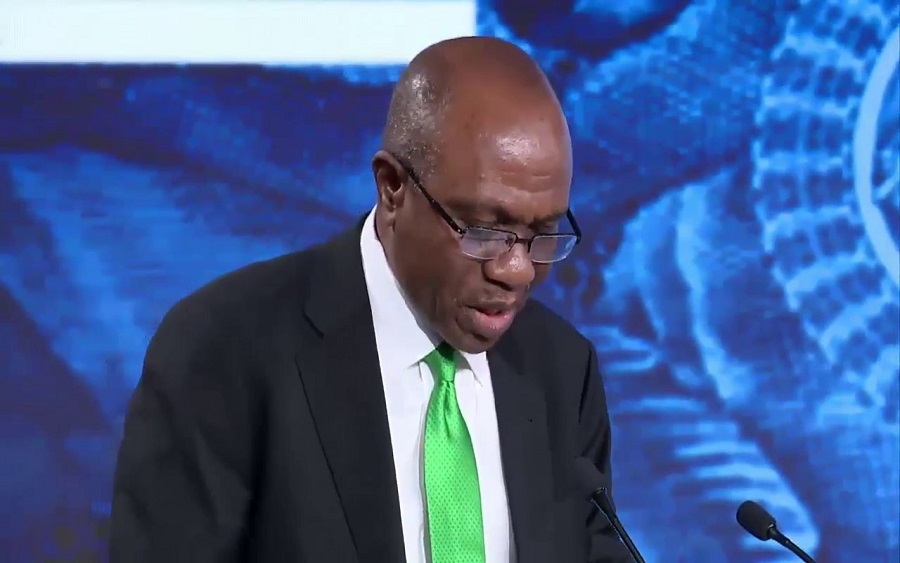

Mr Godwin Emefiele, the Governor of the Central Bank of Nigeria (CBN) has disclosed that the rapid increase in food prices and all other products, excluding farm produce, is momentary and will reverse aggressively in another three to four months.

The CBN disclosed this after the publication of the National Bureau of Statistics’ (NBS), inflation report for the month of October which reflects inflation figures at a 17-month high, from 11.24% in September to 11.61% in October.

According to Channels Television, Mr. Emefiele stated that the attribution of the rise in food prices and all other goods to the border closure is true but the benefits outweigh the temporary rise in prices.

“Inflation goes up from 11.22 to 11.61 between September and October, and mainly it’s because of the border closure.”

Mr Emefiele, after admitting that the border closure led to shortfalls in the supply of goods as a result of local production not meeting up with the market demands and the non-existence of dumped goods from other countries, said it is still Nigerian farmers and car dealers that are benefitting from the price increase.

[READ MORE: Increasing food prices might erase chances of CBN cutting interest rate]

“I am not going to entirely disagree that yes, because of border closure that has resulted in some supply shortages because of goods that are being dumped into the country.

“Who are those benefitting, in as much as I don’t like the fact that prices went up momentarily from September and October, the beneficiaries are Nigerians and companies where we have seen a situation where people have jobs, farmers who produce poultry and those benefitting from import of cars legitimately.”

However, the CBN Governor reportedly expressed his irritation at the inflationary pressure but was quick to assure that the trend would witness an immediate downward trend.

“In as much as I do not like the fact that the inflationary pressures are coming up right now, I’m also saying that it will moderate and very quickly, maximum of another 3 to 4 months aggressively downwards.”

Meanwhile, how long can Nigerians endure increased inflationary pressure and a shortened supply of goods within the economy, as the implications of the border closure take its toll on businesses and individuals?

The recent events with the popular eatery, Chicken Republic running out of chickens to sell to its customers, as earlier published by Nairametrics, might not be unrelated to the happening at the Nigerian land borders.