The global economy has enjoyed a prolonged expansion since the financial crisis of 2009. However, over the past two years, there have been major concerns of another global economic downturn amidst global trade tensions.

US-Sino trade tensions, as well as prolonged uncertainty on Brexit, have been major concerns to global economic growth. There were positive surprises to growth in advanced economies (Growth was better than expected in the United States and Japan) with weaker-than-expected activity in emerging market and developing economies. Elsewhere in emerging Asia and Latin America, activity has disappointed.

[READ ALSO: How Nigeria’s economy could be affected by global events – Analysts]

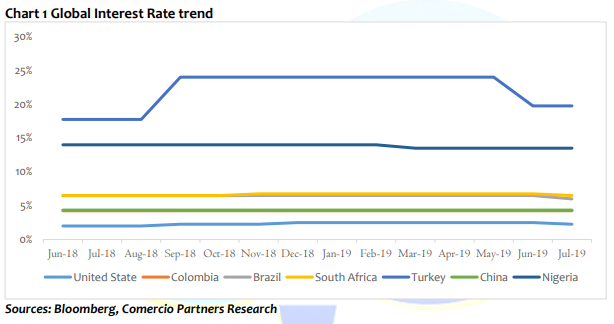

The intensified trade tension and global economic uncertainty have ushered in a dovish stance from global central banks who are essentially keen on supporting the fragile growth trajectory the global economy has been on over the last two years.

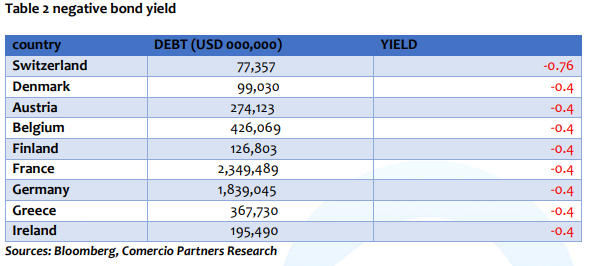

Era of negative bond yields

Concerns about the strength of the global economy, US-China trade war, geopolitics, particularly in the Middle East has ushered in a risk-off sentiment in the global financial market, as Investors are rushing to get their hands on the safest assets available, such as government bonds. Leading to a significant increase in the number of bonds with negative yields. Almost $12 trillion of investment-grade corporate and government bonds have negative yields, predominately in Europe and Japan, according to Barclays data. That’s the largest amount since the middle of 2016.

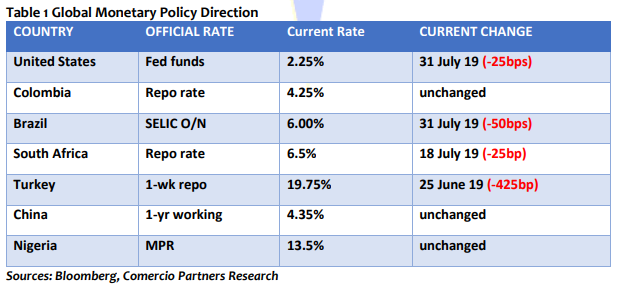

The US Federal Reserve cut the benchmark interest rate by 25 bps during its July meeting, the first rate cut since the financial crisis, as inflation remains subdued amid heightened concerns about the economic outlook and ongoing trade tensions with China. However, the Federal Reserve has ruled out an extended policy easing cycle. It characterized the rate cut as “a mid-cycle adjustment to policy” and stated that the 25-basis-point easing was “not the beginning of a long series of rate cuts”.

