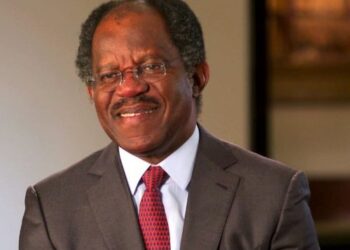

The National Leader of the ruling All Progressive Congress (APC) and the former Governor of Lagos State, Asiwaju Bola Ahmed Tinubu, has urged the Federal Government to print more naira notes to save the economy from total collapse due to the adverse effect of the coronavirus pandemic and crash in crude oil prices globally.

This advice is part of a special message which was issued by the former Governor to President Muhammadu Buhari, a day before his 68th birthday.

In his special message which was monitored by Nairametrics and titled: A message on the coronavirus; A time for unity, a time for thought, a time for action, Tinubu, outlined ideas and measures that the president and members of his team can take in order to navigate Nigeria out of a possible recession that will arise from the coronavirus pandemic as oil prices fall and government revenue shrinks.

He admitted that we as Nigerians are facing challenges that we cannot see, but can find us too easily. That the coronavirus disease is here and cannot be paid off and bargained with by the rich, read their bank statements or intimidated by them. The disease as well does not care or have mercy for the poor, recognize religion or geographical location.

He admonished Nigerians that the present crisis is a wakeup call to unite and act as one blood.

Asiwaju Tinubu, asked Nigeria to emulate China and other Asian countries, who took very drastic actions like lockdown of cities and closure of key segments of their economies in order to confront the spread of the coronavirus.

Read Also: Another crushing recession ‘is coming’

On the economic front, he said that economic activity is a fraction of what it was just a month ago and as such, deep recessions are forecasted.

In his statement, he said, ‘Economic activity is a fraction of what it was just a month ago. Deep recessions are forecasted.

‘Some experts fear depression now tracks the world down. Governments worldwide are responding by embarking on unprecedented stimulus packages to keep their economies afloat’.

The APC National Leader listed some of the stimulus package announced by some major economies around the world to include; the pumping of trillions into their financial markets by the Chinese, launching of an unprecedented fiscal stimulus package in the United Kingdom, the Germans putting aside its constitutional prohibition on deficit spending to formulate a historic and an unprecedented fiscal stimulus package, the $2 trillion fiscal stimulus by Trump administration in the US.

Tinubu believes that Nigeria should take lessons from some of these countries in the implementation of some of those strong economic measures. He said that the crash of oil prices to less than $30 dollar per barrel will lead to a massive reduction in government revenue and foreign exchange earnings.

[Read Also: Kaduna state governor, El-Rufai tests positive to coronavirus]

As a result of this, he advised the Federal Government to print more Naira, just as the US has used its sovereign right to issue its own currency, the dollar to stave off economic disaster. He said, while individuals, companies and state governments can go bankrupt during hard times, the federal government cannot be naira insolvent because it has the ability to issue our national currency.

However, in doing this, together with increased spending, the government needs to monitor the inflation rate and ensure that it doesn’t go too high.

Read Also: Coronavirus: WHO says Nigeria is among countries with highest cases

Other economic measures to help manage the coronavirus threat to the economy includes:

• Suspension of VAT for the next 2-4 months and tax credits of partial tax reductions for companies. This is to help lower import costs and guard against shortages.

• Lower interest rates in order to encourage borrowing and private sector activity.

• Maintaining of government expenditure rather than reduce spending at this critical period. In fact, he encouraged an increase of at least 10%-15% during this kind of emergency.

• Ensuring food security by protecting citizens from food shortages and high prices.

• Increase of stipends to the poor. This can be done by widening the net and substantially increasing the number of recipients of this programme.

• As for the exchange rate, he advised CBN to allow some downward pressure on the naira and should only intervene when it looks like the rate will come down. He said government should revisit the ban on non-institutional Nigerian dollar holders from taking part in open market operations.

• The enactment of extraordinary measures by CBN to forestall stress in the financial sector. They should ensure liquidity in the financial system by expanding its balance sheet and buying of government bonds and other instruments held by banks and other institutions.

Such a simplistic proposition to ‘print naira notes’. What is required is a mechanism to guarantee the provision of household items and other requirements in an effective way. Someone in Ondo state suggested the establishment of food banks. That’s a brilliant idea. Majority of the items on this news are better said than done.