Headline Inflation has assumed a new pattern over the last three months, primarily driven by pressures in the food basket, reflecting a shock to crop cultivation from covid-19 restrictions and border closures. In addition, more recent developments in currency markets, where the Naira has weakened, as well as the increases in petrol prices following the removal of blanket subsidies have underpinned inflationary expectations. Looking ahead, sizable increases in electricity tariffs which came into effect in September as well as continuing fuel price pressures could see inflation head towards 14% levels in Q4 2020. Given the supply-side driven nature of the inflationary bout as well as the recent pivot to unorthodox monetary policies (which include liquidity tightening measures via CRR debits) it is likely that the CBN will ignore these numbers and persist with its current stance.

READ: CBN sequesters N321.6 billion from banks in new CRR Debits

Nigeria’s inflation surged in August with the CPI rising 13.22% y/y (July: 12.8% y/y), the highest level since April 2018, largely driven by pressures in the food basket, where prices climbed 16% y/y (July: 15.48% y/y) while the core index (which includes energy prices) expanded by decelerated to 10.5% (July: 10.1% y/y). On a monthly basis, the inflation climbed by 1.34% over August (July: 1.25%) — the highest monthly number since June 2017.

READ: Nigeria’s inflation rate jumps to 12.82%, highest in 27 months

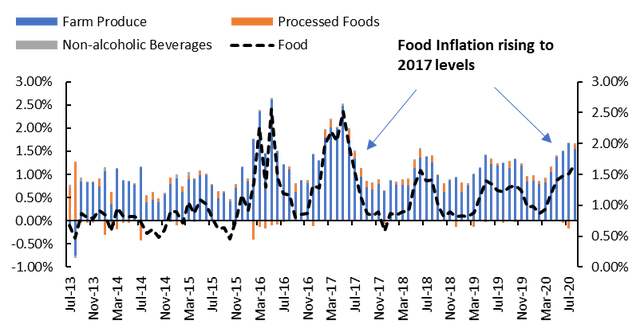

Pressures in Food, Utilities and Transport are driving the rising inflation numbers: Disaggregating the inflation numbers, three segments stand out (Food, utilities aka Housing, Water, Electricity and Gas and Other Fuels, HWEGF and transportation) as central to the pick-up in inflation as they accounted for ~80% of the variation in the monthly CPI print. Food was central and I shall set out my thoughts on the drivers later in this report, but on the latter two, pressures are linked to pick-up in fuel prices following the removal of subsidies in March which has seen fuel prices rise by 15% over the last two months.

READ: UPDATED: Nigeria Inflation rate hits 12.2% as food index rises

Figure 1: Component analysis of monthly inflation

Source: NBS, Authors Calculation

Source: NBS, Authors Calculation

READ: CBN debits banks another N459.7 billion for failure to meet CRR target

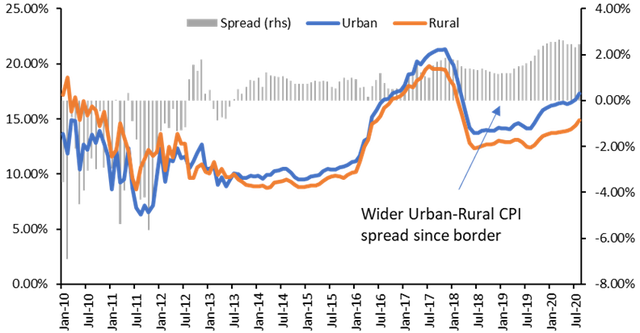

A combination of weaker farming activity, Naira weakness and covid-19 lockdowns are behind the uptrend in food inflation: Looking at food inflation, the big pressures came from the farm produce component which accounts for over 90% of food inflation. August usually marks the start of the main crop harvest season in Nigeria which peaks in September-October and as such in normal years, monthly inflation peaks in July and decelerates thereafter. However, in 2020, monthly farm produce and food inflation readings over the last three months are at levels not seen since 2017 which would suggest factors hurting the supply side. Indeed, most grain and tuber crop prices are moving towards five-year trend levels.

READ: CRR: Banks suffer N917.5 billion debits in latest CBN action

Figure 2: Component Analysis of Monthly Food Inflation

Source: NBS, Authors Calculation

Source: NBS, Authors Calculation

READ: CBN says banks create N2 trillion new loans in 6 months

In 2017, my thesis then was that a sharp Naira depreciation drove heightened exports of Nigerian farm produce into the wider sub-region forcing an upward adjustment in domestic prices. In 2020, in addition to the sharp shift in the FX rate as well, the sense from reading on-ground sources like FEWSNET is that Covid-19 movement restrictions hurt the flow of labourers from neighbouring countries during planting season. Accordingly, field surveys are indicating that the area under cultivation for most grain and tuber crops is lower than levels in prior years which is pointing towards a subpar crop harvest for 2020. As such, Nigeria is facing a more fundamental supply shock, which alongside the rising transport costs is likely to drive higher food prices.

