The present amount of Bitcoin held on leading crypto exchanges suggests a likely bullish bias on the price of Bitcoin as business entities and large organisations continue to accumulate the crypto asset at record levels despite the strong dollar and rising U.S Treasury yields.

Just recently, MicroStrategy a leading institutional investor of the flagship asset revealed that it had purchased an additional 253 bitcoins for $15.0 million in cash at an average price of $59,339 per bitcoin.

Microstrategy further revealed it had about 91,579 bitcoins acquired for $2.226 billion at an average price of $24,311 per bitcoin.

READ: 1 Bitcoin will buy you a house in Nigeria’s rich suburb

MicroStrategy has purchased an additional ~253 bitcoins for $15.0 million in cash at an average price of ~$59,339 per #bitcoin. As of 4/5/2021, we #hodl ~91,579 bitcoins acquired for ~$2.226 billion at an average price of ~$24,311 per bitcoin. $MSTRhttps://t.co/OMQMhA85xw

— Michael Saylor (@michael_saylor) April 5, 2021

In addition, recent data form Glassnode suggests that Bitcoin miners are hoarding the world’s most popular crypto at record levels rather than selling, thereby limiting supply for the highly prized crypto asset as seen in recent days.

READ: Bitcoin whale transfers $105 million worth of crypto, BTC trading at $15,800

#Bitcoin miners are continuing to HODL. pic.twitter.com/AahRS7M9wU

— Documenting Bitcoin ? (@DocumentingBTC) April 4, 2021

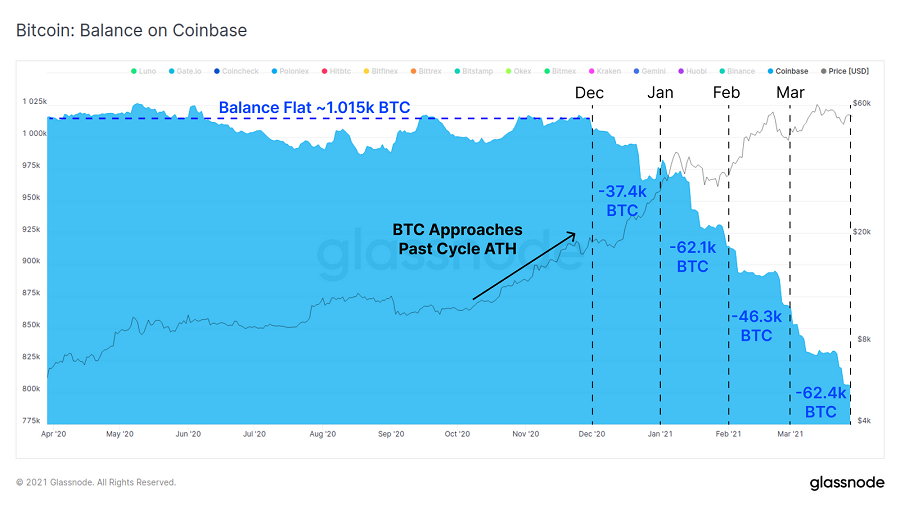

The crypto analytic firm further revealed that institutional buying further reduced the amount of Bitcoin on the world’s most valuable crypto exchange amid growing institutional participation.

The report placed particular interest on the amount on Bitcoin at Coinbase, a preferred venue for accumulation by US institutional investors.

READ: Coinbase executes over $1 billion Crypto trades for world’s biggest clients

The chart shows the BTC balance on Coinbase over the past year

We can see that in December 2020, the game changed. As BTC price approached the previous cycle all-time high at $20k and market confidence grew, serious institutional accumulation commenced. This started with 37,400 Bitcoins withdrawn in December.

Accumulation at rates exceeding +130,000 BTC/month have been consistently maintained throughout this bull market.

Holders were nervous on the rally from $12k to $18k and distributed some coins (box #4).

A significant volume of coins matured/HODLed (+207k BTC/m) as price broke above last cycles ATH as shown by large green bars in Box #3.

Maturing and HODLing of coins continues today with a rate of change hitting +195k BTC/m this week.

It is fair to also note that only 21 million Bitcoins are ever going to be produced in total, and presently, there are about 18.6 million BTCs in circulation, with about 4 million BTCs already lost forever. Taking the present demand for the flagship crypto into consideration, crypto pundits argue that the price will likely continue north except global bureaucrats limit its usage.

At the time of writing this report the crypto asset was trading at $58,674.11 on the FTX Exchange with a daily trading volume of $52,206,280,871 . Bitcoin is up 0.42% for the day.