For most wealthy Africans, the allure of holding a second passport has evolved from a luxury to an outright necessity. From providing a hedge against the political and economic uncertainty currently plaguing the African continent to overcoming immigration and travel restrictions, and increasing access to global business, education and leisure for themselves and their families, second citizenships now help HNWIs compete on a global scale and provide access to enjoy a much better quality of life than is obtainable in their home countries.

READ: How Citizenship by Investment is offering wealthy Nigerians new global opportunities

Nigeria, for instance, is bracing for its worst recession in 30 years, and with her land borders still firmly closed, trade stifled, inflation on the rise and unemployment and its corresponding impact on security looming like a dark cloud over a fine summer afternoon, there is perhaps no better time for Wealthy Nigerians to seek the safety net that a second passport provides.

READ: Choosing the right Citizenship by Investment (CBI) Programme

Grenada, or the ‘Isle of spice’ as it is romantically called for its abundance of nutmeg and mace crop has become an increasingly popular choice for wealthy Africans seeking a second passport. It’s very well-thought-out citizenship by investment programme created in 2013 to drive its economy, continues to draw HNWIs from across Africa for a number of reasons. Firstly, Grenada does not require its second passport holders to live in the country permanently or for any duration at all. Holders are free to live wherever they please as their business or lifestyles demand. Next, when combined with the Nigerian passport, Grenadian passport holders get visa-free travel to 163 countries and territories which account for 58.7% of the world’s GDP, including the US, China, Russia, Singapore, and the EU Schengen zone.

READ: Everything you’ve ever wanted to know about citizenship by investment

READ: Over 1 million have applied for the N75 billion Youth Investment Fund – Buhari

But it doesn’t quite stop there. Through its E-2 treaty with the US, holders of the Grenadian Passport can use the country as a springboard to live and work in the US permanently. Grenada also allows one applicant to include up to four generations and dependents in a single application and holders can pass down citizenships to the next generation. This means even large families can benefit from its programme without having to pay an individual cost of each dependent.

READ: Reasons to hedge your investments with Grenada Citizenship by Investment

All of these are in addition to being a tax haven, home to St. George’s University, a leading global tertiary institution and a very stable country with a rich culture laced with strong West African influence. Grenada’s low-crime rate, gorgeous beaches and exquisite landscapes also make it an attractive country. And its turn-around time for issuing a second passport via its Citizenship by Investment programme is only 60-90 days, making it one of the fastest in the world.

READ: Traders, artisans to get N1 billion credit facility in Kwara

How to acquire the Grenadian Passport via its Citizenship by Investment Programme

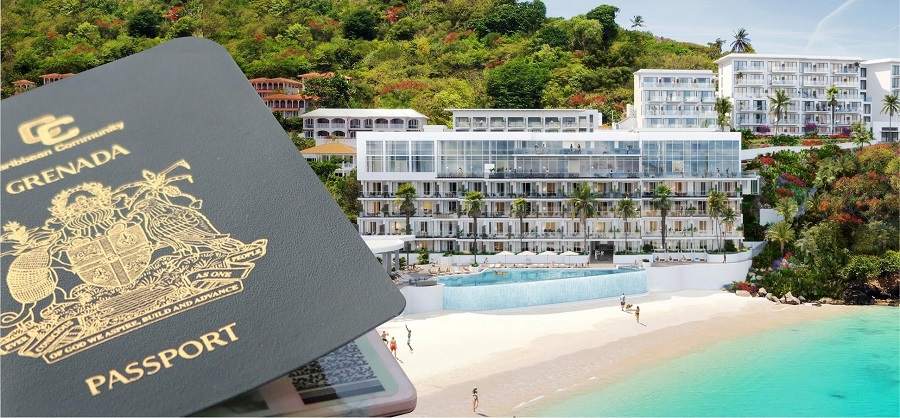

The Kimpton Kawana Bay Resort is Grenada’s most popular Citizenship by Investment Project with title deeded studios and suites for sale for the minimum investment of USD220,000. It is endorsed by the Prime Minister of Grenada who visited the project site along with members of the parliament and complimented the scale and quality of work being executed.

