The Federal Government recently submitted a $30billion debt proposal that was immediately rejected by the National Assembly for “lack of details”.

The government has been looking to borrow from international creditors in its bid to embark on a grand fix Nigeria’s infrastructural challenges.

The proposal has been rejected by most analysts who point to Nigeria’s high debt service ratio in proportion to income as a major impediment. The government has always favored the debt to GDP metric rather than the more punitive revenue to debt service ratio.

The revenue to debt service ratio basically looks at percentage of debt Nigeria is currently repaying including interest against the revenue it earns. This is the same metric ordinary Nigerians will be rated on by commercial banks, when they seek for loans.

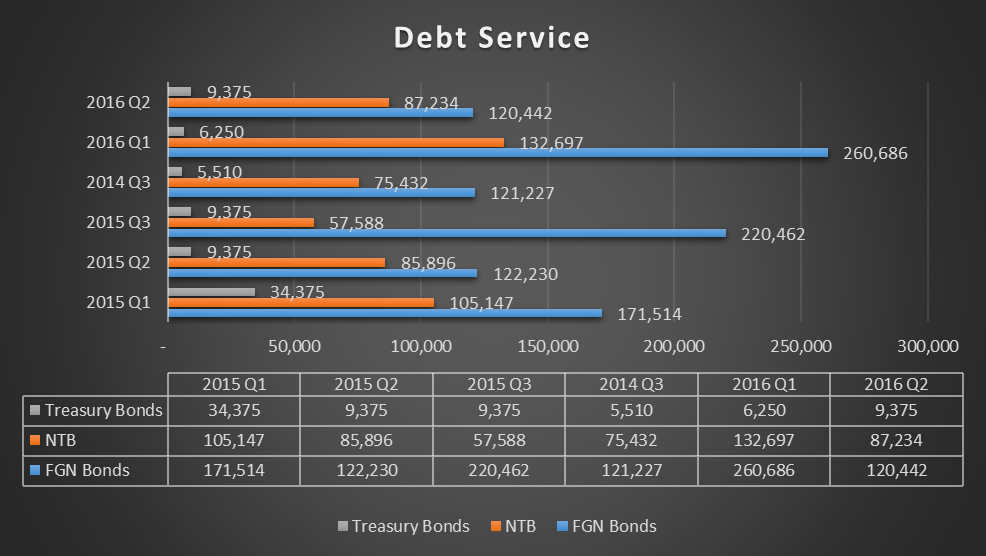

So what is Nigeria’s debt service to revenue ratio. First, we determine Nigeria’s debt service.

As the chart above depicts, Nigeria spends an average of N250b per quarter on servicing debts. This comes to about N1 trillion per annum. Juxtapose that with government expenditure and you get a rather gloomy picture.

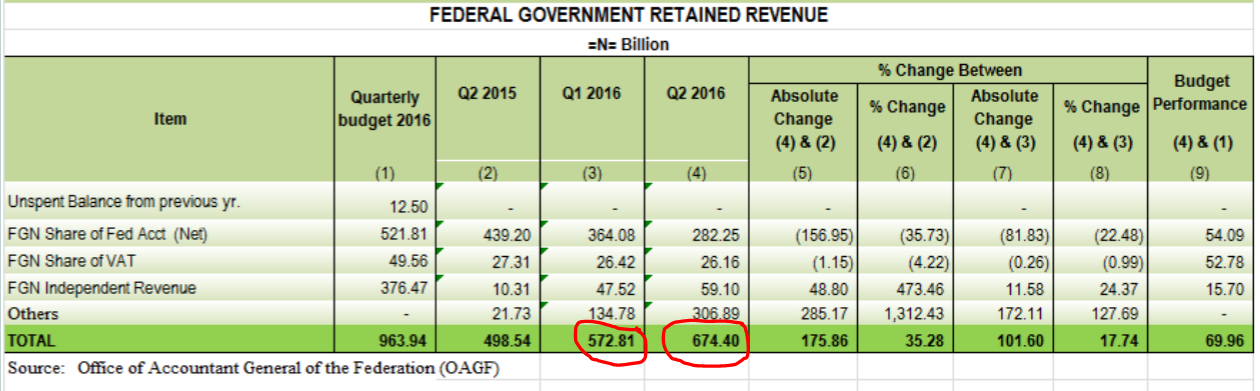

From above, Nigeria spends about N250b per quarter in 2016 on debt service compared to an average revenue per quarter of about N623 billion. This comes to a debt service to revenue ratio of a whopping 40%.

This is an unsustainable figure by all accounts and underpins the need for the government to first consider other sources of raising money in addition to debt. The option of a privatization (asset sale) as some call it, could go a long way in helping to fund the proposed economic recovery plans of the government.