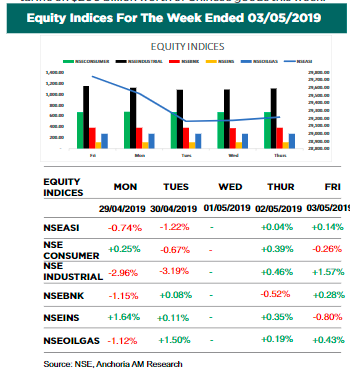

The performance of the Nigerian Equity Market remained bearish last week with the index (NSE ASI) trending downward by WTD to close at an index level of 1.78% 29,212.00 and Market capitalization of N10.98 trillion.

The Market sentiment was mixed, as profit-taking was seen on the first two trading days while the last 2 trading days witnessed bargain hunting.

All sectors closed negative with the exception of two sectors: Oil/Gas and Insurance Index rose by and respectively. The industrial Goods 0.02% 1.30% Sector recorded the highest decline, down by wing to 4.16% price depreciation in DANGCEM (-3.69%) This continuous bearish move in the Nigerian Equity Market could be attributed to negative earnings reports released by some companies during the week. DANGCEM’s Q1 profit was down by 16% YoY.

In the global space, selected markets traded on a mixed note as US market closed in the green following release of strong job report. US added 26 3,000 new jobs in April while the unemployment rate fell to 3.60%, lowest since December 1969. In the week ahead, investors are expected to trade cautiously on the news that Donald Trump vows to hike US. tariffs on $200 billion worth of Chinese goods this week.

Top Stock Watch for the week:06-10 May 2019.

Over the last five trading sessions:

UBA fell by 2.19% to close at N6.70.

Recommendation:

We maintain a buy rating on this stock.

ZENITHBANK fell by 1.64% to close at N21.00.

Recommendation:

We maintain a buy rating on this stock.

GUARANTY fell by 2.19% to close at N33.45.

Recommendation:

We maintain a buy rating on this stock.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com