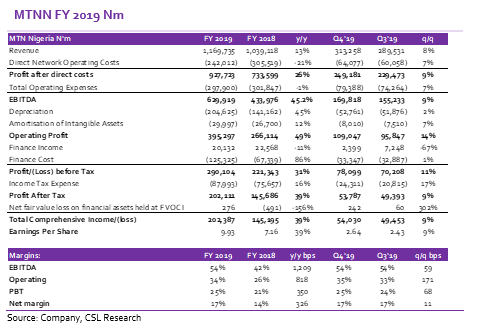

MTN Nigeria (MTNN) reported double-digit growth in Revenue (up 13% y/y to N1.2 trillion) in FY 2019, on the back of growth in voice (+8% y/y) and data revenue (+42% y/y). Buoyed by the topline growth and the sub inflationary growth in Operating Expenses (up 4% y/y), Pre-tax Profit grew strongly, up 31% y/y to N290.1 billion in FY 2019.

We believe the outbreak of COVID-19 which has disrupted activities, leading to shutdown of offices, factories, schools and social gatherings will result in increased data and voice consumption in the short term as people increasingly communicate remotely and seek entertainment during the lockdown.

Thus, we expect MTN’s earnings to receive a significant boost. Post COVID-19, we think favourable demographics, rising smartphone penetration along with increasing internet penetration (38.47% as at Jan-2020 compared with 32.34% in Jan 2019), and continued investment by the company in deepening 4G coverage are positive catalyst for earnings growth.

We have revised our estimates over our forecast years (2020-2024). The overall impact is a marginal increase in our price target to N187.4/s from N184.2/s previously, hence we retain our BUY recommendation.

[READ MORE: Oil Price: A dead cat bounce in the making?)

Our revised target price implies an upside potential of 97.3% from the last closing price of N95.0/s. MTN is currently trading at a FY2020e P/E and EV/EBITDA of 6.7x and 2.8x respectively, a discount to EM peers average of 13.9x and 4.7x respectively.

Read the full report here.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State.

But you how these MTN is enslaving Nigerians especially their customer care reps