Nigeria urgently needs to increase the supply of dollars in the economy, especially at the interbank market where access is really limited and bank customers are unable to get enough dollars to buy. Consequently, there are issues with imports of various petroleum products, food items and even services. The gap between the official and parallel market rate is once again widening and currently stands at almost N60 per dollar. This is a recipe for disaster of Venezuela-sized proportions if not resolved quickly.

To understand how we got into this mess, we will have to look a series of self-inflicted and unavoidable occurrences that brought us here. The following best summarizes how we got here.

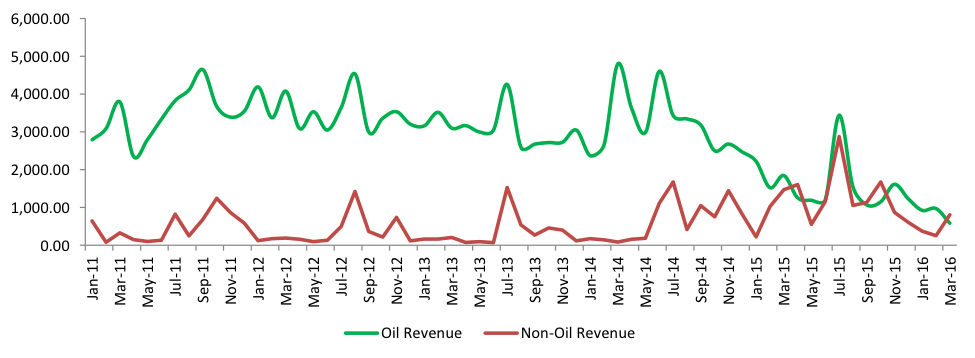

1. Dollar receipts have dropped considerably. Nigeria’s oil revenue has fallen from an average $3 billion a month to under $600m a month as at March 2016. Our non-oil receipts are not really too strong.

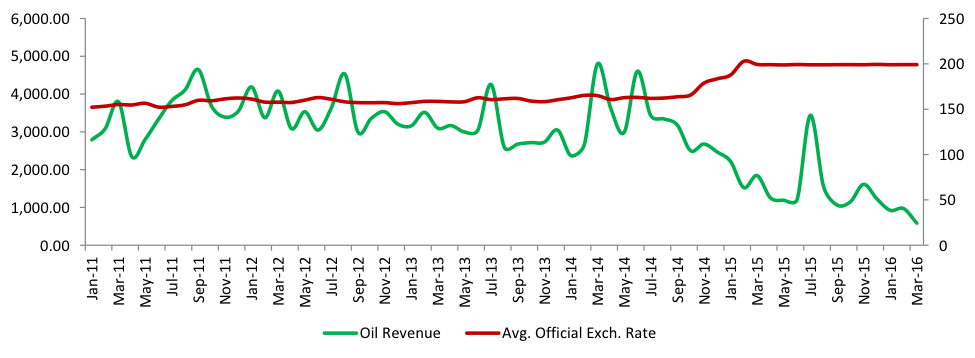

2. We held a fixed rate for too long. Let’s use an allegory. In a market, milk becomes scarce, because cows are not producing enough milk. What happens to the prices of milk? It rises. Why? Because the demand for milk remains but the volume of milk available is less so whoever wants to buy milk will have to convince the seller that they need it more than someone else by offering to pay a higher price. If one seller decides to continue selling the milk at the same price, buyers will be happy to buy from that seller and sell to other people who are unable to get at a higher price – a practice called arbitrage. However, that seller will see demand for his milk increase because people are buying to resell. Very soon he’ll also run out of milk. Think of our dollar inflows as the milk from the allegory above. So even though our flows were shrinking and we had not really raised international debt to plug the gap, we maintained the same rate and we saw that demand for dollars increased as people sort to take advantage of the arbitrage opportunity. So is it any surprise that we’re seeing the lack of fx now?

3. We have given foreign investors reason to be skeptical of our commitment to real reforms and the dedication to see them through. A key area is when it comes to the independence of the CBN. This is the same Nigeria that had a CBN governor removed from office by the President for no real reason except pointing out an issue with foreign receipts. Contrast that to recent public statements that exposed the extent of the current president’s influence on monetary policy. Statements that have not been refuted by the authorities.

4. We switched to a managed floating foreign exchange policy from a fixed regime. However, forex flows in that market have remained really thin. Rencap estimates they have averaged $50m daily, which is really low compared to the volume traded by markets such as South Africa, which trades billions of dollars daily but has a smaller economy compared to Nigeria’s. Thus, foreign investors are still concerned that if they bring in any really large amount, they might have difficulty taking their funds out.

So clearly there’s a supply problem and it needs fixing. We need to develop a comprehensive solution to this issue that embraces short-term, medium-term and long-term approaches to ensure the situation never really repeats.

I think any solution we develop must pay cogent attention to the following:

a. How do we increase the foreign exchange earning capacity of our non-oil sectors? Oil is 10% of our GDP but generates almost 90% of our foreign exchange. Agriculture is about 25% of GDP and generates less than 1% of our foreign exchange. Services are more than 50% of GDP but generate very little foreign exchange also. How do we increase the foreign exchange earning capacity of these sectors?

b. How do we reduce the demand for foreign exchange in the country? How do we become self-sufficient in the production of certain items we are currently importing? We used this sort of thinking to reduce cement imports in Nigeria. We can target other major items and gradually encourage development of local manufacturing capacity, with the right incentives (absent rent-seeking).

Most of these issues require structural and fiscal reforms, which are integrated and interdependent. More importantly, these are medium to long-term issues.

Within the short terms, we may consider the following:

- Allow prices rise to converge with the parallel market and wipe out the arbitrage

- Borrow from the international foreign exchange market – dollar loans

- Create incentives for dollar investments in Nigeria

- Encourage local producers to explore more exports

I believe to some extent, the monetary authorities are already considering these, thus we hope in a few months, the supply of dollars to the market will increase. However, we need a long-term solution, most of which are fiscal and not monetary.

Dolapo Oni is an Oil and Gas Analysts and sent in this article via email. Follow him on twitter @dolarpo