The roller coaster of events that have characterised the global political scene since last year have been quite interesting. The world has witnessed major episodes ranging from failed efforts to denuclearise the Korean Peninsula, to populism, the Brexit process, and of course the escalating US-China Trade War.

Without a doubt, the United States of America and China are two of the largest economies in the world. They are both operating at the heart of global industrial supply chain. However, these two economies have lurked horn in an on-going trade war which has seen both of them try to undermine the economic prowess of each other.

What is a Trade War?

Basically, Trade Wars are subsumed in the concept of protectionism, where tariffs are levied on imports. Tariffs, in theory, make a locally made products cheaper than imported ones; thereby encouraging consumers to buy home-made products.

Trumponomics: How the U.S-China trade war began in retrospect

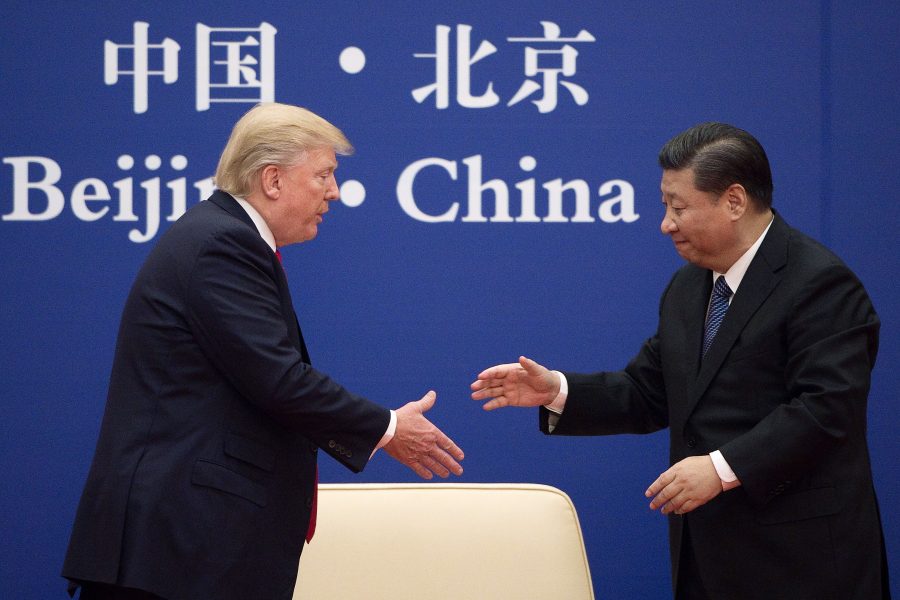

The on-going trade war between the U.S and China began in March 2018, when the United State’s President, Donald Trump, announced general tariffs of 25% on imported steel and 10% on imported aluminium.

According to Trump, the decision to impose such a general tariff was to help reduce the US’s trade deficit from China, which has been described as detrimental to the US steel and aluminium industries. It was also revealed that more than 90% of the 5.5 million tonnes of aluminium used in the United States is imported.

However, The New York Times reported that China is not among the top 10 suppliers (of either steel or aluminium) of U.S. imports. Instead, Canadian aluminium made up more than half of America’s imports in 2016. Also, Canada boasts of the largest share of America’s steel import of 17%. The U.S. Department of Defence also pointed out that most U.S. imports are produced by U.S. allies, including South Korea, and Turkey, which would be hurt by broad tariffs.

It is intrusive to note that one of the hallmarks of the Trump administration since he assumed office, is his concern about China’s trade practices.

Beyond steel, China is the US largest supplier of imported goods

As at 2017, the U.S. exports to China amounted to approximately $185 billion. On the other, China constituted U.S. largest supplier of imported goods worth more than $500 billion in the same year.

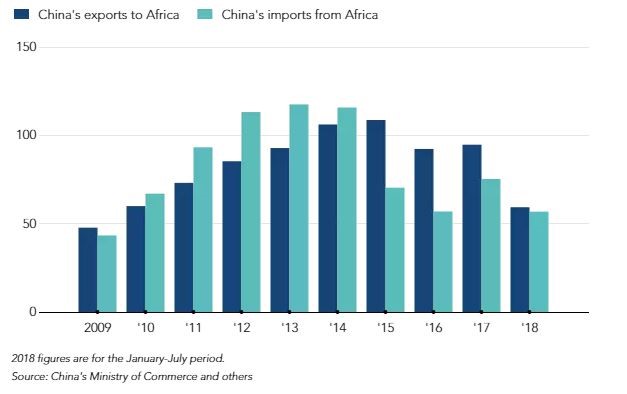

Also note that China is the biggest trading partner for some of the Africa’s most significant economies, including Nigeria, South Africa, and Ethiopia. So, whilst Africa comprises a mere 2% of global trade, US-China trade tension is of direct relevance to the continent.

Despite over $250 billion worth of tariff on Chinese goods, Trump threatens more

Data from the US census bureau shows that the US has imposed three rounds of tariffs on Chinese goods, totalling more than $250 billion.

Despite the $250 billion on Chinese goods entering the U.S, President Trump has also threatened tariffs on another $267 billion worth of goods – meaning all Chinese imports could be subject to tariffs. The US has also put tariffs on worldwide imports of goods like steel and washing machines, which further affects products from China.

China retaliated with $160 billion tariff on US goods – China hit back with tariffs worth $160 billion of US goods, accusing the US of starting the largest trade war in economic history. China has targeted products including chemicals, coal, and medical equipment with levies that range from 5% to 25%.

China has strategically targeted products made in Republican districts and goods that can be purchased elsewhere, like soybeans.

