SOURCE: BLOOMBERG

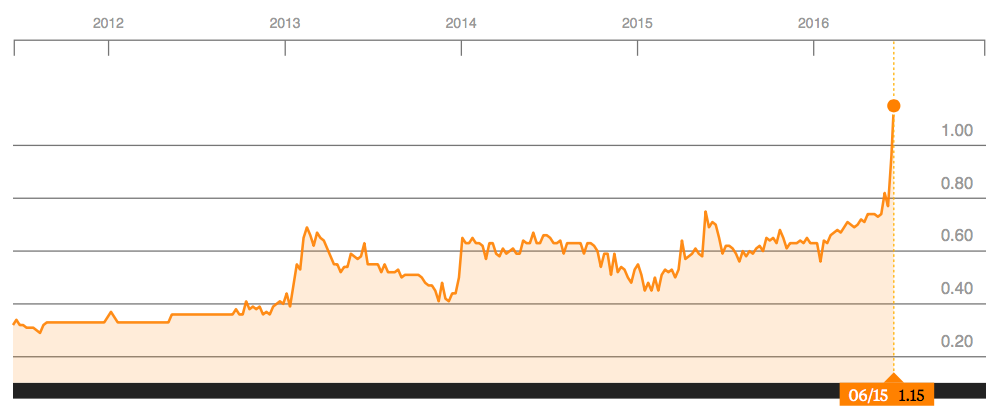

NEM Insurance Plc has in the last one week seen its share price rise by about 42 percent month to date. The share price has risen from 74 kobo as at June 2nd to about 1.15 as at the time of penning this article. In fact, the stock is currently on FULL BID of about 40.49 million units with zero shares on offer.

Investors are understandably bewildered about this unprecedented rise for a stock that released its results months ago and only offered dividends of 6 kobo per share or N361 million payout. At N1.15 kobo currently NEM is trading at its 5 year high which in today’s bear market is unprecedented. So what exactly is going on?

Whilst no official reason is out there to support the rise in the share price one can only infer that investors must be responding to an outcome of the recently concluded AGM held on the 8th of June 2016, for which we await a publication of the board resolutions passed by the company. The share price of NEM was 82 kobo on the day of the AGM and has risen 40% since then.

That’s about the most recent corporate action on NEM we can lay our hands on. The chairman of the company Adewale Teluwo by the way, was also expected to retire at the AGM having served for 10 years, indicative of a new Leadership for the company.

At Nairametrics, we are quite pleased with any suggestion of a new direction for NEM Insurance Plc. The company currently trades at a P/E ratio that is 8x its current earnings however we believe its intrinsic value could be somewhere in the region of N2.50 if the revenue potentials of the company are better harnessed. The company has also consistently paid dividends in the last three years with yields often in the double digits. With better quality risk assets and investments, proper rebranding, better financial transparency and improved dividend payouts, NEM Insurance could be poised to takeover a beleaguered Insurance industry that has been struggling to create value for shareholders.

Nairametrics will continue to track NEM for any corporate actions that can clearly explain the reason for this increase.

Ugodre, institutional investors via 1 – 2 stockbrokerage houses have been accumulating this position for the last 2 – 3 years….free float is moving towards the min.