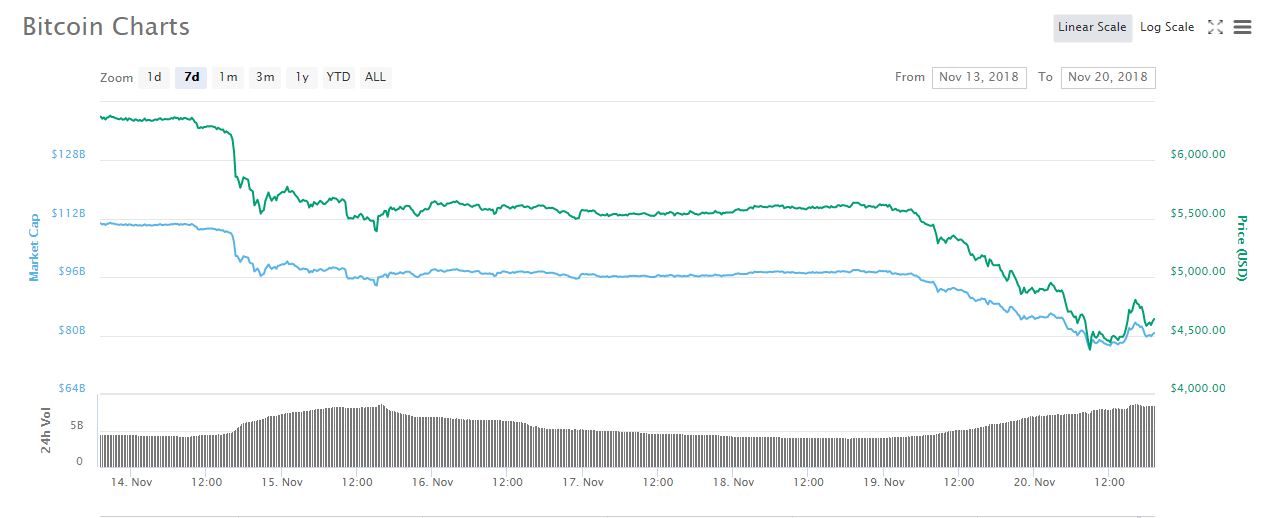

The price of bitcoin, the world’s most valuable cryptocurrency has taken a pounding in the last couple of days. From $6374.92 last Tuesday, the price fell below the $5000 psychological level yesterday, then dropped to the $4380 mark today.

Year to date, the drop is even steeper. Bitcoin opened the year at $14,112.20 and is down 67.1% (currently trading at $4642.05)

Possible factors behind the crash

Meltdown in US stocks

Global markets are also seeing a meltdown, especially in the United States. Investors may thus be fleeing from risky assets like bitcoin, into more stable securities. The Dow Jones and S and P 500 have all erased their 2018 gains.

The hype is gone

Investors poured billions into the coin last year, fueled by its spectacular rise last year. The coin appreciated by over 1000% last year. As expected, a price correction was meant to occur.

A contentious hard fork

Investors also jumped into the coin following several hard forks last year. These were virtually billions of dollars of bonus coins created overnight. There were three hard forks last year, and at a time when the concept was a novel one.

There have been two hardforks this year, the most recent one being a hardfork of Bitcoin cash, which in itself is a hardfork of Bitcoin. Bitcoin cash has split into three camps.

The Fork in simple ‘English’ is a technical term used to describe an option to choose between an update to the application code that users and operators of bitcoin machines use in mining bitcoin. The option is usually between sticking with the old application code or switching to the new one.

Sticking to the old code is a soft one, while switching to the new one is a hard one, and results in the creation of a new coin.

Buy/Sell/ Hold?

At this stage, investors interested in taking a position would be better off waiting for a further decline. For an asset that rose by over 1000% in 2017, a 67% decline leaves room for further correction.

Investors already holding a position, and still significantly in profit may decide to maintain that.