The crypto market recently lost much of its weekend’s stellar gains, as significant selling pressure pushed the value of crypto assets lower across the market spectrum, amid record sell-offs and sudden panic among retail and institutional traders.

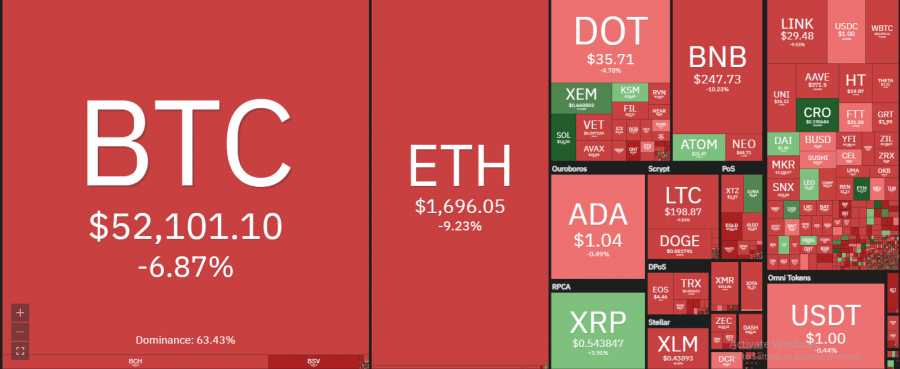

At press time, over $140 billion in value evaporated into thin air, taking into consideration the world’s most popular crypto, Bitcoin, the dominant player in the crypto market, lost as much as $7,000, according to data retrieved from Coin360.

The global crypto market value is $1.57 trillion, an 8.98% decrease over the last day.

READ: Motley Fool reveals plan to buy $5 million worth of Bitcoin

The total crypto market volume over the last 24 hours is $232.12 billion, which makes a 63.54% increase.

- The total volume in DeFi is currently $21.16 billion, 9.12% of the total crypto market daily volume.

- The volume of all stable coins is now $185.65 billion, which is 79.98% of the total crypto market 24-hour volume.

- Bitcoin’s price is currently $52,260.20.

- Bitcoin’s dominance is currently 61.56%, a decrease of 0.03% over the day.

- For the day, 426,586 trades were liquidated.

- The largest single liquidation order happened on Huobi-BTC valued at $20.66 million.

Other leading crypto assets that include Ethereum, Litcoin, Chainlink, Binance coin and Stellar lost more than 8% in value.

READ: Bitcoin joins the trillion-dollar club with Apple, Saudi Aramco and Google

Despite the expected market correction ongoing in the crypto community, some crypto traders remain upbeat that cryptocurrencies are fast emerging as a hedge for risks such as faster fiat inflation, and set to win more attention from the corporate world.

However, crypto pundits anonymously interviewed by Nairametrics are saying that a market correction was long overdue after the sudden bullish move. The bearish trend prevailing at the bitcoin market is largely attributed to a significant amount of profit-taking in play, on the account that Bitcoin’s realized profits are at record highs.

Nice one keep me posted

Considering how deep the crypto ocean is by now, for me I will say it normal to see this kind of relapse from a very bullish trend. Just like it happened before. As I type this the bounce at 46049.2 for $BTC is already taking shape for another bullish run.

The deep buyers are about smiling…

A happy lose is better, use stop loss…