Nigerians spent a total of N46.99 trillion on household consumption expenditure in the first half of 2020 (January – June). This is contained in the Nigerian Gross Domestic Product report (Expenditure and Income approach), released by the National Bureau of Statistics (NBS).

According to the report, the final consumption expenditure of Nigerian households in nominal terms stood at N46.99 trillion in H1 2020, indicating a 4.2% decline compared to N49.06 trillion recorded in the corresponding period of 2019.

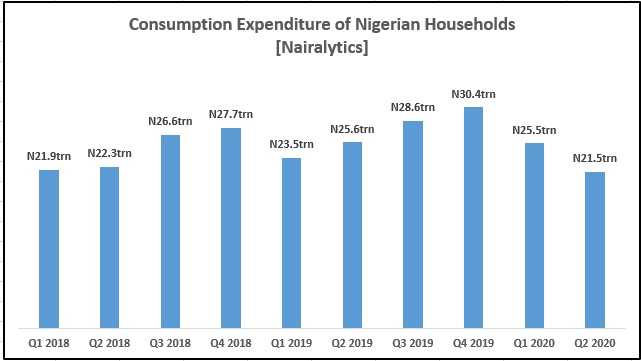

In terms of quarterly breakdown, household consumption expenditure grew by 8.62% in Q1 2020 to stand at N25.49 trillion, while it dipped by 15.96% at N21.5 trillion in the second quarter of the year.

What this means

Consumption expenditure is an important factor in determining economic growth for any country. Thus, as Nigerians suffered the effects of the Covid-19 lockdown in the second quarter of the year, consumption expenditure dropped meaning more Nigerians spent less as they stayed at home.

- A major driver of the lower spending was households with consumption falling to N21.5 trillion, the lowest in over 12 quarters. The data dates to the first quarter of 2018.

- Covid-19 meant more Nigerians stayed at home reducing the amount they spent on household consumption. Most Nigerians spent more on staple food items, and critical supplies required to stay safe.

- Spending on internet data also rose in the period as Nigerians relied on social media and streaming to stay informed.

- Nigeria needs consumption expenditure to rise if it is to exit the recession.

Highlights

- Consumption expenditure of non-profit institutions serving households grew by 56.8% from N267.7 billion recorded in H1 2019 to N419.7 billion in H1 2020.

- Compensation of employees also recorded a 1.9% increase to stand at N18.77 trillion between January and June 2020 as against N18.42 trillion recorded in the comparable period of 2019.

- Also, changes in inventories were estimated at N602.7 billion in H1 2020, a 2.76% increase compared to N586.6 billion recorded in the corresponding period of 2019.

- National disposable income for the first half of the year stood at N68.7 trillion in nominal terms. grew by 4.26% (year-on-year) from N65.87 trillion.

A cursory look at the data in real terms showed that household consumption expenditure in Q1 and Q2 2020 declined by 4.03% and 0.08% (year-on-year) respectively compared to 2.68% negative growth and 0.75% growth for the corresponding periods of 2019.

It is worth noting that household consumption accounted for 63.11% of the total real GDP at market prices in the second quarter, an increase of 3.7% points when compared to Q2 2019.

Government expenditure

In nominal terms, government expenditure grew by 9.61% in Q1 and 157.01% in Q2 2020. General government expenditure accounted for 6.23% of the gross domestic product in real terms in the first quarter and 14.58% in the second quarter of 2020.

- In Q1 and Q2 2020, real general government expenditure grew by 6.80% and 152.05% respectively, with the half-year growth rate recorded at 77.25%.

Compensation of employees

In nominal terms, compensation of employees rose by 9.5% in Q1 but recorded a decline of 4.64% in Q2 2020 compared with growth of 7.83% and 14.35% for the comparative periods in 2019.

- In real terms, however, compensation of employees recorded growth of 6.7% in Q1 and 6.47% decline in Q2 2020, year-on-year). For the first half of 2020, growth in this component was marginal at -0.34% year on year, or 7.74% points slower than 7.4% in 2019.

Net lending to rest of the World

Net lending grew by 348.25% in Q1 but declined by 51.11% in Q2 2020 compared with declines of 172.06% in Q1 and 242.85% in Q2 2019.

- While, for the first half of 2020, nominal Net lending grew by 52.43%, compared to a decline of 213.85% recorded in 2019.

What you should know

- The Nigerian economy contracted by 6.1% in the second quarter of 2020, and consequently slipped into recession after enduring a second contraction in Q3 2020.

- The decline in economic activities in the country can be attributed to the disruptions brought about by the lockdown as a result of covid-19 pandemic.

- Household disposable income, which measures the income of households after taking into account net interest, dividends received, payment of taxes, and social contributions grew by 2.55% and 0.66% in Q1 and Q2 2020 respectively.