Minister of Finance, Mrs. Kemi Adeosun has assured that the Federal Government would settle the inherited debts and contractual obligations to local contractors between 2006 and 2015.

Adeosun made this known while appearing before the Senate Ad-Hoc Committee on Promissory Note Programme and Bond Issuance chaired by Deputy Chief Whip, Senator Francis Alimikhena.

She revealed that the debts owed to various classes of contractors, including the terminal benefits of ex-Nigerian Airways workers, would be repaid through promissory notes and bonds issuance.

A promissory note, sometimes referred to as a note payable, is a legal instrument and debt instrument in which one party the issuer promises in writing to pay a determinate sum of money to the other the payee, either at a fixed or determinable future time or on demand of the payee, under specific terms.

The minister lamented that unpaid Federal Government obligations constituted a clog in economic activity across many sectors, adding that the present administration was determined to address the problem.

We inherited quite a lot of unpaid obligations to civil servants and to contractors: pensions; salary & promotion arrears to civil servants; obligations to contractors; unpaid electricity bills by Ministries, Departments and Agencies (MDAs)…

— Kemi Adeosun (@HMKemiAdeosun) May 15, 2018

She listed the unpaid obligations to include

Obligations to pensioners and salary & promotion arrears to civil servants.

- Obligations to contractors and suppliers who in turn, owe banks increasing the quantum of non-performing loans.

- Unpaid electricity bills by the Ministries, Departments, and Agencies (MDAs).

- Exporters owed funds under the Export Expansion Grant Scheme and unpaid refunds due to State Governments in respect of projects undertaken on behalf of the Federal Government.

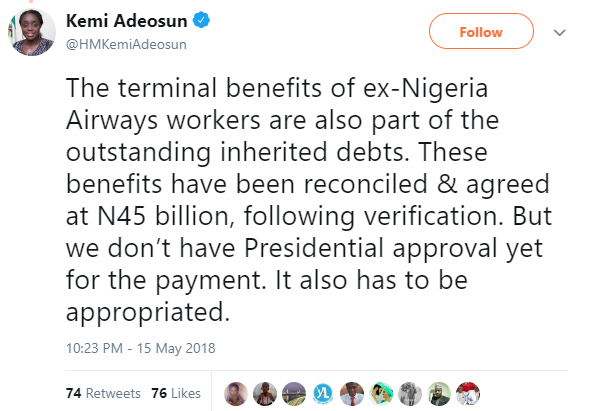

The Minister also revealed that the terminal benefits of Ex-Nigeria Airways have not been appropriated yet and no presidential directive has been given to the payment.

Earlier, the representative of the Accountant General of the Federation, Mr. Mohammed Usman, had told members of the Senate’s Ad-Hoc Committee that the Government paid N34.2 billion to clear the promotion arrears to workers in the MDAs.