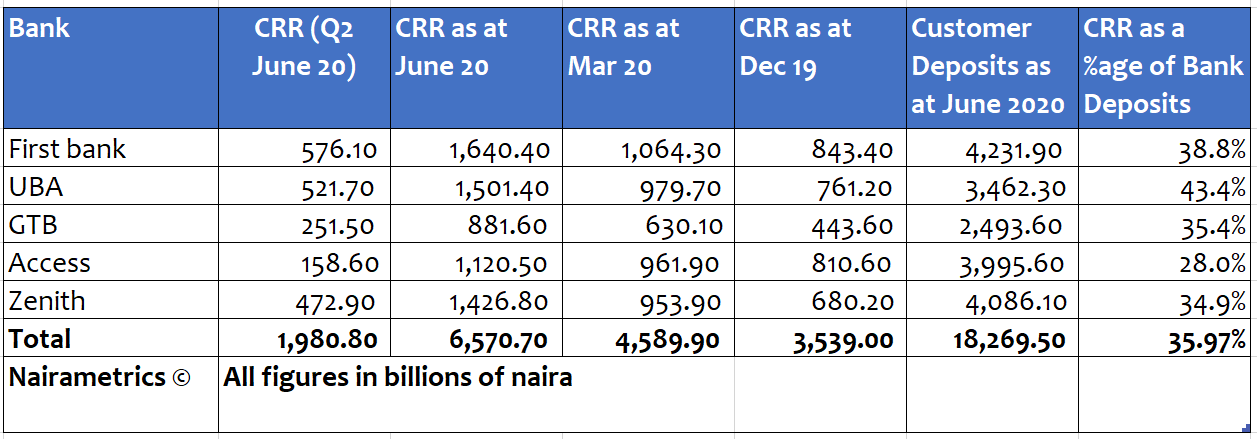

Nigeria’s top 5 banks; First Bank, UBA, GT Bank, Access Bank, and Zenith Bank suffered a N1.9 trillion debit in CRR sequesters in the second quarter of 2020 (April – June).

This is according to information in the financial statements of the banks tracked by Nairalytics the research arm of Nairametrics.

READ: MTN Nigeria revenues rise to over N100 billion monthly in 2020

Nigeria’s central bank has since 2019 debited Nigerian banks a chunk of their deposits as part of a mutually inclusive cash reserve requirement (CRR) and Loan to Deposit Ratio policy that is targeted at coercing banks to lend more to the private sector.

In total, the CBN now holds a total of N6.57 trillion in CRR debits from the nation’s top 5 banks a whopping 43% higher than the N4.58 trillion held in March and more than double the N3.5 trillion CRR debits as at December 2020.

According to our records, the top 5 banks have a total customer deposit (excluding subsidiary balances) of N18.26 trillion thus CRR debits represent about 35.9% of total customer deposits as of June 2020.

READ: UPDATED: Nigeria’s GDP contracts by 6.10% in Q2 2020, as critical sectors plunge

CRR Debit by banks as at June 2020

- First Bank, Nigeria’s oldest bank suffered N576 billion debit in the second quarter of the year alone. First Bank now has a total CRR debit of N1.6 trillion kept with the CBN.

- UBA, the Nigerian bank with the most African presence suffered a CRR debit of N521.7 billion in the quarter ending June 2020. The bank’s total deposit with the CBN is now N1.5 trillion.

- GT Bank, Nigeria’s largest bank by market capitalization reported a CRR debit of N251.5 billion in the quarter under review representing about 8.4% of its N2.49 trillion customer deposits. The bank now has a total of N881.6 billion in CRR debits held by the CBN.

- Access Bank reported a CRR debit of N158.6 billion, the lowest of the FUGAZ banks in the quarter under review. A total of N1.1 trillion in the bank’s customer deposits has now been sequestered by the CBN.

- Zenith Bank, Nigeria’s largest bank by profits suffered a CRR debit of 472.9 billion in the second quarter of 2020 taking its total CRR haul to N1.4 trillion. About 9.6% of the bank’s customer deposits are held by the CBN.

READ: UPDATED: Nigeria received $1.29 billion capital inflows in Q2 2020, down by 78.6%

Upshots: The central bank is likely to continue with this controversial policy as it continues to mount pressure on banks to lend. In August, Nairametrics reported the CBN debited banks with about N321 billion from commercial banks.

Article contributions from Samuel Oyekanmi, John Nwokolo, and Ugo Obi-Chukwu