In the run-up to general elections in two weeks’ time, the subject of corruption comes up a lot in the press. Transparency International recently published its annual (2018) assessment in which Nigeria did not improve on its 2017 score. Yet there are initiatives which are making headway, which suggests that it takes time to change things.

FX

Last week the NIFEX rate remained stable at NGN358.79/US$1. The NAFEX rate depreciated by 0.15% to NGN362.68/US$1. The US dollar in the NAFEX market trades at a 1.08% premium to the NIFEX rate. We expect a unified exchange rate regime to further improve liquidity in the NAFEX market, which is the principal and most visible FX market.

Bonds & T-bills

The yield on a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 40bps to 15.05%, and at 3 years rose by 3bps to 15.10%. The yield on a 364-day T-bill rose by 29bps to 17.45%. The yield on a T-bill with 3 months to maturity decreased by 88bps to 12.03%.

In the bond market yields contracted across all maturities, excerpt at 3-yr duration. Activity in the T-bill market was bearish, evidenced by the expansion of yields across most maturities. T-bill yields were strongly influenced by high volumes in the open market operations (OMO) of the Central Bank of Nigeria (CBN). These were at a total of N2.5tn (US$5.5bn) in January (December: N1.2tn), effectively removing a significant amount of liquidity from the system.

Oil

The price of Brent rose by 1.80% last week US$62.75/bbl. The average price, year-to-date, is US$60.35/bbl, 15.82% lower than the average of US71.69/bbl in 2018, but 10.24% higher than the US$54.75/bbl average seen in 2017.

Equities

The Nigeria Stock Exchange (NSE) All-Share Index recorded a loss of 2.51 last week, taking the negative yar-to-date return to -2.53%. Last week Sterling Bank gained 8.45%, CCNN dipped by 8.33% and Nigerian Breweries fell by 7.38%.

Bearish sentiments characterised last week’s trading. Valuations on a range of value stocks have become cheap and bargain hunters may carefully look to position for upside over the long term, in our view.

Transparency International

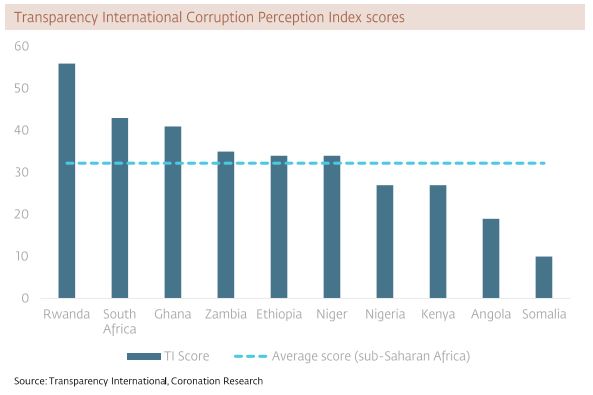

Every year Transparency International (TI) measures and publishes the corruption perception in the public sector of 180 countries and ranks them accordingly. In response to TI’s report, many countries have increased initiatives for public sector reforms to fight corruption and increase transparency.

The most recent publication by TI, for 2018, ranks Nigeria 144 out of 180 countries with a score of 27 out of a possible 100 (the higher the better). This leaves Nigeria’s score below sub-Sahara Africa’s average score of 32. Nigeria scored 27 points in TI’s 2017 survey, with a rank of 148.

A publication by the World Economic Forum puts the amount that is lost through corruption annually at north of US$2tn, accounting for approximately 2.5% of global Gross Domestic Product (GDP).

In Nigeria there are several anti-corruption initiatives, aimed at the public sector and, by extension, banks. The Integrated Payroll and Personnel Information System (IPPIS) is reported to have largely eliminated ghost workers and other abuses, and to have saved N288.0bn (US$794.0m) since its implementation in April 2017. The Treasury Single Account (TSA) prohibits public entities from banking deposits – including US dollars – with private sector banks. It is estimated to save payment systems is thought likely to make further savings.

This report was contributed by Coronation Merchant Bank.