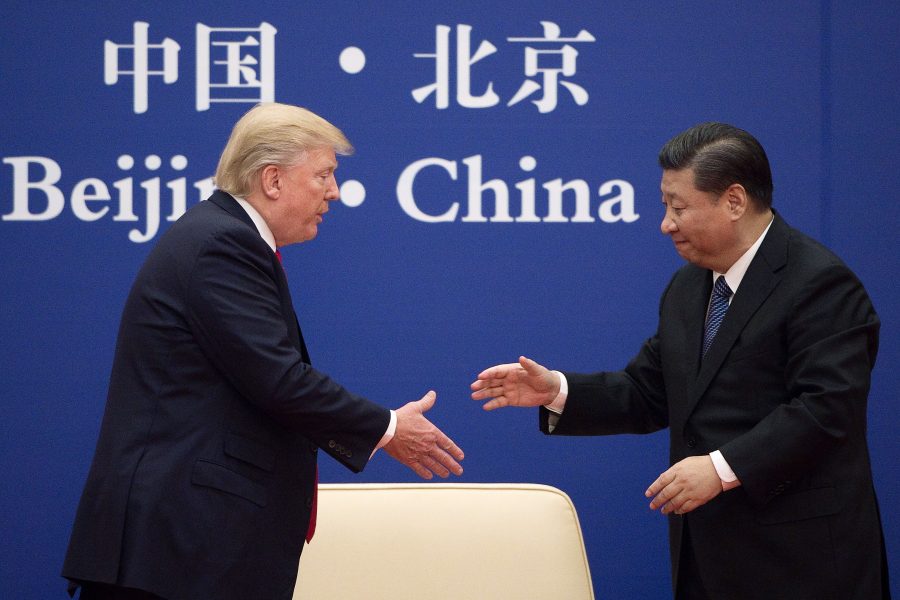

Global trade is currently at a standstill, as the Chinese president Xi Jinping and his U.S counterpart President Donald Trump prepare to meet at the G-20 summit in Japan this week. The two leaders will, once again, hold key talks that may possibly end the bruising on-going trade war between the world’s two largest economies.

The meeting, which will hold during the G-20 summit in Osaka Japan, has become one of the most globally-anticipated events in recent times. Many analysts and pundits expect that the meeting will help forestall moves by Washington to clamp tariffs on the remaining $300 billion worth of exports from China.

Some Recent Developments

Basically, the US-China trade war began in March 2018, when the United State’s President, Donald Trump, announced general tariffs of 25% on imported steel and 10% on imported aluminum. China hit back on US goods with tariffs worth $160 billion.

After the episodes of retaliation and counter-retaliation, recent developments may have forced both parties into another round of negotiation. Last week, President Trump threatened to “immediately” jack up tariffs on the remaining $300 billion Chinese exports to the U.S, should President Xi fail to show up at the meeting. Ahead of the planned meeting, Trump and Xi reportedly held a phone conversation on June 18th to prepare grounds for the expected truce.

Had a very good telephone conversation with President Xi of China. We will be having an extended meeting next week at the G-20 in Japan. Our respective teams will begin talks prior to our meeting.

— Donald J. Trump (@realDonaldTrump) June 18, 2019

After the supposed gesture from President Trump, the Chinese President also issued an official statement in agreement to the meeting.

“I am ready to meet with President (Trump) during the G-20 Osaka Summit to exchange views on fundamental issues concerning the development of China-U’S relations.“

Trade-War Escalates into India

The U.S-China trade war has largely dominated headlines over time, with little or no emphasis on the escalating issues between the U.S and India, which can be described as an off-shoot of the former. See below;

- President Trump recently terminated a trade concession which allowed India to export almost 2,000 products to the U.S. duty-free.

- Trump’s move ended trade concessions for $5.7 billion worth of goods that India shipped to the U.S., as of 2017. These include imitation jewelry, leather goods, pharmaceuticals, chemicals, plastics, and some farm items.

- Following Trump’s move, India announced on June 15 that it would raise tariffs on 28 categories of imports from the United States. The increased tariffs, on goods worth $1.4 billion, cover almonds, walnuts, apples and finished metal items, among other products.

- There is also the issue of the U.S sanction on Iran, which prevents India from buying Iranian oil. This means that India will have to fill the gaps left by Iranian oil with imports from other major oil-producing nations such as Saudi Arabia, Mexico, Nigeria, and the USA.

[READ THIS: Key takeaways from Dangote’s comments at the FT Africa Summit]

China and India are Nigeria’s biggest markets

The recent foreign trade data released by the National Bureau of Statistics (NBS) revealed that the world’s second most populated country, India, remains Nigeria’s biggest export market as of the first quarter (Q1) 2019.

Further analysis shows that two of Asia’s biggest economies (China and India) control a significant part of Nigeria’s foreign trade. Unlike export, Nigeria’s biggest imports come from China.

According to the recent statistics, Nigeria’s highest import in Q1 2019 came from China and it was estimated at N979 billion. Further insight shows that China maintains a distant top of 26% of Nigeria’s import, followed by Swaziland (N528.8 billion) and the U.S (N325.2 billion).

Nigeria’s top ten biggest export markets

The top ten rankings of Nigeria’s export market released by the NBS shows that a total of N3.13 trillion worth of goods were exported in the first quarter of 2019.

- For the first quarter, India imported N744.9 billion worth of goods from Nigeria to rank first, and this is dominated by crude oil (N684 billion). A further breakdown shows that India now imports 16.43% of Nigeria’s total export, as against 15.53% recorded in the previous quarter (Q4 2018).

- Meanwhile, it should be noted that the U.S has completely fallen out of Nigeria’s top 10 export market.

- In recent times, the U.S has continued to cut down oil importation in the country and it appears that it may have already cut ties with Nigerian crude.

- Meanwhile, Angola is the only country that imported zero crude oil from Nigeria but imported the highest non-crude oil products from Nigeria, estimated at N202.6 billion in Q1 2019.

- Also, Sweden has just joined one of Nigeria’s biggest exporting nations, as it ranks ten with crude oil worth N151 billion.

[READ FURTHER: CBN is going after any company that imports banned items]

Cost and benefits – Nigeria needs to trudge smartly

It is important to note that Nigeria generates over 70% of its total revenue and 91% of its foreign exchange revenue from Oil. Hence, the interplay of the trade war between U.S-China with escalation into India will greatly affect Nigeria’s oil money and the economy at large.

- President Trump may announce another tariff on Chinese goods, which will escalate the war. Sources have revealed that China may devalue its currency to sustain U.S sanctions and Nigeria may benefit from this through importation.

- Also, as stated earlier, India can no longer import oil from Iran which currently stands at 23.6 million tons. This portends a big opportunity for Nigeria to tap into the supply gap for more revenue.

- Meanwhile, a critical downside, irrespective of the U.S-China trade war outcome, is the escalation of trade war into India.

- U.S may employ its economic power to redirect a significant portion of India’s oil import to the U.S shale oil. What this suggests is that Nigeria’s biggest oil importer will be forced to reduce what it buys from Nigeria, which means that Nigeria revenue may lose billions, and this may critically affect the Nigerian economy.