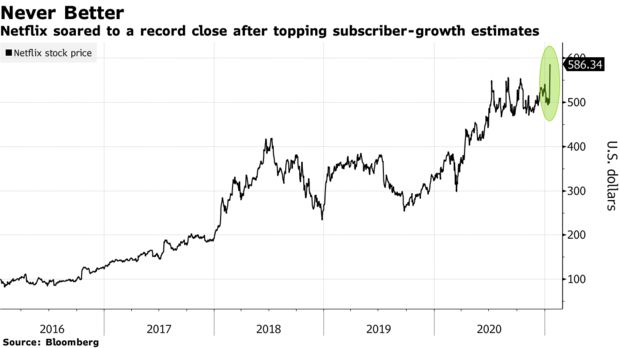

Netflix’s share price bounced about 17% higher after it beat market expectation, powering the video streaming stock to close high after adding more customers than expected and revealed it no longer needs debt in building its entertainment empire.

The positive upbeat guidance on free cash prompted bullish remarks from Wall Street analysts, though some questioned how much of the subscriber growth was pulled forward.

Stock traders increased their buying pressure on Netflix stock because of the surprisingly strong growth, as well as news that Netflix balance sheets are solid enough for Netflix considering share buybacks. Shares jumped 17% percent to $586.34 in recent trading Wednesday.

Netflix for the first time ever passed the 200 million subscriber mark and had an impressive reserve of $8.2 billion in cash.

READ: Netflix, Amazon, Zoom, Shopify drop over 10%

COVID-19 pandemic has aided Netflix’s business, forcing people in spending more time indoors coupled with curbing other traditional entertainment options like movie theaters and concerts.

Netflix added 25.9 million customers in H1, 2020, and ended up adding 36.6 million customers in all – a record.

“Investors come out of the fourth quarter incrementally more bullish on the potential of a powerful developing shareholder return story for Netflix in the coming years,” Evercore ISI analyst, Lee Horowitz wrote in a note to Bloomberg News.

READ: McCaleb, co-founder of Ripple sells 28.6 million XRP

Analysts at J.P. Morgan Securities said the company is likely to begin share buybacks in the second half of the year.

Quick fact: Netflix is an American streaming company that allows subscribers to watch movies, documentaries, different popular TV shows, and many more through internet-connected hardwires.

Stephen Innes, Chief Global Market Strategist at Axi in a note to Nairametrics also spoke on the impressive gains sighted in the $259 Billion valued company;

“Earnings reports also underpinned equity sentiment. Netflix rose 16% after noting its subscriber numbers increased by a record 37 million in 2020. Serenely, it seems lockdowns and TV go hand in hand.

READ: Nigeria leads the world in Bitcoin searches on Google

“A testament to the maximum policy overdrive, investors wasted little time getting their feet wet after Janet Yellen espoused by the Biden “go big” policy approach to repair the economic damage caused by the pandemic, which also highlights the importance of helping small businesses and the unemployed.”

What to expect: The Stock market is seeing through longer lockdowns on the premise that COVID vaccinations will lead us out of the pandemic quickly and had helped triggered significant buying pressure on stocks like Netflix taking advantage of reduced social mobility in play