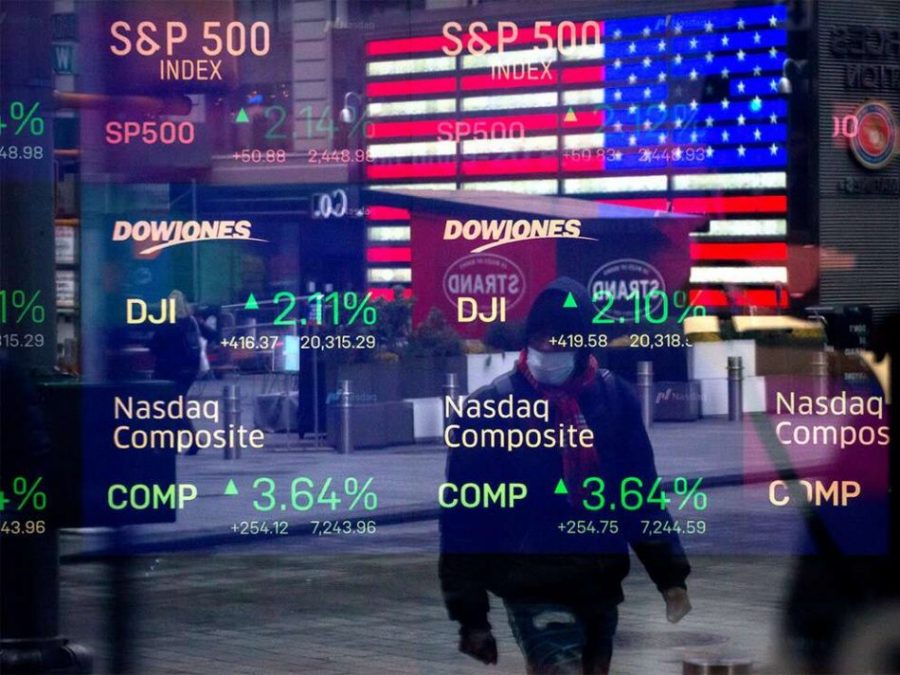

Major investors reduced their holding on stocks popularly referred to stay-at-home stocks amid falling COVID-19 caseloads globally.

The stay-at-home stocks which include Facebook, Alphabet’s Google, Microsoft, and Netflix fell in a trend seen for most of the week. Amazon.com, the world’s most valuable online retail company also dropped in value, as investors sold these growth stocks that have done incredibly well since last March.

The global number of new COVID-19 cases has plunged by 16% over the past week, the World Health Organization recently revealed.

READ: Red Monday: Investors lose $2 billion trading crypto

Stock traders momentarily increased their selling pressures on technology shares that have rallied through COVID-19 and rotated into cyclical stocks set to benefit from record demand once the COVID-19 pandemic is curbed to the barest minimum.

- Industrials led rising sectors in the S&P 500 at the most recent trading session spurred by a 9.9% surge in Deere & Co and Caterpillar 5.0% surge to an all-time peak of $211.40 a share. Financials, materials, and energy, along with industrials, rose more than 1%.

- The S&P 1500 airlines index jumped 3.5%, with post-pandemic travel in focus.

- When the world’s largest economy is roaring, usually industrial-based stocks like Caterpillar Deere & Co. do well, but when America’s economy weakens investors get less attracted to them.

READ: Crypto traders suffer heavy losses of $639 million within a day

Stephen Innes, Chief Global Market Strategist at Axi in a note to Nairametrics spoke on macros investors are keying into amid rising inflation.

“US stocks struggled and rebounded into the close, but the reflation rotation has given way to the heated debates around US rates for most of the day.

“Stocks are at the brink of moving from the sweet zone into the danger zone as the US Fed rate hikes start nudging towards 2022 and the taper tantrum drum keeps beating in the distance.

“With large-scale stimulus amid recovery from the Covid-19 shock, investor attention has focused on potential impacts from rising rates and inflation.

READ: Bitcoin produces 94,000 millionaires

Bottom line: Stock traders are reducing their positions in these growth stocks, on COVID-19 caseloads receding, as global investors are fully aware the best offense is a good defense by taking your foot off the gas pedal at these tech stocks as the most straightforward function of damage control.