Several crises reportedly facing the Western Metal Products Company (WEMPCO) may further worsen the unemployment challenges in the country as about 250,000 jobs are currently being threatened.

Earlier, it was reported that the popular Oriental Hotel in Lagos, owned by WEMPCO Group, is planning to leave the country after over four decades of doing business in Africa’s largest economy.

However, reports of WEMPCO’s imminent exit took another twist, as several media reports have revealed that no fewer than 19 enamelware firms are equally closing business due to WEMPCO’s proposed exit. While the exit of Oriental Hotel may result in 14,000 job loss, WEMPCO group exit may lead to a whopping 250,000 Nigerians losing their daily means of livelihood.

Background Story of WEMPCO Operations in Nigeria – WEMPCO which has a heavy presence in steel and hospitality sectors is reportedly being faced with a debts burden of over N90 billion. Specifically, WEMPCO is the authorised sole distributor of cold-rolled iron sheet used in the manufacturing of roofing sheets and annealed iron sheets used in the manufacturing of enamelware.

WEMPCO was founded by Lewis Tung and his brother Robert Tung to produce roofing sheets, galvanised pipes, wire nails, plywood, ceramic tiles and sanitary ware. The company is actively involved in agricultural and hospitality sectors with 11 subsidiaries.

The group is witnessing hard times and is considering leaving Nigeria along with its steel plant, which has 700,000 tonnes-capacity and about 14,000 people currently employed, mostly Nigerians.

How WEMPCO’s imminent failure began – It has been revealed by a section of the media that WEMPCO’s trouble stemmed from the influx of substandard roofing sheets smuggled into Nigeria from Cameroon and other neighbouring countries.

Accordingly, local firms in steels sector have been mandated by the Standards Organisation of Nigeria (SON) to keep the standard of roofing sheet at 0.015mm in thickness. This reportedly posed competition challenge against smuggled roofing sheets which were 0.013mm and 0.014mm.

To compound its woes, the smuggled products were also said to be preferred by buyers due to cheaper prices being charged. Hence, this results in low patronage and stock of inventories unsold. By the end of 2018, the company had reportedly closed down almost all its plants as they were no longer producing.

Although, top directors in the steel and hospitality sectors have disclosed that the reasons for the group’s ordeal are poor corporate governance, over-dependence on government policy, inability to consider Nigerian realities before making key decisions, and harsh business environment.

WEMPCO and its questionable operations – In 2017, the Chief Magistrate Badejo-Okusanya of an Ogba magistrate’s court awarded N11million damage against WEMPCO over an alleged breach of contractual agreement with a businessman, Emmanuel Onaiwu and his company, Unibomec Technical Apex Limited. This suggests the company has been defaulting in business transactions.

Similarly, in 2018, scores of casual workers at WAMPCO annex, Magboro, Ogun State, allegedly protested against the inability of the management of the WEMPCO to pay their salaries for over three months.

WEMPCO’s sharp practises maybe responsible – It has been revealed that WEMPCO was alleged to have abused the exclusive rights and waivers that were granted to it by the Federal Government for the former President, Goodluck Jonathan. The previous government had granted the firm heavy waivers to aid it in the production of cold-rolled sheet locally.

Similarly, in 2015, the Central Bank of Nigeria (CBN), as part of its initiative to resuscitate local industries and improve employment generation, released a list of items not eligible for foreign exchange in the government-created Importers & Exporters window. Among the 41 items on the list are cold-rolled steel sheets, galvanized steel sheets, and roofing sheets. However, the firm had instead embarked on heavy importation of the product.

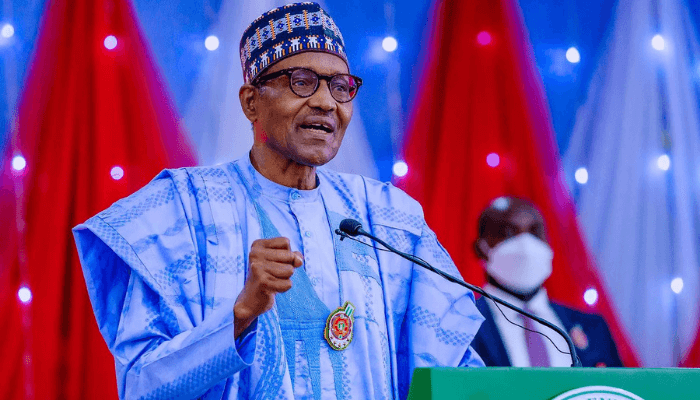

Meanwhile, reports have shown that WEMPCO trouble began when the current administration of President Mohammadu Buhari assumed office and decided to cancel the waivers. Since then, it has been a mountain task for WEMPCO imports and meets local demands. The aggressive import stoppage policy is Buhari in no doubt is good for the economy, but it needs to be done in such manners that big companies don’t exit the country to avert increasing unemployment woes in the country.

Nigerians may be the worst hit – WAMPCO may eventually exit Nigeria, and the implication is that all the firms that produce roofing sheets and enamelware in Nigeria may have to shut down.

With this imminent closure, massive jobs loss will further worsen the unemployment rate in Nigeria which currently stands at 23.1 percent. This is definitely not a good sign for a fragile economy like Nigeria that is just gradually rising towards a sustainable economic growth path.