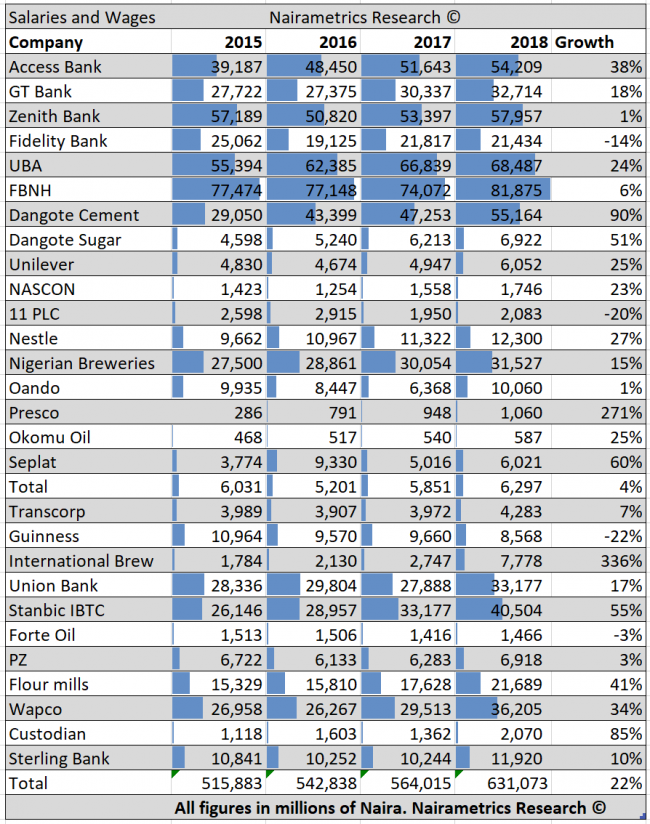

Salaries and wages of some of Nigeria’s largest corporations topped N631 billion at the end of 2018 representing a 22% growth from the N515.8 billion recorded in 2015. Nigeria has faced economic hardship since 2015 following the fall in the price of oil sliding into a recession in 2016.

Nigeria’s economic situation has adversely affected the working-class population as companies cut back on payroll increases to remain in the black. However, a review of the payroll data of 29 of most capitalized stocks on the Nigerian Stock Exchange over the last 4 years reveals companies have generally increased salaries and wages ahead of rising inflation but not enough to cover for the 35% impact on the devaluation of the naira.

