Trading in Nigerian equities last week was a tale of two parts, big losses in the first part and then a recovery in the latter part. A follow through on the profit taking which started the previous week just before the holiday as well as selling by index funds who had to do a month end rebalance, sent the market sharply lower. The President’s comments on FX over the weekend also dampened the mood. By mid-week this was mostly out of the way, thus leaving the market some room for a retracement.

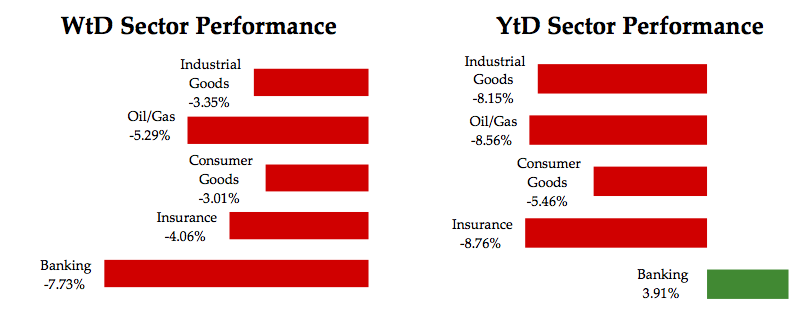

On a balance, the market ended the week lower, with the All Share Index coming off by 439bps to close at 27,634.43pts. At current levels, we are back in negative territory YtD (-352bps). The biggest losses were in the Banks, which shed 773bps, on declines in the likes of STANBIC, ZENITH & ETI. The other sectors also saw big declines, the Oils, Industrial & Consumers were down by 529bos, 335bps and 301bps respectively.

A turnover of N11.58bn (a daily average of N2.90bn) traded this week compared with the N14.79bn (a daily average of N2.98bn). The tier-1 banks led the way, seeing the most volumes, with the likes of UBA, FBNH & ZENITH accounting for more than a third of total volumes. While in term of transaction value, activity in NB, ZENITH, GTB & SEPLAT accounted for more than half of total turnover.

Market Snapshot

| All-Share Index: | 27,634.43pts |

| Market Cap (NGN): | N9.49tn |

| Market Cap (USD): | $48.18bn |

| Total Volumes Traded: | 1.26bn |

| Total Value Traded (NGN): | N11.58bn |

| Daily Average Value Traded – WtD: | N2.90bn |

| Daily Average Value Traded – YtD: | N2.27bn |

| Advance/Decline Ratio: | 12/60 |

Sector Performance:

Market Screeners:

- Top Risers:

CADBURY (+21.66%; N20.50); ETRANZACT (+17.37%; N5.88) & TRANSEXPR (+13.82%; N1.73)

- Top Decliners:

OANDO (-17.87%; N6.16); NEIMETH (-15.05%; N0.79) & MANSARD (-13.79%; N2)

- Top by Volumes Traded:

UBA (170.09mn); FBNH (137.63mn) & ZENITHBANK (110.98mn)

- Top by Value Traded:

NB (N2.48bn); ZENITHBANK (N1.58bn) & GUARANTY (N1.11bn)