There were news reports yesterday that President Muhammadu Buhari had approved the suspension of the payment of interest on debts owed by state governments. According to the Minister of Finance, Budget and National Planning, Zainab Ahmed, this was part of measures to reduce the debt burden on state governments.

The moratorium, according to the minister, would be granted on Federal Government and CBN-funded loans in order to create fiscal space for the states, given the projected shortfalls in FAAC allocations.

Recently, the Adamawa State Governor was quoted in newspaper reports saying his state will be unable to pay the new minimum wage in March due to the COVID-19 Pandemic.

READ MORE: Nigeria considers request for debt relief as debt stock climbs

The truth is that as long as state governments do not make desperate efforts to develop their internal revenue-generating capacity, the states in the country would continue to operate an inefficient rent collection system where they rely solely on FAAC allocation to meet basic needs such as paying workers salaries.

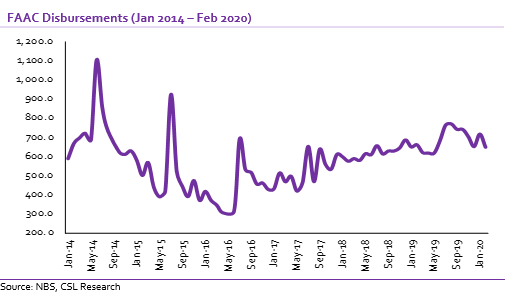

Most states depend primarily on monthly receipts from the Federal Accounts Allocation Committee (FAAC) to fund their budgets. However, there are a few exceptions like Lagos and Rivers more State. Some other states have also made some efforts to increase Internally Generated Revenue (IGR).

Unfortunately, monthly FAAC disbursements, which mainly originate from oil receipts to the Federal Government, are an unreliable source of income given its dependence on oil prices.

READ ALSO: Senate orders investigation of banks over withholding tax non-remittances

In December 2014, six months after oil prices began to decline (oil prices had fallen by about 46.5% at the time) it was reported that 11 state governments were unable to fund workers’ salaries and many needed bailouts to continue to fund their budgets.

_______________________________________________________________________

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State.