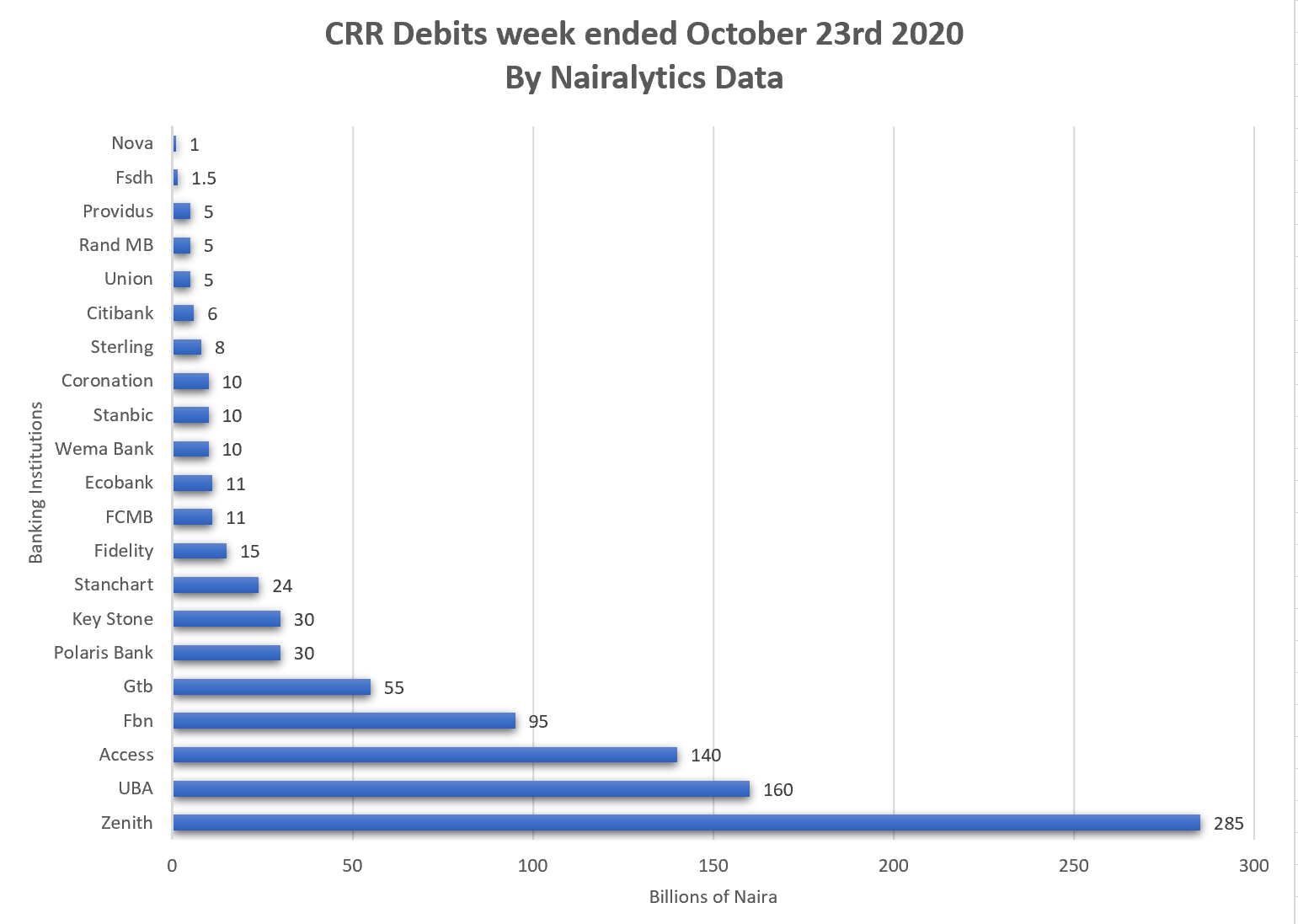

Nigerian banks suffered a total of N917.5 billion in new CRR debits from the Central Bank of Nigeria. Reliable sources inform Nairalytics Research that the latest debits occurred in the week ended October 23rd, 2020.

The cash reserve requirement is the minimum amount banks are expected to leave retained with the Central Bank of Nigeria from customer deposits. In January, the CRR was increased by 5% to 27.5% by the CBN Monetary Policy Committee (MPC) who explained that the decision was intended to address monetary-induced inflation whilst retaining the benefits from the CBN’s LDR policy.

READ: CBN says 17 banks to restructure over 32,000 loans

Nairalytics Data

READ: Union Bank suffers N188 billion in CRR debits as at June 2020

From the data, Zenith Bank topped the list with N285 billion followed by UBA with N160 billion. The rest of the FUGAZ, Access, FBN, and GTB were debited N140 billion, N95 billion, and GTB N55 billion respectively. The FUGAZ also suffered a N1.9 trillion debit in CRR sequesters in the second quarter of 2020 (April – June) alone.

READ: Nigeria’s forex devaluation timeline – 2020

Nigeria’s central bank has since 2019 debited Nigerian banks a chunk of their deposits as part of a mutually inclusive cash reserve requirement (CRR) and Loan to Deposit Ratio policy that is targeted at coercing banks to lend more to the private sector.

READ: CBN reviews minimum interest rates on savings deposit to 1.25%

Last month, Nairametrics reported that the CBN now holds a total of N6.57 trillion in CRR debits from the nation’s top 5 banks a whopping 43% higher than the N4.58 trillion held in March and more than double the N3.5 trillion CRR debits as of December 2020. CRR debits in the third quarter of 2020 will be revealed when banks release their results in the coming days and weeks.

READ: Nigeria’s telecom sector posts double digit growth of 18.1%, manufacturing, others contract

Meffynomincs: CBN under the leadership of Godwin Emefiele has deployed several heterodox policies as it strives to stimulate the economy and manage the exchange rate crisis in the absence of strong fiscal support.

- Interest rates on fixed deposits and money market instruments have fallen to single digits despite the galloping inflation rate.

- Last month, the CBN monetary policy committee admitted it was no longer combating inflation but will direct its policies towards stimulating lending to the private sector hoping this will spur local production.

- This policy has placed banks in the crosshairs with the Apex bank exposing them to CRR debits if they cannot use customer deposits to spur lending.

Lol when did the inflation become monetarily induced? Meffy has been saying its structurally induced.

You are right. Flipping or preaching the monetary policy is falsetto. Structure and framework is grandfathered, old and archaic. Administration policy rooted in lies and lack prudence.