The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) is set to convene next week for its periodic meeting.

The notice of the meeting, which was released by the apex bank on its website, stated that the 275th meeting of the MPC is scheduled to hold on next Monday, September 21 and Tuesday, September 22, 2020, at CBN Headquarters, Abuja.

READ: UBA Plc H1’2020 results, a true reflection of its rightsizing decision?

The MPC meeting: Basically, the MPC is the CBN’s highest monetary policy decision-making body. It comprises the governor of the Bank who is the chairman, the four deputy governors of the Bank, two members of the board of directors of the Bank, three members appointed by the president, and two members appointed by the governor.

The MPC sets monetary policies for banks in the country through decisions on the Monetary Policy Rate (MPR), Cash Reserve Ratio (CRR) and Liquidity ratio. These variables determine the quantum of funds that the banks have at their disposal to lend.

The MPR is the rate at which the CBN lends to banks. This, in turn, determines the interest rate that banks charge members of the public.

READ: President Buhari approves N13.3 billion for Community Policing in Nigeria

Decisions at the last meeting

The Central Bank’s MPC meeting was last held in August 2020, where all key rates were left unchanged. Basically, the MPR was kept at 12.5%, while other parameters such as Cash Reserve Ratio (CRR) at 27.5%, Liquidity ratio at 30%, and asymmetric corridor remained unchanged.

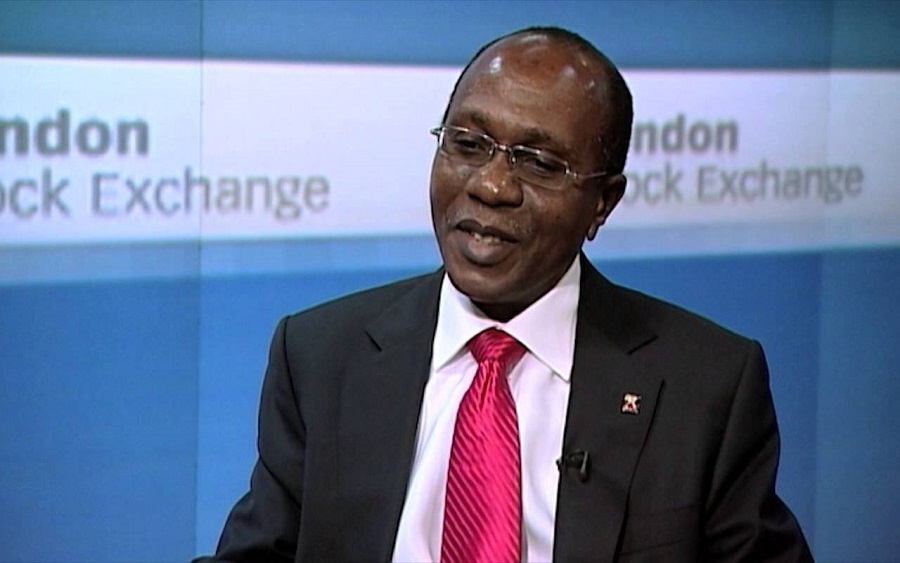

Emefiele explained that eight members of the committee voted in favour of holding the MPR, while two members wanted it reduced.

READ: CBN debits banks another N459.7 billion for failure to meet CRR target

According to the MPC, the decision to hold all rates constant was largely driven by the effect of the outbreak of COVID-19 that has largely disrupted the global economy.