). The World Bank loan is not new as this is exactly the facility approved in December for Nigerian states (so not for FGN budget support) so the Senate approval suggests that actual deployment is imminent and per foreign borrowing requirements, the procedural senate green light is required. The BNDES loan is for agriculture mechanization. These two facilities should provide a momentary boost to FX reserves but the key to Naira outlook remains a potential Eurobond sale.

This week (April 26-30, 2021)

This week, system inflows should improve driven by inflows from FAAC (NGN681billion), FGN Bond coupons (NGN160billion), NTB (NGN88billion) and OMO bills (NGN10billion). The improved liquidity conditions should drive moderation in funding pressures and by extension interest rates across money markets. At the NTB auction on Wednesday, where the CBN, on behalf of the DMO, will look to roll over NGN88billion in NTB maturities, my suspicion is that we are likely to see the 1-yr paper achieve parity with stop rate for the 1-yr OMO bill level (10%), in tandem with the gradual pattern towards convergence observed in recent weeks. In the corporate space, two transactions are on the market: Dangote Cement’s NGN100billion bond sale split across three tenors: 3yr, 5yr and 7yr and C&I Leasing’s NGN10billion offer.

Above-target local borrowing suggests supply slowdown likely in H2 2021

YTD, the DMO has sold NGN909billion worth of bonds. In addition, a total of NGN1.5trillion worth of NTBs has been issued which, adjusted for maturities thus far of NGN1.02trillion, implies that on net basis, DMO has conducted NGN488billion of fresh borrowings on the front end of the curve. As 82% of these fresh NTB sales (NGN399bilion) pertain to 1-year papers, it appears to me that the DMO has effectively raised NGN1.3trillion on aggregate relative to its NGN2.1trillion target for domestic borrowings. This translates to a monthly borrowing run rate of NGN274billion for bonds, well ahead of the implied NGN216billion run rate. Adjusting what’s left to borrow over the rest of 2021 for a likely Sukuk bond sales of NGN200-250billion, my suspicion is that actual monthly issuance rates will have to slow down to under NGN150billion at some point possibly over Q3 2021 when the DMO views it has a clear line of sight to its target NGN2.1trillion. Under that circumstances, depending on monetary policy which I expect to tighten aggressively either in May or July, interest rates which are now over 2019 levels are likely to peak.