According to media reports, the Association of Senior Staff of Banks, Insurance and Financial Institutions (ASSBIFI) has lamented the practice of casual, contract and outsourcing staff policy in the banking sector.

According to the President of the association, she claimed the percentage of banking sector workers who fall within the casual, contract and outsourced category stands at 65.0%. This implies just 35.0% of banking sector staff can be considered core employees.

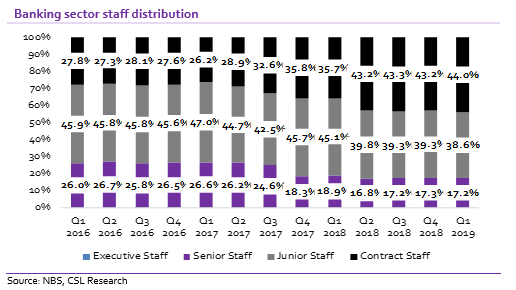

While official statistics for staff within the casual and outsourced category is unavailable, data from the Nigerian Bureau of Statistics puts the percentage of contract staff to total banking sector workforce at 44.0% as at Q1 2019. This is a significant increase from 27.8% as at Q1 2016 when NBS started to publish this data.

To manage the increasing cost of banking operations in Nigeria especially regulatory costs as well as the tough economic environment, banks have sought to find ways to manage costs, one of which is a reduction in staff costs.

[READ MORE: Global Markets: U.S Fed delivers another rate cut]

Thus, while the banking sector staff strength has grown by 29.5% over the past three years, many of the hired staff have been contract staff. According to NBS data, over the past three years, there has been a 14.6% decline in the number of Senior staff, an 8.9% increase in the junior staff number while the number of contract staff is up 104.8%.

_____________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.

Good morning,

I don’t believe the claims of banks on cutting cost is the engagement of casual workers. What is the essence of cutting cost and engaging incompetent staff as bankers. Whereas, their profit is increasing every year as a result of free money they are charging customers.

Many of the outsourced companies are been floated by bank directors and it is a way of transferring funds to them in form of business.

This is one of the reasons for poor performance and cause of liquidation as there is poor commitment by the casual staff to the organisation.

Take for instance a new bank that is poaching staff of one of the top bank recently. Almost 20% of the bank staff are this particular/ single bank. That is the staff will appreciate to leave with experience and rather join the new bank where they will be committed as staff.

Thanks.

Thanks for the wisdom,thanks for the achievements made so far for the year. For those who are on contracts,can you not start making some of them permanent on yearly bases for encouragement? The agents can be increased to improve the employment rate.