[READ ALSO: Nigeria’s total Foreign Trade hits N8.6 trillion in Q2 2019, up by 4.4%]

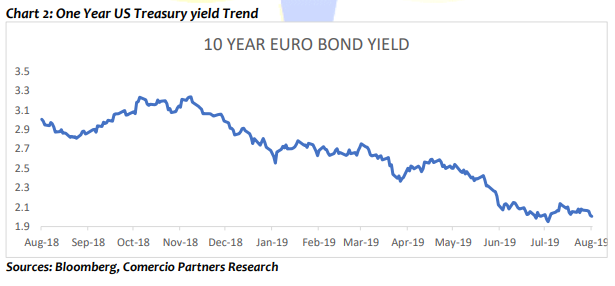

The announcement was immediately trailed by a sell-off in most risk assets as the market had priced in additional cuts in 2019, Yields on 10-year US treasury climbed to 2.053% and the U.S. dollar climbed to levels not seen since May 2017.

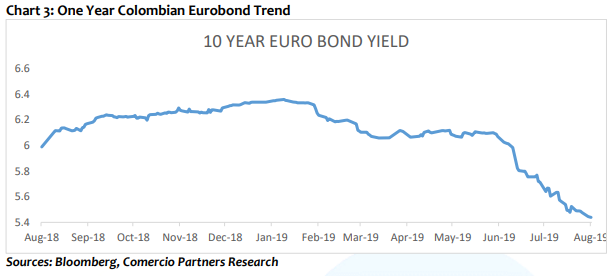

The central bank of Colombia left the benchmark interest rate unchanged at 4.25% at its July 26th, 2019 meeting. Members of the monetary committee collectively voted to leave the rate unchanged for the fifteenth straight month (last change was in Jan 2018), stating that new information is indicating a strong Q2 economic growth which will be supported by investment in machinery and equipment and public consumption.

The Committee said that they will continue to monitor developments around inflation which rose to 3.43% in June from 3.31% in the prior month mostly boosted by the cost of food, economic activity and balance of payments and take actions depending on new data.

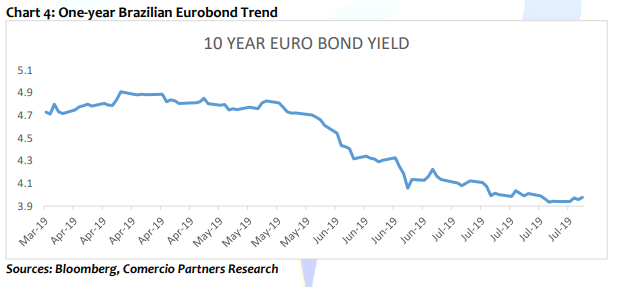

The Central Bank of Brazil voted unanimously to lower its key Selic rate by 50bps to a record low of 6% during its July meeting. The Committee emphasized that recent data on economic activity indicate weaker economic activity from previous quarters and that risks of a global slowdown persist, as brazil economy grew by 0.5% in Q1 2019 from 1.1% in Q4 2018. The Committee signalled further easing, highlighting; a decelerating global economy and slower domestic inflation.

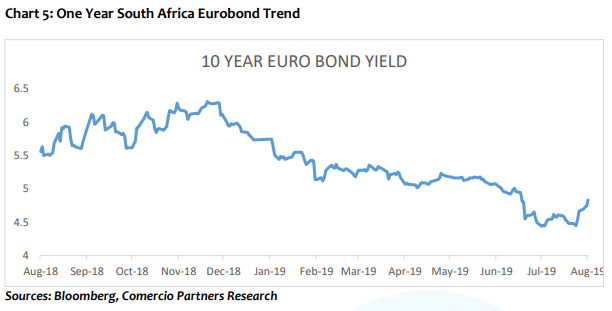

As widely expected, The South African Reserve Bank cut its benchmark repo rate by 25 bps to 6.5% on July 18th, 2019 It was the first-rate cut since March last year, amid a persistently uncertain environment. Members of the monetary committee noted that inflation expectations continued to moderate and said that they will focus on anchoring it near the mid-point of the inflation target range. The Committee added that future policy decisions are highly data-dependent, sensitive to the assessment of the balance of risks to the outlook. Also, policymakers said that the GDP is expected to rebound.