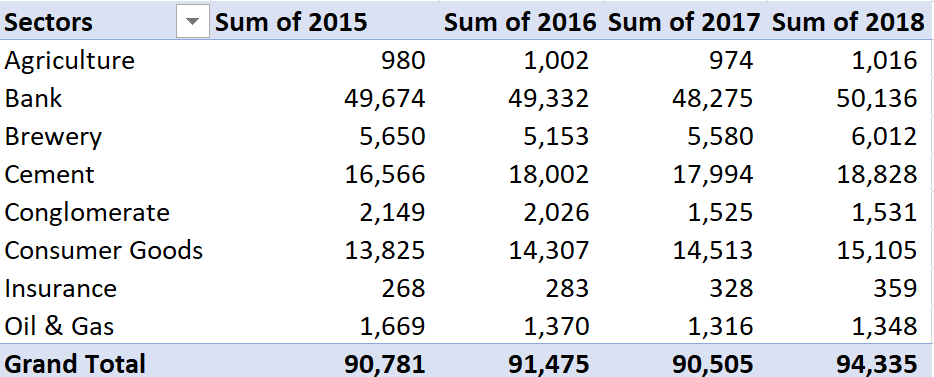

Sectors – Headcount

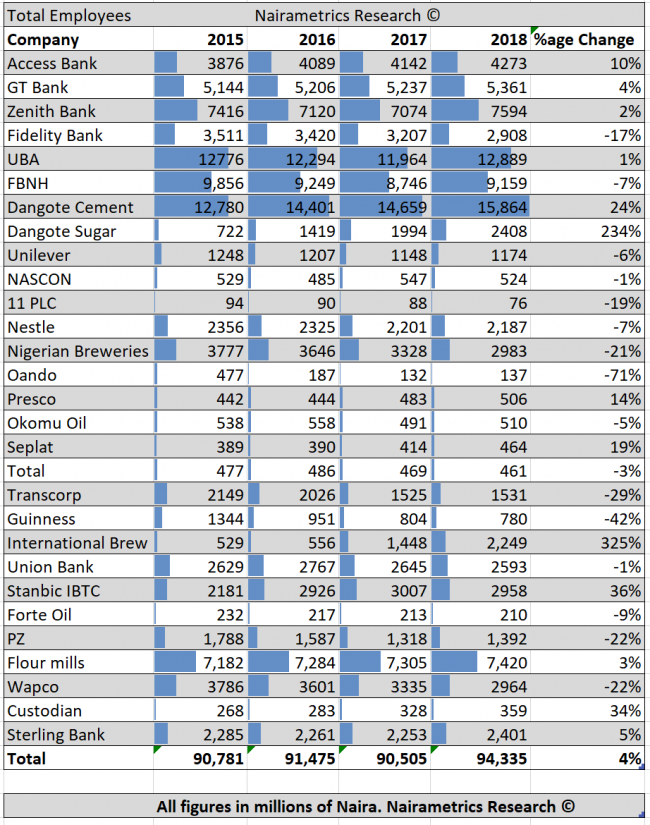

In general, the combined 29 companies on our list recorded a headcount growth of 4% from 90,781 in 2014 to 94,335 in 2018. Headcount growth was 1.3% on a compounded annual growth rate basis.

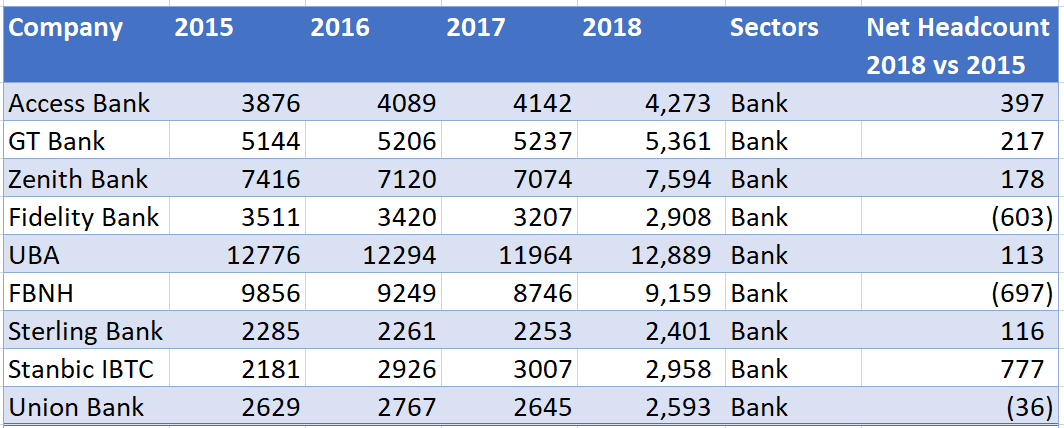

Banking sector: They lead the pack with about 50,136 employees on their payroll for just the 9 banks on the list. This compares to 49,674 jobs in 2015 representing a net job created of just 462. Data from the National Bureau of Statistics reveals banks employed about 104,669 employees in 2018 out of which 45,238 were contract staff. This perhaps explains the low net jobs created data as banks now channel most of their job creation to casual staffs.

UBA had the most employees with 12,889 staff followed by FBNH with 9,159. It is important to note that a significant portion of the employees of UBA reside outside of Nigeria as they are spread across Africa.

Cement: The sector which includes just Dangote Cement and Lafarge Wapco employed about 18,828 people in 2018 compared to 16,566 in 2015. As expected, Dangote Cement employed the most with about 15,864 employees compared to Lafarge Wapco’s 2,964. Just like UBA, Dangote Cement has operations outside Nigeria accounting significantly for its huge headcount. Dangote Cement also has the highest headcount with about 15, 864 employees as of 2015. This represents a 24% growth when compared to our baseline year of 2015.

Consumer Goods: This sector can be considered a prolific job creator in Nigeria however, the have been experiencing tough economic challenges following the 2016 recession as well as low economic growth. Despite this, the 6 companies on our competitive set employed about 15,105 people compared to 13, 825 in 2015.

However, Dangote Sugar created the most net jobs as its headcount rose from 722 to 2, 408 employees. PZ, Nestle, Nascon, and Unilever had a lower headcount when compared to their 2015 figures.

Others: The competitive brewery sector increased headcount by 362 between 2015 and 2018. A closer look into the data reveals, International Breweries led the way with 1,720 net jobs created between 2015 and 2018 while Guinness and Nigeria Breweries shed 564 and 794 jobs respectively. International Breweries has stepped up its competition in the brewery sector after a series of mergers and acquisitions drove it to number 2 on the largest brewery by revenue in Nigeria.

On the Oil & Gas front, the total headcount of 1348 was recorded and 321 less than 1669 that existed in 2015. This is expected considering the negative effect of the crash in oil prices in 2014. Most Oil and Gas firms have had to cut down on jobs as part of its restructuring. Our Oil and Gas list includes Forte Oil, Mobil (now 11 Plc), Oando, Seplat and Total.

