The Federal Government has said that the recent increase in the pump price of Premium Motor Spirit (PMS), otherwise known as petrol, is due to the announcement of a positive outcome in the final stage trial of the coronavirus vaccine being developed by American pharmaceutical giant, Pfizer Inc in collaboration with BioNTech.

The explanation follows the public outcry and criticisms that have greeted the petrol price increase.

READ: Petrol price to increase as subsidies drain Government’s revenue

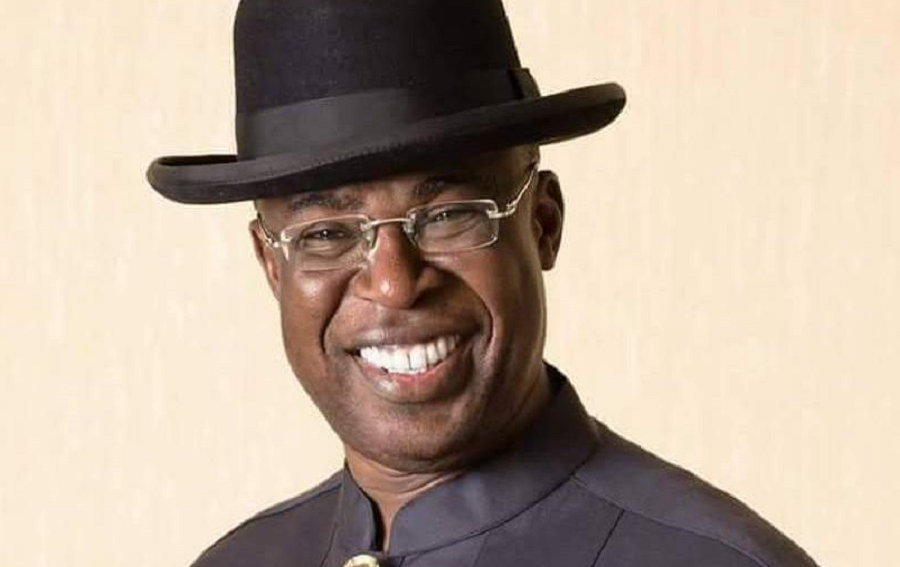

This disclosure was made by the Minister of State for Petroleum Resources, Mr Timipre Sylva, during an interaction with State House correspondents on Monday, November 16, 2020, after a routine meeting with President Muhaammadu Buhari at Aso Villa, Abuja.

According to a report from Channels Television, Sylva pointed out that the announcement by Pfizer, that its COVID-19 vaccine is over 90% effective, triggered a slight increase in the price of crude oil in the global market.

He said, “What happened recently was because of the announcement of a vaccine for COVID-19 by Pfizer. With that, crude oil prices went up a little bit.

READ: NNPC spends N535.9 billion on subsidy, FAAC in Q1 2020

“If you have been following crude oil prices, you would have seen that crude oil prices went up a little bit as a result of this announcement. So, when crude oil prices go up a little bit, then you will see that (it will) instantly reflect on the price of petrol, which is a derivative of crude oil.”

Sylva, who pointed out that this is not the first time that the Federal Government will be giving this explanation whenever there is a movement in petrol price, said that the pump price of petrol is directly determined by the price of crude oil in the global market.

He said, “When the price of crude oil goes up, then it means that the price of the fixed stock has gone higher; it will also affect the price of the refined product and that is why you see that product prices are usually not static, it depends on the price of crude oil which goes up and down.

READ: Commissioner attributes high cost of rice to increased production cost

“That is why we say, deregulate so that as the price goes up or down, you begin to go up and down as well at the pump. Before now, we fixed it – which was not optimal for us as a country.”

The Minister while speaking on the petrol price deregulation explained that the price of petrol will continue to fluctuate depending on the price of crude oil. He said it may crash again to a much lower figure, like was experienced in March 2020, if the price of crude drops again.

Nigeria govt have started again with this excuses hmmmmm

This their excuse did not fly well with us.

God punish devil