US-China Trade War rages on, as China’s exports rose back in January

China’s export rose dramatically in January 2019 due to a surge in exports to the European Union and Southeast Asia. Export rose by 9.1%, contradicting earlier forecast by Bloomberg of a 3.3% decline.

Also, in 2018, exports to the U.S. rose 11.3% year on year in 2018, while imports from the U.S. to China rose 0.7 percent over the same period. China’s surplus with the U.S. grew 17% from a year ago to hit $323.32 billion in 2018. It was the highest on record dating to 2006, according to Reuters.

How the global economy will be affected?

From an economic standpoint, escalation in trade war would see a reduction in global trade and consequently global demand. For instance, a weaker US and Chinese economy would weaken global supply chains.

By extension, the weak global supply chain would result in slower global growth, and in turn, affect commodity prices.

This may not be a Trade War after all, but where does Africa stand?

There has been concern from the West that the Chinese policy of using Chinese banks to issue grants to developing economies, is deliberately designed to capitalise on their global financial infrastructure to rival the IMF and the World Bank.

That is to say that the tussle between the US and China may not just be a Trade War, but a war over who controls the world’s financial flows in the long term.

Meanwhile, as though response to the allegation levied against China of debt trapping developing economies like Nigeria with loans, China tripled its offerings of interest-free loans and grants to Africa to dispel such threat. This further deepens its romance with the African continent. Just recently, China offered $15 billion assistance to Africa, with about $60 billion aid package pledged to the continent.

Africa may be regarded as the new bride for the developed economies, for instance, China-African trade increased to $170 billion in 2017. A recent United Nations Conference on Trade and Development (UNCTAD) prediction shows that in the aftermath of the on-going trade war, Africa would be an enticing destination for these foreign goods.

Therefore, as president Trump continues to put tariffs on Chinese exports, China is gradually turning to Africa to make up the difference. In the end, both Africa and China will benefit.

The Asian Romance and the Nigerian economy

Despite the lingering U.S-China Trade War, the Nigerian economy continues its economic romance with the Asian superpowers. Recent data from the National Bureau of Statistics (NBS) shows that Nigeria export to Asia was estimated at N1.42 trillion in just the last quarter of 2018. The country’s highest import, which also came from China, is estimated at N900 billion for the same period.

Also, in terms of export, India is the biggest market for Nigeria export, with 15.53% of the total export in the last quarter of 2018. In the same period, Nigeria exported both oil and non-oil products worth N780 billion to the country. On the export chart, the U.S ranks 10th while India leads the top 10 recipients of Nigeria exports.

Last year when Nigerians became critical of the country’s $5 billion China loan, the Debt Management Office (DMO) stated the following:

“Borrowing from China Exim is one of such means of ensuring that Nigeria has access to more long term concessional loans. Given the country’s infrastructure deficit, which needs to be urgently addressed, the loans from China Exim, which provide financing for critical infrastructure in road and rail transport, aviation, water, agriculture and power at concessional terms, are appropriate for Nigeria’s financing needs and align properly with the country’s Debt Management Strategy.”

Hence, the bilateral trade war and slowing growth in the two superpowers’ economies will create unwelcome challenges for Africa in terms of currencies, slower trades and dampened investor sentiment.

The most imminent impact is likely to be on emerging markets via financial markets. Increased anxiety surrounding the US-China Trade War could trigger large capital flights to safety and a sell-off in emerging markets’ riskier assets.

Another risk to the African continent comes from its particularly close economic relationship with China (Africa’s largest trading partner and a major investor), making it vulnerable to any potential weaknesses in the Chinese economy. Slower growth in China could, therefore, depress investment flows from there.

Meanwhile, Nigeria may just have discovered its “new oil”

A slowdown in China-centred trade would negatively affect demand for raw materials such as iron ore, coal, and platinum, which in the event of price burst could seriously distress any country (like Nigeria) which depends on trade with China.

With 923,763 km2 land arable land, the U.S-China trade tussle portends an opportunity for Nigeria to become a major supplier of agricultural products to China and other Asian neighbors.

Also, the rise in tariffs on Chinese goods going into the United States will create supply gaps in the U.S. market, exports from other countries become “more competitive” due to the tariffs on China. This situation presents new opportunities for Nigerian export in the United States market which is currently reducing.

As Reuters put it, summarising Carmen Ling, Managing Director and Global Head of RMB Solutions,

“We believe that countries like Kenya and Nigeria will benefit because China will look to import more from Africa; some agricultural products from Kenya, some oil products from Nigeria.”

Hence, the Nigerian Government needs to be forward-looking in policy formulation and implementation, that will aid penetration into the impending global markets that could open up.

Hence, the Nigerian Government needs to be forward-looking in policy formulation and implementation, that will aid penetration into the impending global markets that could open up.

Nice write up if only one pegs and fit in round holes.

Is it not too late now,i thought nairametric would have written on this issue some month ago.now in 2019,some new development would have happeni.e we are looking forward for this Trade war between America and the Chinese THE FALLOUT AND THE CAUSES OR EFFECTS OF THIS TRADE WAR.

is this trade war a good idea and for who ? let us look at the evidence,the Chinese have a surplus with America for many reason,some of them are (1) the rate of yuan against the dollar (2) labour law are weaker in china than in America a swearshop,the Chinese can uses cheap labour cost to penetrates American market.thse are some of the difference between American economic and financial system against the Chinese eco/fin system.

The sine quo non will provides it’self,do not forget hong kong free market,there is a lots of implications for the americans than for the Chinese,the americans export agricultural products and natural gas to China,the Chinese have concluded plan for importing natural gas from Russia and Mr trump have started to subsidizing American farmersLOOK FOR EVIDENCE THAN EMOTIONS.

For Nigeria,we should not concern ourself with this trade war.we should take advantage of the Chinese initiative and entering African market.