Analysts at Franklin Templeton Investments and BlackRock Inc are of the opinion that the Central Bank of Nigeria will be able to keep Naira stable.

According to an article on Bloomberg, the investors believe higher oil prices will help keep the exchange rate stable despite other emerging market currencies taking a beat as investors desert.

This opinion may appear as good news to the Central Bank who have in recent weeks shed some of its external reserve hoard of just about $47 billion. It is widely believed that the sale was mostly due to demand pressures in the Investor and Exporter window.

Following the sell-offs in May, local analysts believe a cross-section of foreign investors may have sold off some of their stakes in local equities. This has led to speculations that the central bank may be considering a devaluation of the Naira if its external reserves continue to be under pressure.

Just last week, the central bank merged the exchange rates used by the BDCs to trade with that of their competitors, Nigerian Banks. This was after mandating traders to ensure forex was available for Nigerians looking to travel allowances in forex.

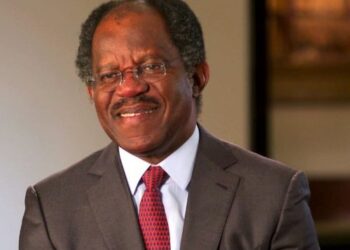

Isaac Okorafor, CBN Acting Director, Corporate Communications Department, noted that the decision was to give BDCs a level playing field to compete with other authorized foreign exchange dealers, the Nations reports.

Nigeria fell into a recession two years ago amidst huge dollar shortages and an exchange crisis that eventually saw the Naira depreciated by over 40%. However, the economy has recorded paltry GDP growth rates since the second quarter of 2017.

Supporters of the CBN policies have often cited the external reserve of over $47 billion as the main reason why the exchange rate won’t be devalued. Even as Oil prices remain high, crude oil production has increased this year though still short of the budget target of 2.5mbpd.

It is thus no surprise that foreign investors are bullish about Nigeria’s ability to hold a stable currency allowing them to pile into our local government bonds and securities.

The CBN also last month finalised modalities for the currency swap deal with China worth over N720 billion. The agreement is valid for three years and can be extended upon mutual consent. Analysts believe this was a move aimed at reducing the demand pressure for the US Dollar considering that Nigerians import more from China compared to any other country in the world.

This they believe could play a major role in the ability of the Central Bank to keep the Naira stable in a situation where dollar shortages appear again.

Are there other risks? Nigeria remains a mono-export economy thus whenever oil production or price of crude falls, it is seen as a trigger that the Naira will be devalued. Most believe this is the real elephant in the room with the capability of jolting whatever measures put in place by the government.

What about the budget? The slow passage of the 2018 Federal Budget is also a major concern and could still impact on the exchange rate one way or the other. However, so long as oil prices and production continue to rise, it is likely that CBN is able to continue to defend the naira.

I think,it is sh–t,we are moving toward uncertain water towards certain and stable scenario,my fear is that the naira will depreciate,as new animal spirit was created,the president and the vice-president had series of meeting and the cbn becoming very active more before in the forex market.

With the honouring of Abiola in this way,it will heals a lot of open wound in Nigeria,with the conviction of Joshua dariye of corruption,all activities are up,socially,,politice and money