Located on Grande Anse beach, voted by CNN and Conde Nast Traveller as one of the world’s best beaches, the Kimpton Kawana Bay Hotel is a new 5-star luxury beachfront resort which will feature an infinity-edge pool overlooking the long white sand and crystal clear waters of the Grand Anse Beach, state-of-the-art gym and spa facilities, exquisite fine dining restaurant, roof-top bar, beach bar, lounge with terrace, and water sports facilities.

READ: Why Bitcoin might go for $3 million in 2025

The Kimpton Kawana Bay Resort will be operated by IHG, one of the world’s leading Hotel groups and offers in itself, a range of benefits in addition to a second passport by providing a projected 3-5% rental income via a transparent revenue share model and hassle-free ownership with no out of pocket annual fees. Perhaps most interestingly, is that investors can divest after 5 years should they choose to and recoup their initial investment. Making it a win-win scenario for all parties involved and highlighting the fact that acquiring a second passport via citizenship by investment programmes is indeed an investment- not a cost.

READ: Bitcoin’s market value can reach $600 billion – JP Morgan Chase

Getting Started

Acquiring the Grenadian passport as an investor via its Citizenship By Investment programme is a seven-step process that commences with the appointment of an international marketing agent. La Vida Golden Visas, for example, is a London-based Investment Migration firm and a leading facilitator of the Grenadian Citizenship by investment programme who has advised over 30,000 potential investors and currently serves clients from over 80 countries, including many Nigerians.

READ: Nigerian passport holders have access to just 2.1% of the world’s GDP – Forbes

- Appointing an International Marketing Agent.

To start the process applicants need to first appoint a government-approved international marketing agent such as La Vida. La Vida runs a pre-application background check on every applicant prior to initiating the application to ensure that they will be eligible. The background check is free and the turn-around time is less than 24 hours. - Initiating the application

Once applicants have passed the pre-application background check, they will need to formally appoint their agent by signing a client facilitator agreement and paying a pre-application deposit to initiate the process. La Vida’s expert team will assist applicants in compiling all the required documents and completing the government’s official application forms. - Application submission, deposit and processing fees.

Once the application is prepared the applicant will also need to sign a purchase and sale agreement with Kimpton Kawana Bay and pay the initial real estate deposit along with the government’s processing fees. The application can then be officially submitted to Grenada’s Citizenship by Investment unit who will begin the vetting process. - Vetting and Due diligence.

The Citizenship by Investment Unit (CIU) will study each application to ensure all documentation has been submitted and meets their requirements. They will also run advanced due diligence checks on all applicants to ensure they pose no security threats and the information provided is correct. However, there is no interview required. - Recommendation and Approval of Application.

Should the CIU require any additional documents they will request these via the marketing agent. The cabinet will make a decision on the application within 90 days following submission. Once approval has been made, the marketing agent will be informed and will notify the applicant of their approval. - Payment of Government Fees and Balance of the unit of Kawana Bay.

On approval, the final government fees and balance of the real estate investment is due and will need to be paid via bank transfer to the agent. - Certificate of Citizenship and Passport

Approximately 30 days after receipt of funds, the CIU will issue the certificate of registration and passports, which can be couriered directly to the applicant. The entire process can be completed remotely and there is no requirement to visit Grenada.

READ: Reasons to diversify investments through Grenada second citizenship

At a time when Africa’s most populous country appears to be grappling with a lot of fundamental issues, Grenada and its Citizenship by Investment Programme is offering HNWIs a chance to play on a global scale and there is no better time than now to embrace this new world of opportunity.

To find out more about the Citizenship By Investment process or initiate your application, contact La Vida for more details.

Website: www.goldenvisas.com

Phone: +44 207 060 1475

Email: info@goldenvisas.com