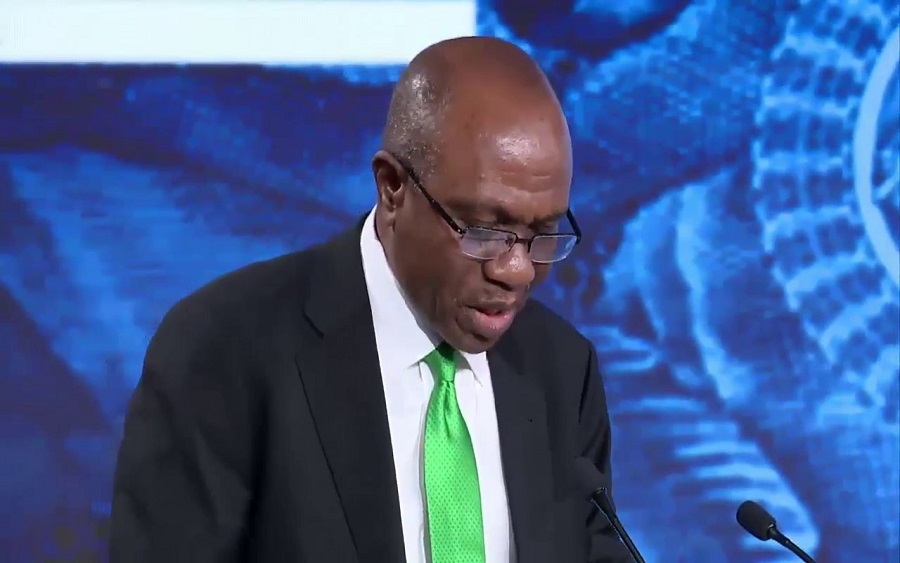

So far this week, the Nigerian treasury market has been characterised by bearish sentiment. This has particularly been affecting tenured Open Market Operation (OMO) securities, according to Access Bank’s Head of International Treasury, Oluwemimo Omotosho, who spoke to CNBC Africa.

Apparently, this bearish sentiment is due to a recent decision by the Central Bank of Nigeria (CBN) to completely restrict OMO sales to individuals and startups starting from the end of November.

Omotosho acknowledged that the decision by the apex bank is quite understandable, as the move is aimed at encouraging banks to lend more to the real sector of the economy.

“It has to do with the need to also support the initiative of the CBN such that funds will be available for the domestic SMEs. It’s just to encourage SMEs and for funds to be provided to them instead of the usual activity we see in the market whereby demand for treasury bills was always on the increase. So, yes, it supports the initiative of the CBN to grow the real sector.”

Interestingly, the foregoing situation has also been favourably-disposed to the market in general because the level of liquidity has been very positive. As Omotosho noted, the market opened yesterday with at N339 billion, a situation that has caused the OBB and overnight rates to drop by 14 and 29 bases points, respectively.

[READ MORE: Alert: CBN issues N847.4 billion treasury bills for Q1 2020)

He also added that it is expected that about N345 billion would mature into the market today. This, he said, would encourage the market liquidity to continue to increase. In the same vein, it would positively impact on the OBB (Open By Back) and overnight rate in the market.

It should be noted that the overnight rate helps to ensure that banks can access short-term financing from the CBN depositories. The lower the overnight rate, the easier and cheaper it is to borrow money; not just for banks but also for bank customers. High liquidity in the system is good for the overnight rate.