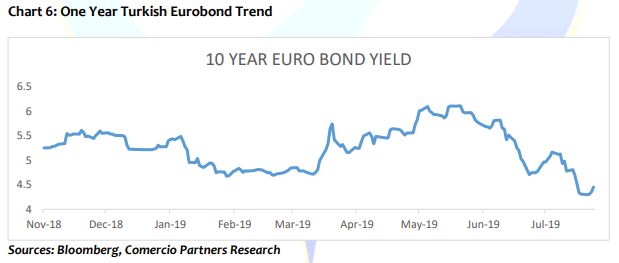

The Central Bank of Turkey slashed its one-week repo auction rate by 425bps to 19.75% during its July meeting, saying inflation outlook continued to improve as domestic demand conditions and the tight monetary policy continue to support disinflation. In addition, policymakers voiced concerns about rising protectionism and uncertainty regarding global economic policies.

[READ ALSO: Nigerian Eurobonds Weaken as Trade war Depresses Oil Prices]

Early July, President Erdogan sacked the governor of the Turkish central bank, Murat Cetinkaya and replaced him with his deputy Murat Uysal. Before the sack of Murat Cetinkaya there have been speculations that he had a disagreement with the government on cutting the interest rate.

The benchmark interest rate in China was last recorded at 4.35%. It was last cut by 25 basis points in October 2015. On September 27th, 2018, the People’s Bank of China left interest rates for open market operations unchanged even after the Federal Reserve s decision to tighten monetary policy. However, the People’s Bank of China made a cut to the cash reserve ratio earlier this year, as they cut the cash reserve ratio by 100 bps. reserve requirement ratios (RRRs) are currently 13.5% from 14.5%.

The Monetary policy Committee of the Central Bank at its July meeting maintained the benchmark interest rate of 13.5%. In a follow up to the May meeting and its five-year strategic plan, CBN has issued 2 circulars, essentially aimed at implementing its strategic intent of reducing the crowding-out effect of the private sector with respect to bank credit. On the back of the circulars, Yields declined sharply as a sizeable amount of liquidity was” freed-up” driving yields to their lowest points in 18 months.

CBN governor Godwin Emefiele said at a press conference he is not in a hurry to bring interest rates down but will start reviewing bank’s loan to deposit ratio after September 30th aiming at increase lending and stimulate growth.

More monetary easing likely as trade tensions escalates

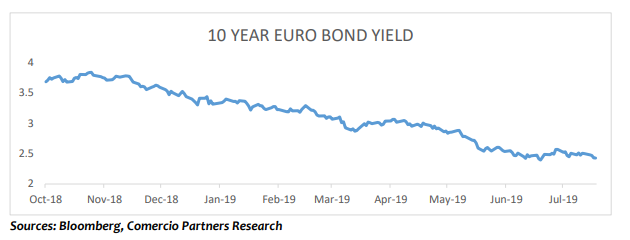

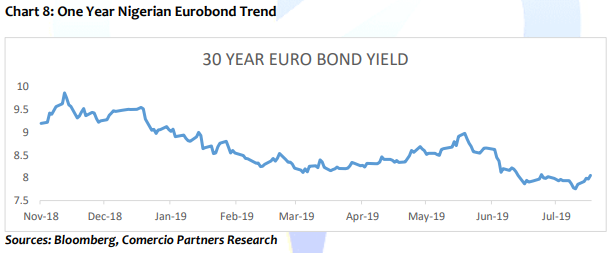

The continued dovish stance of global Central banks has created a “wall of Money” looking to get deployed at the best yields possible. This has seen yields drop significantly through the month of July, particularly in emerging markets. The on-going trade dispute between the US and China remains the elephant in the room.

[READ ALSO: NNPC and China Oil Corporation seek to expand $16 billion trade investment]

How things shape up on that front would play a key role in determining monetary policy posture for global central Banks for the remainder of the year. Barring any negative idiosyncratic factors, these developments should bode well for the Nigerian Fixed income market as we expect to see inflows in emerging markets with good fundamentals and attractive yields.