Mutual Funds are a great form of investing especially for passive investors. They are designed to pool funds from various investors with the sole purpose of investing them in a portfolio of investments (shares, bonds, treasury bills etc).

The year 2020 was ravaged by the covid-19 outbreak in Nigeria, causing a decline in most economic activities. However, major mutual funds in Nigeria recorded double-figure growth in year, a reason for investors to smile despite the pandemic.

According to data from the Security and Exchange Commission (SEC), 54.3% of the registered funds recorded positive growth in the year, 37.1% remained unchanged while only 10 (15.9%) funds recorded negative growth in the period.

READ: Pension fund administrators pile up cash in anticipation of withdrawals

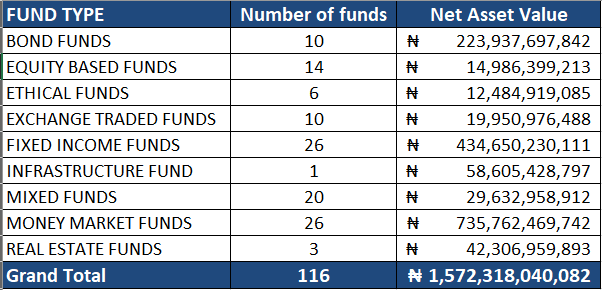

As of 31st December 2020, the Security and Exchange Commission (SEC) registered a total of 116 mutual funds with over N1.57 trillion net asset value cutting across several fund types.

Below is a breakdown of the fund types available to investors.

To determine the best performing Funds in 2020, we compared the Fund Prices as of 27th December 2019 with the Fund Prices as of the last day of December 2020 (31st December).

These were the top 5 performing mutual funds in 2020. We also highlighted their performance in terms of changes in net asset value and included profiles of the Funds as described on their websites.

READ: Nigeria’s mutual fund asset value hits N1 Trillion

AIICO Balanced Fund – AIICO Capital Limited (Mixed Funds)

AIICO Balanced Fund is an actively managed open-ended Fund. The Fund invests primarily in equities, government securities, fixed deposit, fixed income securities.

December 27th, 2019

Fund Price – N2.50

December 31st, 2020

Fund Price – N3.70

Return – 48.2%

Ranking – Fifth

Commentary: This is a Mixed Fund by AIICO Capital Limited. The Fund grew by 48.2% in 2020. The net asset value stood at N171.60 million as of 31st December 2020, growing by 57.7% compared to N108.8 million recorded in 2019.

READ: Understanding how Mutual Funds and ETFs work in Nigeria

Lotus Capital Halal ETF – Lotus Capital Limited (Exchange Traded Fund)

The Lotus Halal Equity Exchange Traded Fund “LHE ETF” is an open-ended fund that tracks the performance of the NSE-Lotus Islamic Index (NSELII). It is designed to enable investors obtain market exposure to the securities of the constituent companies of the NSE-Lotus Islamic Index and to replicate the price and yield performance of the index.

December 27th, 2019

Fund Price – N8.39

December 31st, 2020

Fund Price – N12.73

Return – 51.7%

Ranking – Fourth

Commentary: This is an Exchange Traded Fund by Lotus Capital Limited, grew by 51.7% in the review period. The net asset value also stood at N613.59 million as of 31st December 2020, growing by 51.7% compared to the 2019 NAV of N404.4 million.

READ: Investors pump N7 billions into New Gold ETF

PACAM Equity Fund – PAC Asset Management Limited (Equity-Based Fund)

PACAM Equity Fund is a pure equity fund that invests funds predominantly in a portfolio of Nigerian companies, using a rigorous research-based system.

The fund provides long-term capital preservation by investing at least 75% of the fund’s assets in a diversified portfolio of high-quality companies listed on the Nigerian Stock Exchange. In order to manage liquidity, the fund may also invest up to 23% in short-term money market instruments.

December 27th, 2019

Fund Price – N1.02

December 31st, 2020

Fund Price – N1.59

Return – 55.6%

Ranking – Third

Commentary: This is an Equity-Based Fund by PAC Asset Management Limited. The Fund grew by 55.6% in 2020. The performance is impressive considering that it is purely focused on Equity, which is a reflection of the performance recorded in the equities market of the NSE in 2020. The net asset value grew by 41.1% from N204.9 million recorded in 2019 to N289.2 million in 2020.

New Gold ETF – New Gold Managers (Exchange Traded Fund)

The NewGold Exchange Traded Fund (NewGold) is an ETF listed on the Nigerian Stock Exchange in December 2011. NewGold tracks the price of gold and offers institutional and retail investors the opportunity to invest in a listed instrument (structured as a debenture) that is fully backed by gold bullion.

The fund is managed by NewGold Managers Limited while the sponsoring broker is Vetiva Capital Management Limited.

December 27th, 2019

Fund Price – N5,220

December 31st, 2020

Fund Price – N9,100

Return – 74.3%

Ranking – Second

Commentary: Gold prices have been on the up since the Covid-19 pandemic took hold of the global economy, which has reflected on the performance recorded on the gold ETF fund. New Gold ETF grew by 74.3% in 2020 while the Net Asset Value recorded 1,621% increase to close at N13.2 billion as at 31st December 2020.

New Gold also got a major boost from investors who found dual-listed companies as a means of repatriating dollars out of the country. This is done by buying shares locally and then selling on a foreign stock exchange so as to get their money out.

VI ETF – Vetiva Fund Managers Limited (Exchange Traded Funds)

The Vetiva Industrial ETF “VETIND ETF” is an open-ended Exchange Traded Fund managed by Vetiva Fund Managers Limited. The VETIND ETF is designed to track the performance of the constituent companies of the NSE Industrial Index and replicate the price and yield performance of the Index.

The NSE Industrial Index comprises the top 10 companies in the Industrial sector listed on the Nigerian Stock Exchange (NSE), in terms of market capitalization and liquidity and is a price index weighted by adjusted market capitalization.

December 27th, 2019

Fund Price – N10.49

December 31st, 2020

Fund Price – N20.52

Return – 95.6%

Ranking – First

Commentary: VI ETF is the first Fund on the list of best performing Mutual Funds in 2020. The fund price grew by 95.6% in the year under review. The net asset value also grew by 138.1% to close at N216 million as of 31st December 2020.

Bubbling under…

The following Funds make up the rest of the top 10 on our list in ascending order;

Lead Balanced Fund – Lead Asset Management Limited (Mixed Funds)

Return – 34.4%

Legacy Equity Fund – First City Asset Management Limited (Equity-Based Funds)

Return – 36.3%.

Stanbic IBTC Nigerian Equity – Stanbic IBTC Asset Management Limited (Equity-Based Fund)

Return – 36.6%.

VG 30 ETF – Vetiva Fund Managers Limited (Exchange Traded Fund)

Return – 38.6%.

Stanbic IBTC lmaan Fund – Stanbic IBTC Asset Management Limited (Ethical Fund)

Return – 41.9%.