Not less than 31 state governments in Nigeria borrowed N457.17 billion to pay salaries to their respective civil servants.

This borrowing was facilitated through the Salary Bailout Facility (SBF), an intervention by the Central Bank of Nigeria (CBN). Established in August 2015, the SBF was designed to help state governments clear the backlog of outstanding salaries owed to their employees.

The amount borrowed is contained a report seen by Nairametrics, which presents the disbursement of the over N10.3 trillion intervention fund by the apex bank under the former governor, Godwin Emefiele.

According to the detailed breakdown in the report, 31 state governments have benefited from this initiative, with a disbursement amounting to N457.17 billion. Despite the substantial disbursement, the principal repayments made were N117.21 billion, with interest repayments at N45.21 billion as of September 2023. Consequently, a considerable sum of N339.97 billion remained outstanding, which was about 74% of the total amount disbursed. There was also an overdue amount of N1.31 billion as of September 2023.

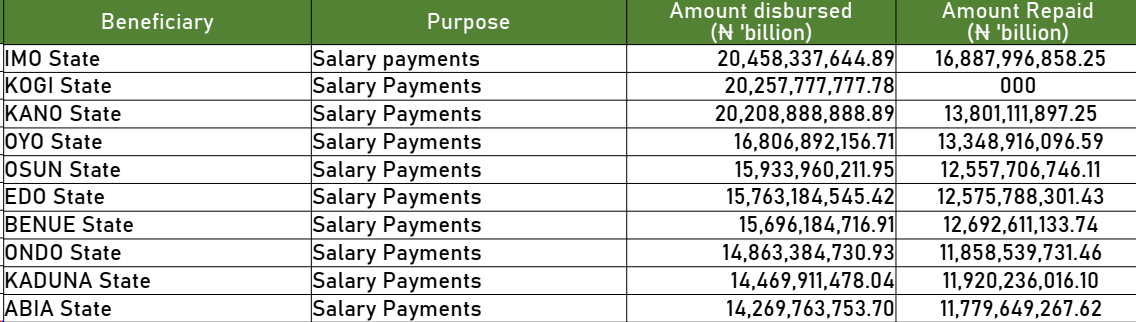

Here are the top 10 states that benefitted most from the salary bailout fund:

10. Abia State

Abia State secured the tenth position with an amount of N14.27 billion disbursed for salary payments. Known for its commercial hub in Aba, which is famous for crafts and footwear, the state has had to navigate economic challenges, likely leading to this borrowing.

9. Kaduna State

Kaduna State follows with N14.47 billion. As a key industrial center in Northern Nigeria, Kaduna’s borrowing underscores the economic pressures faced by this state, which is also struggling with cases of insecurity.

8. Ondo State

Ondo State, renowned for its cocoa production and rich cultural heritage, borrowed N14.86 billion. The state’s reliance on federal allocations and this borrowing indicates a need to diversify its revenue base.

7. Benue State

Known as the “Food Basket of the Nation,” Benue State required N15.7 billion. Despite its agricultural prowess, the state’s need to borrow points to fiscal strains in managing its administrative responsibilities.

6. Edo State

With a disbursement of N15.76 billion, Edo State is sixth on the list. The state, famous for its rich history and as a cultural nerve-center of the old Benin Empire, has sought financial intervention to meet its governmental obligations.

5. Osun State

Osun State, with a loan amount of N15.93 billion, holds the fifth spot. Known for its tourist attractions like the Osun-Osogbo Sacred Grove, the state’s economic activities are diverse, yet salary payment requires central borrowing.

4. Oyo State

In fourth place, we have Oyo State which obtained N16.81 billion. As one of the larger states by population and economy, particularly with Ibadan being a major urban center, the state still had to turn to the CBN for fiscal support.

3. Kano State

Kano State, a major commercial and agricultural hub in Northern Nigeria, borrowed N20.21 billion. This substantial amount reflects its large civil service and the state’s efforts to maintain stability in its government services.

2. Kogi State

Just a notch below the top borrower is Kogi State, with a loan of N20.26 billion. The state has a strategic location with several natural mineral resources but still faces economic challenges leading to the need for borrowing to pay salaries. The state is also the most expensive state to live in Nigeria.

1. Imo State

At the top of the list is Imo State, which borrowed the highest amount at N20.46 billion. Imo’s economy is heavily reliant on oil and agriculture, but the size of its public sector workforce and the huge burden of salary arrears has likely necessitated significant borrowing to manage salary payments.

I saw the complete list and didn’t see Kwara. Seems that government knows how to cut its coat according to its cloth.

Why