READ: Fitch forecasts that banks’ earnings will be hit hard by CBN’s CRR policy, others

The price pressures are likely to be steep in urban centres as is evident in the spreads between rural and urban inflation which have widened since the border closures. Thus, in a departure from prior years, when regional supplies from neighbouring countries moved through the border to temper these pressures, existing blockades imply that limited relief is forthcoming. Solving the price runaway for food items clearly involves a combination of allowing targeted food imports or at least re-opening the borders to allow regional food trade flows to resume. However, Nigeria’s economic managers appear to be on the other side of this fence.

Figure 3: Rural and Urban Inflation

Source: NBS, Authors Calculation

Source: NBS, Authors Calculation

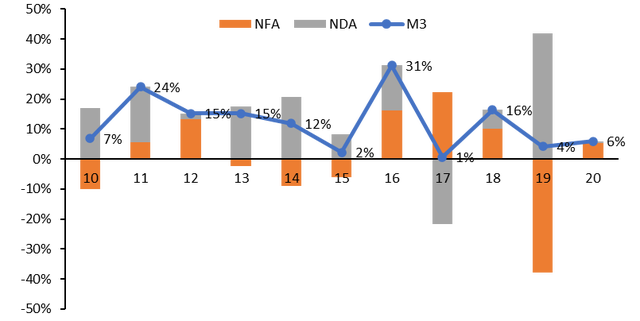

But money supply growth has been restrained by CRR debits in the banking sector: The textbook monetary policy response to accelerating inflation is to raise interest rates to induce a shift away from consumption towards savings in a bid to force inflation to within a target level. This would pre-suppose inflation was driven by an expansion in money supply often through credit growth. A look at developments on this front would rule this out.

As at the end of July 2020, annualized growth in monetary aggregates was mixed with strong growth in M1 (+33%) and M2 (+27%) relative to M3 (+10%)[1]. The muted growth in M3 relative to the narrower measurers of M1 and M2 reflect declines in OMO bills (- 72%) after the CBN elected to proscribe non-bank domestic investors from its sterilization securities sales. This resulted in a drop in OMO bills from NGN8trillion at its peak in November 2019 to NGN3.5trillion in July 2020. As these monies flowed unhindered into the banking system, they spurred an expansion in Demand Deposits (+42% and Quasi-Money (+24%). Although these should ordinarily stoke concerns, a look at the monetary base (M0)[2] throws up evidence of how the CBN has still managed to sterilize liquidity: via the cash reserve requirements. Specifically, bank reserves have expanded at an annualized pace of 132% to NGN11trillion at the end of July or by some NGN4.8trillion – which is more than double than the quantum of growth in Naira terms in M3 (NGN2trillion). Effectively, as many have argued, the entire move to outlaw access for non-bank (and tacitly banks) was essentially targeted at zero cost liquidity sterilization. Thus while there has been growth in money supply from maturing OMO bills, the concurrent expansion in monetary base via CRR debits has effectively drained the financial system of excess liquidity.

From a more structural perspective, money supply growth is often driven by two sub-parts: net domestic assets (NDA) and net foreign assets (NFA). The CBN’s use of CRR debits has ensured that NDA growth over the first seven months of 2020 has been subdued (+1.3% annualized) relative to a faster expansion in net foreign assets (+54%) following the surge in FX borrowings with the IMF loan. In simple terms, the liquidity deluge from OMO bill maturities have been managed away.

Figure 4: Growth in Money Supply

Source: CBN

Source: CBN

So what gives?

In the near term, my suspicions are that the CBN is set to follow the global trend of ignoring the inflation numbers, which suits its ‘home-grown’ philosophy, that has underpinned a spate of interventions across a host of sectors. These interventions has resulted in the CBN directing credit towards certain sectors (manufacturing, renewable energy, gas-to-power, housing, agriculture etc) at single digit interest rates in a bid to stimulate activity. In combination with the Loan-Deposit Ratio (LDR) policy as well as the arbitrary nature of the CRR debits, which are well above the 27.5% target number, the CBN has been able to force banks to boost loan volumes as a coping mechanism in the face of collapse in net interest margins from lower rates on government securities. Though sceptics remain over the efficacy of supply-side policies on stimulating production among other unorthodox policies such as offering better rates for offshore investors relative to onshore investors, the CBN’s recent policy of lowering minimum savings rate has provided a strong signal of its direction: there will be no reward for risk-free anymore. Will this work or not? We will have to wait to find out. But interest rates are likely to remain lower for sometime.