Sectors – Salaries & Wages

In general total salary and wages rose by 22% to N631 billion when compared to N515.8 billion recorded in 2015. Out of the 29 companies on our list, only Fidelity, 11 Plc, Guinness Plc, and Forte Oil recorded lower total salary and wages when compared to 2015. There was marginal growth with 11 Plc and Forte Oil between 2017 and 2018 even though still significantly lowe from their 2015 baseline.

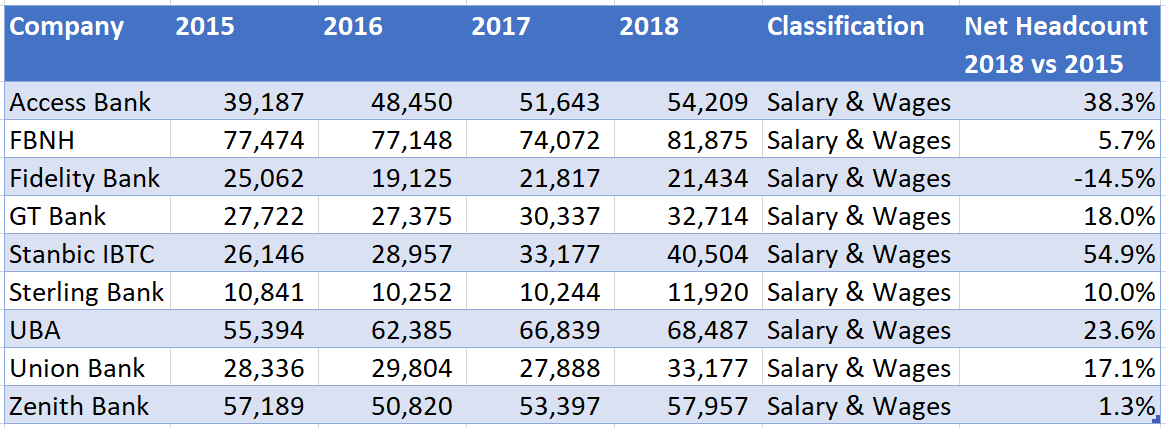

Banking Sector – As expected, the Banking Sector led with about N402.2 billion in 2018 representing a 15.8% growth when compared to our baseline year of 2015. A deep dive into the data reveals, Stanbic IBTC increased its salary and wages figure by a whopping 54.9% from N26.1 billion to N40.5 billion annually. This is also in tandem with its payroll which has increased by 36% over this period. Stanbic IBTC also includes allowances in its salaries but the not disclose if this includes bonuses.

We also observed, UBA and GTB’s salary and wages also increased by 23.6% and 18% respectively over the comparative period (2015 vs 2018). This could also be linked to increased headcount recorded during the period. Fidelity Bank was the only bank that cut down on its payroll, reducing 14% to N21. billion. FBNH still leads with the most salaries and wages of N81.8 billion.

Highest paying bank per staff (FUGAZ): We also looked at income distribution of Nigeria’s Tier 1 Banks, First Bank, UBA, GT Bank, Access Bank, and Zenith.

| Bank | Total Staff | Highest paid | Highest Pay Range | %age |

| First Bank | 9,158 | 2,352 | Above N9m | 26% |

| UBA | 12,880 | 1,024 | Above N9m | 8% |

| GT Bank | 5,366 | 505 | Above N8.6m | 9% |

| Access Bank | 4,273 | 1,207 | Above N9m | 28% |

| Zenith Bank | 7,594 | 1,938 | Above N9m | 26% |

Other Sectors: Dangote Cement recorded one of the highest salary and wages with N55.1 billion in 2018 alone representing an 89% spike from the N29 billion recorded in 2015. The company’s headcount grew as well by 24%. On average the company is incurring at least N3.4 million per employee compared to N2.27 million in 2015.

Dangote Sugar, another company in the group also recorded a 51 spike in its salary and wages expenses as it continues with its capacity expansion and increases its market share.

In the Oil and Gas space Seplat recorded a 60% spike in its salary and wages, incurring N6 billion compared to N3.7 billion in the baseline year. Oando maintained a 1% growth over the baseline period closing at N10 billion. 11Plc and Forte both recorded drops of 20% and 3% respectively.

See the comprehensive list below;

Salaries and Wages used in this data were obtained from the annual report of the companies in our comparative set. It excludes bonuses, share options and other perks typically paid by the companies. It may, however, include welfare packages and pension for some companies depending on how it is classified in their general ledger which is not public.

Note: This article was amended to reflect new information after receiving positive feedback from our readers and partners.

While average salary is nice to know, the median salary would have been a better indication of a true wage growth. A case in point is Oando. According to your report 132 of its 137 employees receive between N8 million and N10 million in salaries annually,yet the average salary is N73 million. This shows that 5 of its employees (most likely the management) makes up the roughly N63 million difference in average wage.