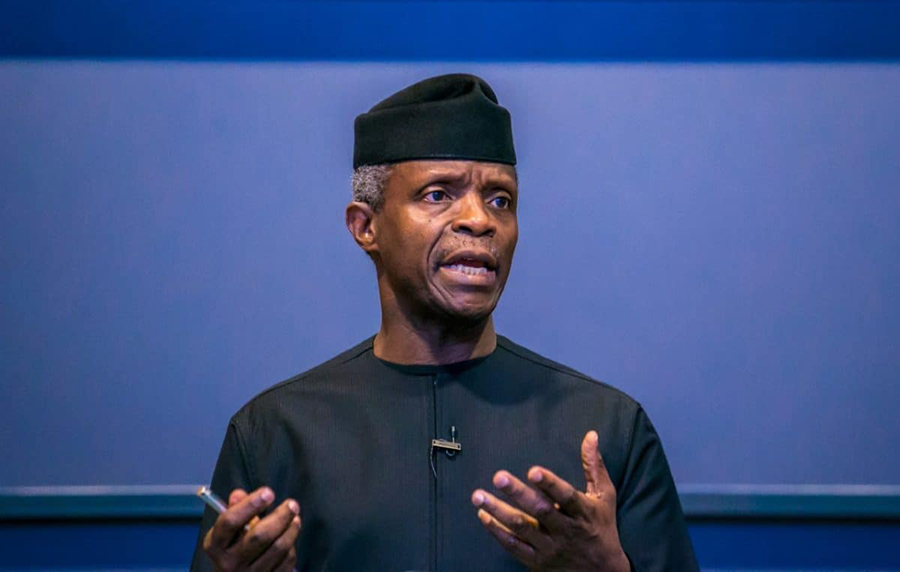

Vice President Yemi Osinbajo disclosed recently that Nigeria will not be issuing Eurobonds due to their costs, and was considering further options in capital to boost Africa’s largest economy in the face of a looming recession.

The Vice President said this in a report credited to Reuters News.

“We are not likely going to explore again the Eurobond market because we are trying to avoid commercial borrowing,” Osinbajo said.

Explore Data on the Nairametrics Research Website

Africa’s largest economy has been on the squeeze, with the worst pandemic known to man, disrupting Nigeria’s major export earning, crude oil, and the poor participation of foreign portfolio investors which crunched Nigeria’s earning at unprecedented levels.

However, Michael Nwakalor, a Macroeconomist at CardinalStone Research, in a note seen by Nairametrics gave key vital insights on why Nigeria’s fiscal players might consider such a move in view of taking the FGN 2021 budget into play.

READ: Nigeria makes sudden U-turn, suspends external borrowing from international debt market

“In our view, given its ever-widening budget deficit and concurrent FX needs, Nigeria may be tempted to revisit the Eurobond market next year after having shelved plans to raise $3 billion in 2020 following the COVID-19 outbreak. However, a return to the international debt market may, ultimately, depend on external financing conditions. Even though weaker oil prices and domestic FX liquidity issues are concerning, the Fed’s long-term dovish posture and relative stability in the Eurobond market suggest that a few providers of long-term capital may still be up for some risks. That said, investors are likely to demand a premium to pre-pandemic levels of c.7.5%, on duration, for a potential Eurobond issuance,” it stated.

READ: $945 million worth of BTCs options expiring this week

If recent body language, statements by Nigeria’s fiscal policymakers are taken into full consideration, it’s likely Nigeria might consider multinational lenders like World Bank rather than going to the overseas debt market, as the nation seeks cheaper options in building its commodity-dependent economy.

Talking about economics and hoe the social societies country are affected by the commodity they are investing in. Buy or saling. The banks e. G like the big corn. Now. The oil triecing and all others bussine entities are at hold at this moment. Let say only business on line is still fontioning Well. computer on lines bussines. Covid19. All the lock down. The business en economic needs to go on before the system collapse. We say. Yet good health maters. To manage an economy.