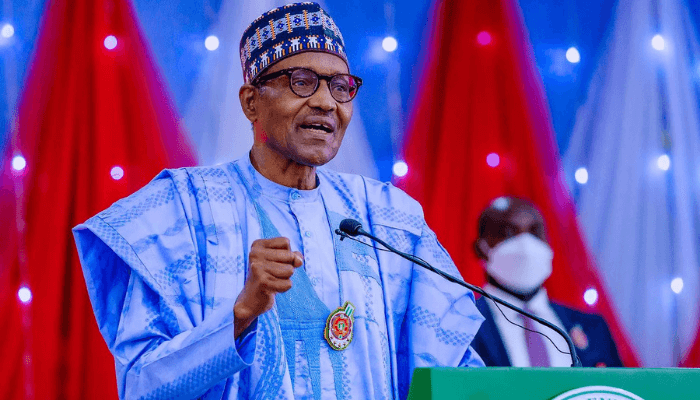

Six aviation bills have been forwarded to the Senate for consideration and passage into law by President Muhammadu Buhari, according to Nigerian Tribune.

The Details: The six bills include Civil Aviation Bill 2019, Federal Airport Authority of Nigeria Bill 2019, Nigerian College of Air Space Management Agency Establishment Bill 2019.

Others are Nigerian College of Aviation Technology Establishment Bill 2019, Nigerian Meteorological Agency Establishment Bill 2019, and Nigerian Safety Investigation Bureau Establishment Bill 2019.

The request was contained in a letter addressed to the Nigerian Senate and read by Senate President, Dr Ahmad Lawan at a plenary session.

The letter read: “Dear Distinguished Senate President,

“Transmission of Six Aviation Sector Bills to the National Assembly for consideration and passage into law.

“Pursuant to Section 58 of the Constitution of the Federal Republic of Nigeria 1999 as amended, I formally request that the following six bills be considered for passage by the Senate.

“While I trust that these bills will be expeditiously and favourably considered by the Senate, please, accept Mr Senate President the assurances of my highest consideration.”

[READ MORE: Senate to pass 2020 budget on November 28, breaks eleven-year jinx]

To hasten the process, Lawan directed the Clerk to the Senate, Nelson Ayewoh to ensure that the bills were gazetted and distributed to all the Senators for consideration.

Why this matters: Nigeria has experienced the absence of enabling laws to provide a safety net for professionals in the aviation sector which is a critical situation for aviation professionals in Nigeria. This could be the reason for the President’s immediate request for passing the bills to the Nigerian Senate for consideration.

What you should know: The primary legislation regulating aviation in Nigeria is the CAA. Section 77(2) of the CAA provides that all regulations, by-laws, orders and subsidiary legislation made under the old Civil Aviation Act of 1964 shall continue to be in force until new regulations, by-laws, orders and subsidiary legislations are made pursuant to the CAA of 2006.

This is why Managing Director, Med-View Airline, Alhaji Muneer Bankole, called on the Aviation Minister, Hadi Sirika to implement certain reforms needed in the Nigerian aviation industry as reported by Nairametrics.