There is an ongoing debate on Twitter on whether sports betting is truly a sustainable business model or simply a means some young entrepreneurs are using to eat down on the income of many young Nigerians.

The arguments against: A Nigerian financial expert, Kalu Aja, opined that all forms of betting are addictive and for this reason, it falls under the category of gambling.

He advised that people should not be hooked onto it, as it is a tax on the poor. He further buttressed his point by quoting research findings by the American Psychiatric Association which said,

“Pathological gambling as an impulse-control disorder and that pathological gamblers and drug addicts share many of the same genetic predispositions for impulsivity and reward seeking.”

https://twitter.com/FinPlanKaluAja/status/1147839858288680962

[READ ALSO: Meet Akin Alabi, the founder of Nigeria’s ‘first’ online sports betting platform]

Advice for sport betting entrepreneurs: Another Nigerian entrepreneur, Tayo Oyedeji, urged Nigerian entrepreneurs to come up with inventions that won’t destroy the youths. According to him, entrepreneurs should build “business models that don’t destroy people’s lives” while it enriches them. He stressed that sports betting is destroying the lives of many in Africa.

Dear entrepreneurs,

Please build business models that don't destroy people's lives while making money for you.

Sports betting is literally destroying communities across Africa. https://t.co/6QtimnMpH1

— Prof. Tayo Oyedeji (@tayooye) July 6, 2019

Another Twitter user named Sam Hart recounted how when he was working on a project in his village and noticed that many young people were not interested in the daily job but rather were more fascinated with how they could bet their money for a quick increase. According to him, sports betting as a means of getting rich, is a scourge in Nigeria.

Sports Betting as a means of getting rich is a scourge in Nigeria.

Working on a project in my village & all the young men were not interested in the daily grind. What do they do with their time? Sports betting. All day everyday.

Worrisome.

— Sam Hart, mni (@hartng) July 5, 2019

[READ FURTHER: Facebook ‘will die’, replaced by the next cool Social Media – Mark Essien]

People’s reactions: Different opinions have made the rounds online as many are either for or against the idea of boycotting sports betting. Many disagreed on the notion that the act is a tax on the poor, as they defended it by arguing the rich people also partake in the betting.

https://twitter.com/neduchikezie/status/1147881707879706624

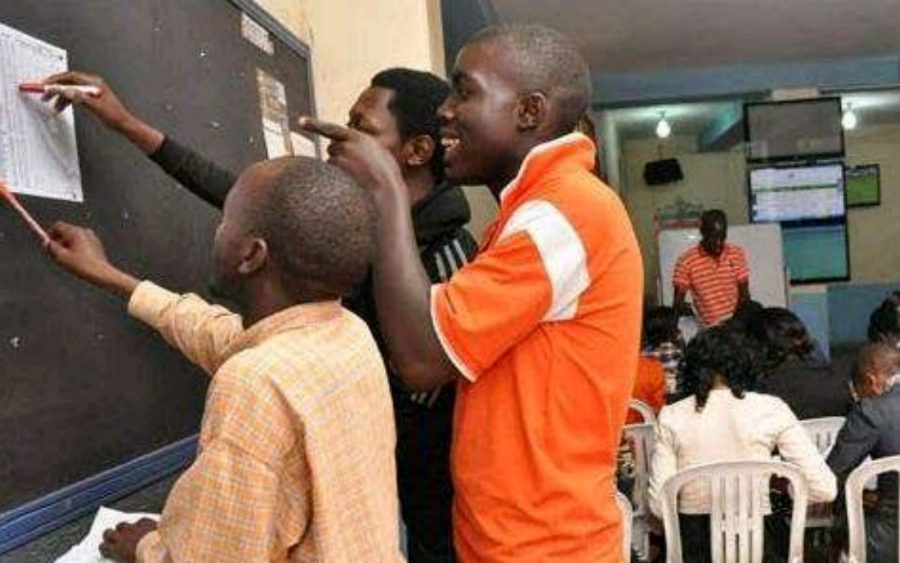

Should sports betting company owners be worried? Online sports betting is no longer a new thing in Nigeria, as each day sees the emergence of a new brand. One of the main reasons the business is flourishing is because of Nigerians’ love for football.

According to an earlier report by Nairametrics, roughly 60 million Nigerians between the ages of 18 and 40 are involved in active sports betting. Almost N2 billion is spent on sports betting daily in Nigeria. This translates to nearly N730 billion in a year.

The industry keeps thriving because there is a population for it, including the high rate of unemployment, which had made many youths resort to quick ways of making money. Based on the foregoing, it is safe to say that there is really no reason for sports betting companies to be worried.

How it benefits the economy: They are many benefits of a legal sports betting. It can increase state revenue in the form of taxes and other levies paid to the government. Taxes from sports betting in Lagos State, for example, rose from 30 percent in 2016 to 40 percent in 2017. It will also generate more job opportunities in existing casinos (oddsmakers, analysts, security, cashiers, etc.).

[READ FURTHER: Economics of $2 billion Sports Betting Industry in Nigeria]