And 3 more things…

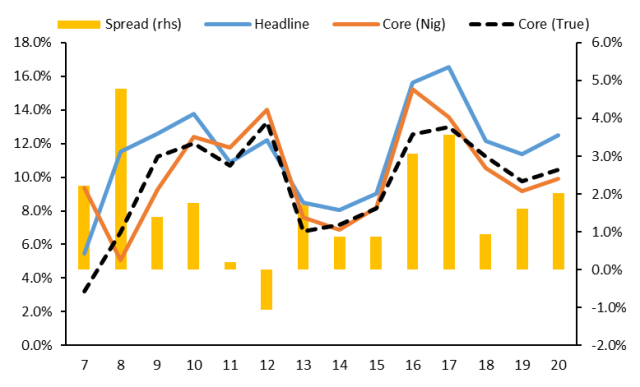

- Changing the definition of core inflation: Presently, Nigeria defines core inflation as headline inflation less farm produce which reflected historic stability in fuel prices due to the existence of subsidized regime. With the removal of subsidies and 30-day averaging period, fuel prices now move from month-to-month implying higher volatility. Now is the time to change the definition of core inflation to exclude farm produce and fuel in line with the theoretical meaning. Looking back, the spread between headline and the true core definition which the NBS publishes suggests maybe we should not have tightened policy as aggressive as we did in 2016-17 by focusing communication on the true core number. Economic policies should focus on more lasting structural drivers than transient one-off shocks like fuel & electricity price hikes which tend to have disinflationary base effects afterwards.

- Adopting a more meaningful inflation target: In Nigeria, that target level for inflation is defined as 6-9% for the headline number. Given the weight of food inflation (55%) in the CPI numbers as well as elements without recourse to monetary policy (like fuel and electricity prices), some (including myself) have argued that the 6-9% target for headline is meaningless. In countries which pursue inflation targeting, the target is more refined with preference for demand-side inflation metrics like core inflation, wage inflation or personal consumption expenditures. Nigeria needs to adopt something similar.

- Explicitly incorporating FX into Nigeria’s monetary policy reaction function: In theory, the core mandate of central banks is price stability, but this does not preclude the pursuit of other objectives. In the US, the Fed has a dual mandate that explicitly includes unemployment. I believe a proper explicit mandate for the CBN is one that requires that it optimize a reaction function of price stability and an export competitive exchange rate. The price stability mandate should entail lowering some measure(s) of inflation (preferably ‘core’ demand side measures) towards a target band defined as conducive for consumption and welfare in Nigeria over a medium-term period set as 2-3 years. This allows to evaluate the efficacy of monetary policy and provides a good feedback loop. On the other factor, given the importance to policymakers we need to include that the CBN target a competitive exchange rate. The idea in mind is a variant of what obtains in Singapore, wherein the nominal exchange rate must coincide with a REER level that ensures that Nigeria’s non-oil manufacturing exports are competitive. This way, we resolve this obsession for nominal exchange rate stability. Balancing both items and ensuring better communication are the ultimate goals for monetary policy.

Figure 5: Trends in headline and core inflation

Source: NBS, Authors calculation

Source: NBS, Authors calculation

* core (Nig) refers to the present definition of core inflation, Core (True) is the theoretical definition of core inflation. Spread is the difference between headline and True core inflation.

* REER: Real Effective Exchange Rate is the weighted average exchange rate of a currency with its trading partners adjusted for inflation. In Nigeria, this effectively defaults to the bilateral REER against the USD given the dominance of the USD in Nigeria’s trade basket.

[1] In Nigeria, the operational definitions are as follows: M1 = Currency outside banks + demand deposits, M2 = M1 + quasi-money (time and savings deposits) and M3 = M2 + CBN T-bills.

[2] M0 is defined as currency in circulation and bank reserves. In theory, central banks monetary policy influences the monetary base via bank reserves while banks behaviour and actions influence money supply.

The reality is our markets appear isolated without input from professionals and industry experts. Inasmuch as the trend is importation without the balancing local development for productivity; it cannot be uncertain that occurrences of exploitation will negatively act to distort market prices.

The market being a place for human activities and relations can afford the harsh environment…?