***PMI Grows at Faster Rater Rate in August*** – CBN

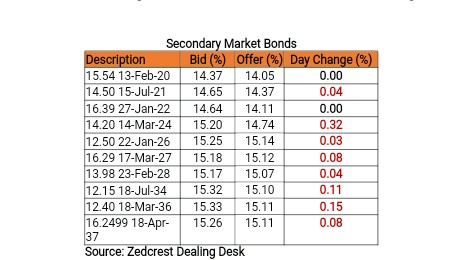

The bond market closed the month on a bearish note, with continued selloffs pressuring yields higher by c.8bps across the curve. We witnessed the most selloffs on the 2026s which was sold off to 15.26%.

Amid continued weakness in Emerging market assets and expected increase in FGN Borrowings, we maintain a bearish outlook for the coming month.

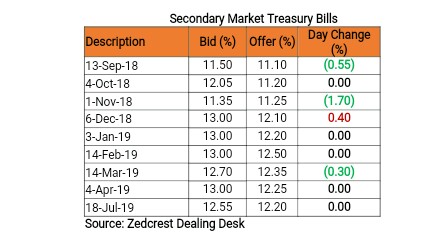

Treasury Bills

Yields in the T-bills market moderated by c.20bps, due to the buoyant level of liquidity in the system, on the back of the OMO maturities and Retail FX refunds in the previous session. Market players however constrained demand to the shorter end of the curve, with only few real money client orders seen on the mid tenor bills (Feb & Mar), which were bought down to the last PMA levels (12.30%), and no further.

Barring an OMO auction by the CBN on Monday, we expect yields to still moderate slightly, due to the significant inflows anticipated from FAAC payments to state and Local Governments. We however expect most market players to adopt a wait and see approach, while those with pressure to invest are expected to still maintain the short end play for now.

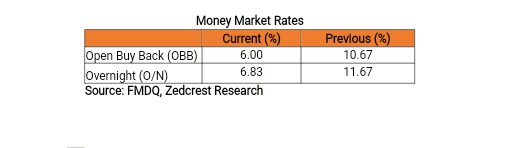

Money Market

The OBB and OVN rates fell sharply to 6.00% and 6.83% respectively in today’s session. This came on the backdrop of the significant increase in net system liquidity from the previous session, with opening figures published at c.N780bn from c.N105bn previously. This is however estimated to have declined to c.N430bn as at COB today, due to estimated outflows for retail FX funding by banks.

Due to expected inflows from FAAC payments, we expect rates to decline further on Monday, barring a significant liquidity management action by the CBN.

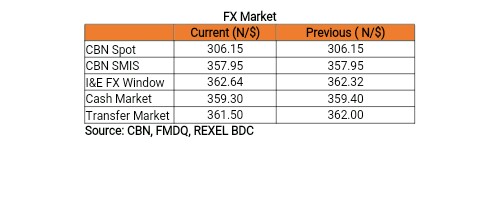

The Naira/USD rate remained stable at the interbank, closing at N306.15/$. At the I&E FX window, a total of $425.98mn was traded in 472 deals, with rates ranging between N355.00/$ – N364.00/$. The NAFEX reference rate depreciated by 0.09% to N362.32/$ from N363.06/$ previously.

At the parallel market, the cash and transfer rates appreciated by 10k and 50k to N359.30/$ and N361.50/$ respectively.

Selloffs Persisted on the NGERIA Sovs, as trade tensions persisted, while sentiments remained negative across the EM space. Yields rose by c.10bps across the curve, with the most selloffs seen on the Feb 2032 which rose by c.11bps on the day.

The NGERIA Corps were muted, except for slight interests witnessed on the DIAMBK 19s, consequently pushing yields on the bond below the 10% mark.