Selling by ‘dividend capture’ investors – the practice of buying a stock on or before the qualification date in order to capture the dividend, then selling it immediately it goes ex–dividend – saw the market end the week lower. The selling pressure came in mainly from the Banks, with the likes GUARANTY, ZENITH & UBA – all going ex–div during the week. However, the selling cut across all sectors, with the stock price of over 10 quoted companies touching a new 52week low

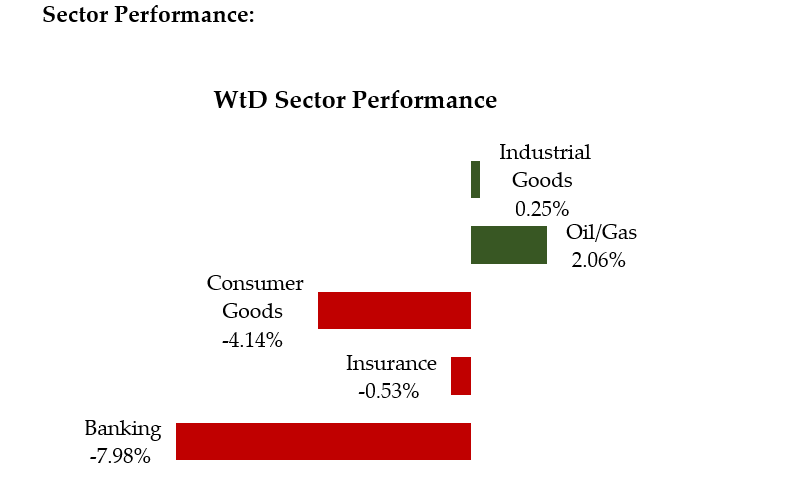

The All–Share Index came off by 1.52% WoW to close at 25,507.09pts, keeping the YtD loss in double digits –10.95%. The Banks were the worst hit, dipping 7.78%, with the likes of FBNH & DIAMONDB touching their lowest level in more than 5–years. Behind the banks, were the Consumers on waning interest, given the macro challenges and pressure on disposable incomes. On the Flip side, the Oils ended higher on the back of demand for the shares of OANDO following the return to profitability of its Toronto listed exploration business, following 2–years of losses. The Industrials closed higher, driven by decent demand for the shares of DANGCEM, performance in the sector was however mixed with the other cement makers closing lower WoW.

Market activity was sharply lower, with a total market turnover of 1.26bn shares valued at N6.43bn when compared with the 1.55bn shares valued at N10.45bn that traded in the previous week. With a daily average of N1.16bn compared to the YtD daily average of N2.37bn. The action was mainly in the shares of GUARANTY, WAPCO, NB & ZENITH – with the first 2 names accounting for over a third of market turnover on the back of cross trades by offshore investors. When we strip out the cross trades, market activity was piss–poor. This was quite unusual, as the last week of a quarter would typically see significant activity levels driven by portfolio rebalancing trades by index funds.

Market Snapshot

- All-Share Index: 25,507.09pts

- Market Cap (NGN): N77tn

- Market Cap (USD): $44.53bn

- Total Volumes Traded: 26bn

- Total Value Traded (NGN): N43bn

- Daily Average Value Traded – WtD: N61bn

- Daily Average Value Traded – YtD: N37bn

- Advance/Decline Ratio: 24/36

Market Screeners:

- Top Risers:

VITAFOAM (+14.83%; N5.42); OANDO (+14.50%; N4.58) & FCMB (+11.25%; N0.89)

- Top Decliners:

UCAP (-19.75%; N1.30); TRANSCORP (-15.97%; N1.00) & TIGERBRANDS (-13.33%; N2.21)

- Top by Volumes Traded:

FCMB (172.12mn); STERLNBANK (105.53mn) & LIVESTOC (104.50mn)

- Top by Value Traded:

GUARANTY (N1.49bn); WAPCO (N0.74bn) & NB (N0.68bn)

- New 52-Week High:

Nil

- New 52-Week Low:

CAVERTON (N1.33); LIVESTOCK (N1.05); PORTPAINT (N3.20); UACPROP (N4.38); WAPCO (N76.51); STERLNBANK (N1.54); AIICO (N0.76); DIAMONDBNK (N1.10); FBNH (N3.00) & SKYEBANK (N0.88)