PayPal Holdings, Inc. on Tuesday announced it will be providing its users the opportunity to buy, hold and sell cryptos directly from their PayPal account by early next year.

It also hinted at a strategy to significantly boost its crypto’s utility capability by making it readily available as a funding source for purchases at its 28 million clients globally.

READ: Chatbot provider, eBanqo, builds value system for customer-facing organisations

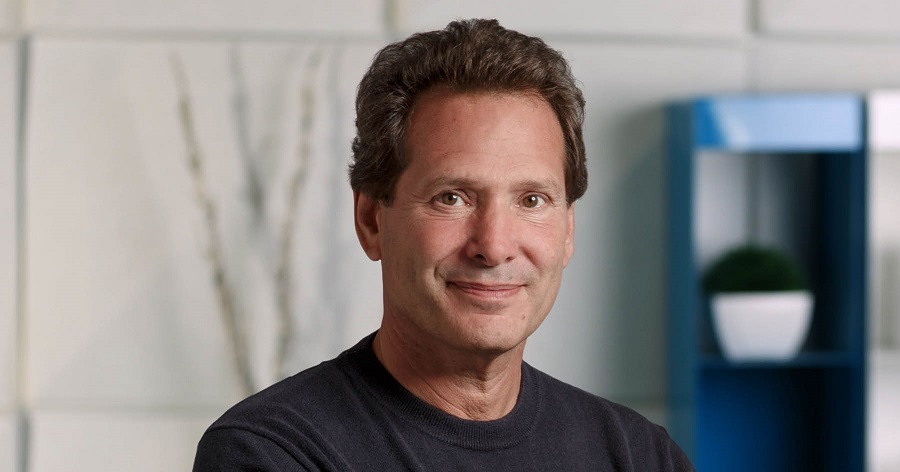

In a press statement seen by Nairametrics, Dan Schulman, president, and CEO, PayPal, gave key insights on why the global payment company was going crypto; “The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of ;

- financial inclusion and access,

- efficiency

- speed

- resilience of the payments system

- and the ability for governments to disburse funds to citizens quickly.”

READ: Commercial Paper value appreciates by N243 billion YOY, hits N539.8 billion in H1, 2020

“Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption, and inter-operability of these new instruments of exchange,” he said.

Furthermore, he said, “We are eager to work with central banks and regulators around the world to offer our support and to meaningfully contribute to shaping the role that digital currencies will play in the future of global finance and commerce.”

This offering was made possible through a partnership with Paxos Trust Company, a regulated provider of crypto services and products.

READ: FG set to provide interest-free loans and agricultural inputs to farmers

PayPal was also granted a conditional Bitlicense by the New York State Department of Financial Services (NYDFS), In a statement credited to Linda A. Lacewell, superintendent, NYDFS, she said; “NYDFS’ approval today follows our June 2020 announcement for a new framework for a conditional Bitlicense to encourage, promote, and assist interested institutions to have a well-regulated way to access the New York virtual currency marketplace in a way that is both timely and protective of New York consumers, through partnerships with New York authorized virtual currency firms.”

She continued, “NYDFS will continue to encourage and support financial service providers to operate, grow, remain and expand in New York and work with innovators to enable them to germinate and test their ideas, for a dynamic and forward-looking financial services sector, especially as we work to build New York back better in the midst of this pandemic.”