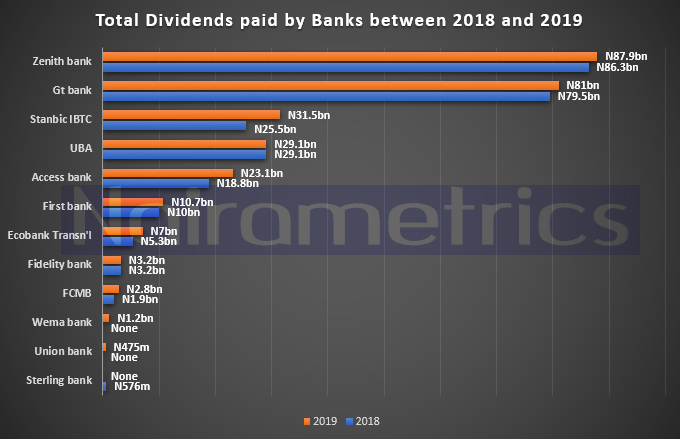

Between 2018 and 2019, quoted Nigerian banks paid out a total of N538.1 billion as dividends to their shareholders. In 2019 alone, the total dividends paid by these banks stood at N277.9 billion, according to checks by Nairametrics Research.

Interestingly, even though the banking index of the Nigerian Stock Exchange has been one of the most-liquid and best-performing indexes so far in 2020, there are strong indications that many bank shareholders will receive lesser or no dividends in 2020. This is because of the recent economic challenges occasioned by the Coronavirus pandemic.

See the listed banks

There are thirteen commercial banks that are listed on the Nigerian Stock Exchange. These are all familiar names, including the tier-1 banks – FBN Holdings Plc, United Bank for Africa Plc, Guaranty Trust Bank Plc, Access Bank Plc, and Zenith Bank Plc. Others are Ecobank Transnational Incorporated, Fidelity Bank Plc, Stanbic IBTC Holding Plc, Union Bank of Nigeria Plc, Sterling Bank Plc, FCMB Group Plc, Wema Bank Plc, and Jaiz Bank Plc.

(READ THIS: Nigeria gets $3.4 billion disbursement from IMF, interest rate 1%)

Let’s compare the stats

A brief comparison of the total dividends paid by the banks in 2018 and 2019 showed that Zenith Bank doled out the highest amounts of N86.3 billion and N87.9 billion. This is followed by Guaranty Trust Bank which paid out N79.4 billion worth of dividends in 2018, and then N81 billion in 2019.

UBA paid out N29 billion worth of dividends in both 2018 and 2019, while Access Bank paid N18.8 billion and N23.1 billion in 2018 and 2019, respectively. On the other hand, FBN Holdings Plc (which is the parent company of First Bank of Nigeria Ltd), paid out N10 billion in 2018 and N10.7 billion in 2019.

Based on the foregoing, we can see a clear pattern whereby the top banks were the ones paying out the highest dividends. Coincidentally, these tier-1 banks reported the biggest profits during the periods under review. A closer analysis also proved what most investors should already know, and that is the fact that the more profitable a company is, the bigger the dividends its shareholders are entitled. For instance, Zenith Bank and Guaranty Trust Bank (respectively) reported the highest and second-highest profits in 2018 and 2019.

How much dividend the rest of the banks paid

Note that Nigeria’s tier-1 banks were responsible for 94.6% and 89.3% of the total dividend payouts by NSE-listed banks between 2018 and 2019, respectively. The dividend payouts by the other banks can be seen below.

Possible dividend draught in 2020

As earlier mentioned, there are strong indications that some banks may resort to paying lesser or no dividends at all in 2020. This is due to the economic fallouts from the Coronavirus pandemic, which has triggered a recession in Nigeria. There are also other macroeconomic factors that might be responsible for this, as we shall see shortly.

Recall that Nairametrics recently reported about Augusto & Co’s latest assessment on Nigerian banks, which basically noted that COVID-19 has weakened the asset quality of the banks. According to the ratings agency, Nigerian banks are significantly exposed to several sectors, including the oil and gas sector, manufacturing, real estate, public sector, construction, and general commerce.

A related report by Augusto & Co also noted that Nigerian banks’ earnings and profitability are expected to decline drastically in 2020. In specific terms, banks’ earnings from their core business are projected to decline in the short term due to an expected rise in impairment charges and lower yields on their loan books. More so, the contractionary monetary policy stance, exacerbated by discretionary Cash Reserve Requirement (CRR) debits by the CBN, is expected to affect banks’ overall performance this year.

(READ FURTHER: Analysis: A better way to price Guinness shares)

Agreed, the Q1 2020 results so far released by the banks show generally positive performances. However, it must be noted that earnings reports were for the first three months of the year, shortly before the Coronavirus hit Nigeria hard. Subsequent quarterly results are projected to reflect the adverse effect of the pandemic in the form of lesser earnings/profitability. And as you may well know, companies find it difficult to pay dividends when their profits are low.

Cutting down on expenses in order to survive

Earlier this week, Nairametrics quoted Lanre Buluro of Chapel Hill Denham as saying that “…some companies (banks) have already begun to slash their CAPEX and will most likely cut dividend payouts in 2020.”

Of course, these are hard times for everyone, including the banks, so shareholders should be ready for a downtime.

Wondering why Union banks dividend are not paid for several years now. The last we got was a bonus share of 200unit per 1000 shares in 2008.

Just wondering if the bank is not making it why not merge with other bank. Shareholders want dividend the reason for investment in the 1st place.