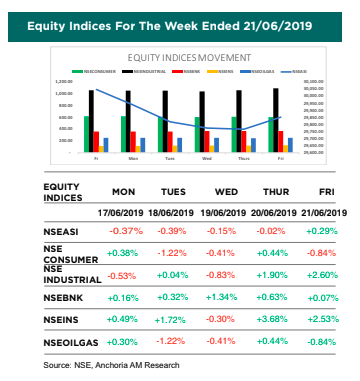

The performance of the Nigerian Equity Market remained bearish last week with the index (NSE ASI) trending downward by 0.65% WTD to close at an index level of 29,851.29 and Market capitalization of N13.16 trillion. This represents 1 month low.

However, the Sectoral Performance was positive, with bargain hunting seen on all sectoral index, with the exception of Consumer Good Index. The Consumer Good Index went down by 10.04% due to significant price depreciation in NESTLE (-5.57%) and PZ (-4.76%).

The Nigerian Equities market could be characterised with a quite a number corporate activities during the week ranging from Forte Oil resignation and appointment of CEO and CFO to activities at Lafarge Africa, Ecobank et al (see corporate disclosure section on page 2).

[READ MORE: Forte Oil’s majority shareholder to acquire fresh N22 billion worth of shares]

In the global space, all selected markets closed on a bullish note as the expectation of an interest rate cut drove equities on the first 3 trading day. However, the US Federal Reserve left the benchmark rate (Fed rate) unchanged.

Also, the Presidents of the United States of America and China are expected to meet at the G20 summit which is scheduled to hold between 28 and 29th June 2019 to find an end to the year long trade war.

Top Stock Watch for the week: 24 – 28 June 2019

Over the last five trading sessions:

SEPLAT fell by 0.66% to close at N510.00 with a YTD price

return of -20.31%.

Recommendation: We maintain a hold

rating on this stock.

ZENITHBNK remained unchanged to close at N20.00

with a YTD price return of -13.23%.

Recommendation: We

maintain a buy rating on this stock.

GUARANTY rose by 0.81% to close at N31.25 with a YTD

price return of -9.29%.

Recommendation: We maintain a

buy rating on this stock.

[READ THIS: Things to consider when investing in shares]

Money Market Rate Weekly Closing Rate: The average money market rate rose by 3.46% to settle at 8.96% from 5.50% in the previous week despite buoyant system liquidity seen during the week as CBN held off on the issuance of OMO during the week. The increase in the average money market rate was due to the funding pressure since on Monday as a result of the Wholesale, Invisible and SME FX auction.

The Overnight rate (OVN) and Open Buy Back (OBB) rose to 9.21% and 8.71% from 5.71% and 5.29% respectively in the previous week. Major inflow for the week included: OMO Maturity of cN75bn while major outflow included Weekly Wholesale, Invisible and SME FX auction of $210 mn.

With the expectation of renewed OMO auction, bond auction and bi-weekly FX retail auction, the money market rate is anticipated to close high this week.

READ MORE: CBN reacts to exchange rate policy change, says Naira not “floated”

Anchoria Asset Management is a subsidiary of VFD Group, a financial service holding company with interests in consumer finance, auto lending, currency exchange, asset management, international remittance, real estate development, and proprietary investment management.

CONTACTS

Anchoria Asset Management Limited

5th Floor, Elephant House

214, Broad Street

Marina

Lagos

Investment Research research@anchoriaam.com +234 908 720 6076

Wealth Advisory investor-relations@anchoriaam.com +234 818 889 9455