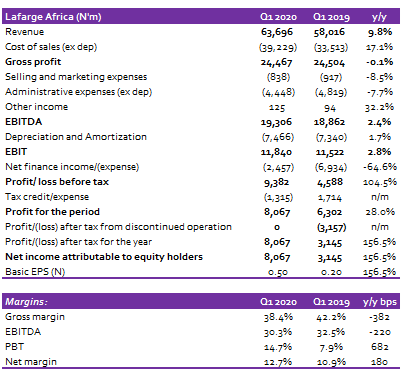

Lafarge Africa Plc published its Q1 2020 unaudited financial report late last week Friday. We note that the comparative figures for Q1 2019 were restated to present Lafarge South Africa Holdings (LSAH) as discontinued operations since the disposal was concluded in Q3 2019. Lafarge reported Revenue of N63.7bn in Q1 2020, implying a growth of 9.8% when compared with Q1 2019.

The growth in revenue was driven by growth in Cement Sales (up 11% y/y to N62.3bn) which offset the weakness in Aggregate and Concrete (down 21% y/y to N1.4bn). We expect revenue growth to slow in Q2, owing to subdued activities in the construction sector caused by the lockdown measures implemented across the country, reduced fiscal spending on capital projects as well as reduced private investments in capital formation due to frail macro conditions.

Get the Nairametrics App

EBITDA grew 2.4% y/y to N19.3bn. The low single-digit growth in EBITDA was due to the rise in Cost of sales adjusted for depreciation (up 17.1% y/y), which offset the gains from cost optimising initiatives of the company evidenced in the decline in Operating Expenses adjusted for depreciation (down 7.8% y/y to N5.3bn). We note that the rise in the Cost of sales adjusted for depreciation was largely driven by the increase in Fuel and Power cost (up 52% y/y). On the other hand, the reduction in Selling and Distribution Expenses (down 8.5% y/y) and Admin Expenses adjusted for depreciation (down 7.7% y/y) drove the decline in Operating Expenses. Overall, the EBITDA margin weakened by 220ppts to 30.3% in Q1 2020.

Net Finance Cost declined significantly, down 64.6% y/y to N2.5bn, on the back of a steep moderation in Finance Cost (down 69.1% y/y to N2.6bn) which offset the decline in Finance Income (down 91.7% y/y to N115mn). The decline in Finance Cost was driven by the decline in Interest on borrowings (N2.1bn in Q1 2020 vs N7.8bn in Q1 2019).

(READ MORE: 11 Plc announces board meeting and closed period(Opens in a new browser tab)

We believe the decline in Interest on borrowings was due to the deleveraging efforts of management, following the rights issue of N89.2bn in 2019 as well as reduced cost of borrowing due to low yield environment. Notably, the debt of the company declined by 76% y/y to N60.1bn in Q1 2020 from N253.2bn in Q1 2019. On the other hand, the decline in Finance Income was due to the absence of Foreign exchange gain in Q1 2020 compared to N1.2bn recognized in Q1 2019.

READ ALSO: Quick take: Loss from discontinued operations drives UACN’s net loss in FY 2019

Buoyed by the steep decline in Finance Cost, PBT rose by 1.04x to N9.4bn in Q1 2020 compared to N4.6bn in Q1 2019. Net Profit, however, grew at a slower pace (up 28% y/y to N8.1bn in Q1 2020 vs N6.3bn in Q1 2019) due to a tax expense of N1.3bn in Q1 2020 compared to the tax credit of N1.7bn in Q1 2019. Following the restatement of the Q1 2019 numbers, the company reported N3.2bn as a loss after tax from the discontinued operation which further buoyed the growth in earnings. Accordingly, Net Profit rose by 1.56x to N8.1bn in Q1 2020 compared to N3.1bn in Q1 2019. EPS also grew 1.56x to N0.50 in Q1 2020 compared to N0.20 in Q1 2019.

We have a target price of N24.4 for Lafarge Africa with a BUY recommendation.

READ MORE: STERLING BANK: Reduced fee income, weak operating efficiency drives steep decline in pre-tax profit

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina, Lagos.