Growing up, for some reason I watched a lot of boxing fights, firstly on DBN and later on Channels. One of the all-time great fights is Rumble in the Jungle – Ali v Foreman – a bout which was the focus of the film Ali starring Will Smith. Coming into the fight George Foreman, had a fearsome reputation: He demolished the immovable smoking Joe Frazier knocking him down six times in just two rounds to take the title and then went on to batter the only other man to have beaten Ali, Ken Norton, in equal fashion – two rounds. For a boxer, commentary about George was generally unfavourable with regard to his ring IQ and style but consensus was achieved about his punches: they were the heaviest around and fight after fight, same outcome – Foreman basically pummelled opponents into submission with brute force.

Like Foreman, Nigeria relied on a strong crude oil driven export surplus in the current account to fuel government revenues and keep its currency stable. There was no diversity or style to exports with crude oil accounting for over 90% of total exports on average. Importantly average crude production ranged between a narrow set of 2-2.3million barrels per day on average between 1990 and 2015. Nonetheless with oil prices climbing multiple-fold from an average of $18 per barrel in the 1990s to over $100 per barrel after 2010, Nigeria’s exports climbed from a range of under $20billion in the 1990s to between $80-99 billion between 2010 and 2014. Clearly the export gains owed largely to the bullish run in global oil prices.

Table 1: Nigeria’s oil revenues

| Oil Production (million barrels per day) | Oil price ($/barrel) | Oil/total exports (%) | |

| 1990-1999 | 2.0 | 18.3 | 97% |

| 2000-2009 | 2.3 | 49.6 | 97% |

| 2010-2014 | 2.3 | 102.0 | 94% |

| 2015 | 2.1 | 52.3 | 92% |

As exports rose, strengthening dollar reserves and implementation of several economic liberalisation policies following the return to democracy in 1999 meant that imports would also rise in tandem. Thus, looking at data, imports of goods rose from under $10 billion in the 1990s to between $50-66billion. While a lot of focus remains on imports of goods, barely inaudible attention is paid on service imports which given the structure of the economy are likely the proverbial latent iceberg. Here, a major insight from the NBS re-basing of the economy is that Services GDP is now the biggest sector of the economy – clearly individuals making comments about economic diversification have no idea of what they are saying. Services are invisible and largely non-tradable unlike physical goods and in countries with low productivity like Nigeria – a large services’ sector implies a drain pipe on FX. Indeed the historical account since 1981 suggests Nigeria is a net importer of services which places a negative call on our FX reserves with the negative balance climbing from under $5billion in the late 1990s to an average of $20billion between 2010 and 2014.

Think of it this way if Nigeria were a company, while the Goods division racked up a profit, the services unit, which is the biggest portion of the company, was a loss making entity. Look no further than airlines – all the trips on board BA and Virgin, Emirates etc you think those chaps take naira back to their home base? All the ships bringing our imports – all need dollars. Re-insurance, education, health etc. all are paid for from our FX reserves.

What I’ve done so far is to try to explain components of Nigeria’s current account, there are two other segments, one of which is the popular remittances from our very rich diaspora who send in $15-20billion annually. Unfortunately, foreigners invested in Nigeria also send out a roughly similar account largely offsetting the inflows from our rich relatives. Thus the overall current account is dictated by developments in imports and exports of goods and services.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015* | 2015 (annualised) | |

| Exports ($’millions) | 80,579 | 99,878 | 96,905 | 97,818 | 82,586 | 36,037 | 48,049.20 |

| Imports ($’millions) | 50,118 | 66,776 | 57,396 | 55,301 | 61,594 | 37,819 | 50,425.88 |

| Goods balance | 30,461 | 33,102 | 39,509 | 42,517 | 20,992 | (1,783) | (2,376.68) |

| Services balance | (18,472) | (21,361) | (21,716) | (19,566) | (22,466) | (12,418) | (16,557.57) |

| Dollar excess/shortfall | 11,989 | 11,741 | 17,793 | 22,952 | (1,474) | (14,201) | (18,934.25) |

The ousting of the bulls in global oil price markets starting in 2014 puts which continued in 2015 and now appears to be the start of a prolonged bear run implies the era of price driven gains to Nigeria’s exports has ended which as in the table below implies exports will gravitate to a between $25-45billion as long as production hovers around current levels. As production numbers are less likely to remain undisturbed by militants in the creeks, my estimates can be said to be quite sanguine. On the flipside, import growth (both goods and services) had no correlation with price but with fundamental changes in the economic structure which as I argued previously are largely a fall-out of a strong currency; a negative trade balance is going to be with us for a while.

I’ve taken time out to try to explain the macro-under currents to show that Nigeria’s policy makers face tough choices in the coming days which require paradigm shifts in thought process. As Abdul Ganiyu Garba put it in a recent MPC communiqué – now is the time not to make hasty decisions but to articulate our thoughts about where Nigeria’s economy should go with due consideration about the trajectory of economic resources (human and natural).

Given the tie in between Services GDP and FX, a policy of dollar rationalization as currently practiced will no doubt weaken overall GDP growth. If this policy is deliberate with a view to changing the structure of the economy its fine but if it’s to focus on commodity exports like Solid minerals as currently being touted then need we remind policy makers that all commodities are in the bear phase of the super-cycle. This also rules out a pivot to boosting agriculture production unless it’s to reduce food import dependence. Policy makers need to realise that commodities exploitation requires less of human capital, which Nigeria has in abundance, and more of capital, which is in short supply locally. Put simply, the goal of economy policy should situate sectors of the economy which are intensive in Nigeria’s teeming human resources. Clearly this will mean de-emphasis on Services and primary based sectors which require maintenance of reserve levels a beleaguered oil price outlook will not permit. Blessed are the flexible in currency, they shall not be bent out of shape – a policy of weakening the naira outweighs the fleeting benefits of a hard peg to the structural evolution of our economy.

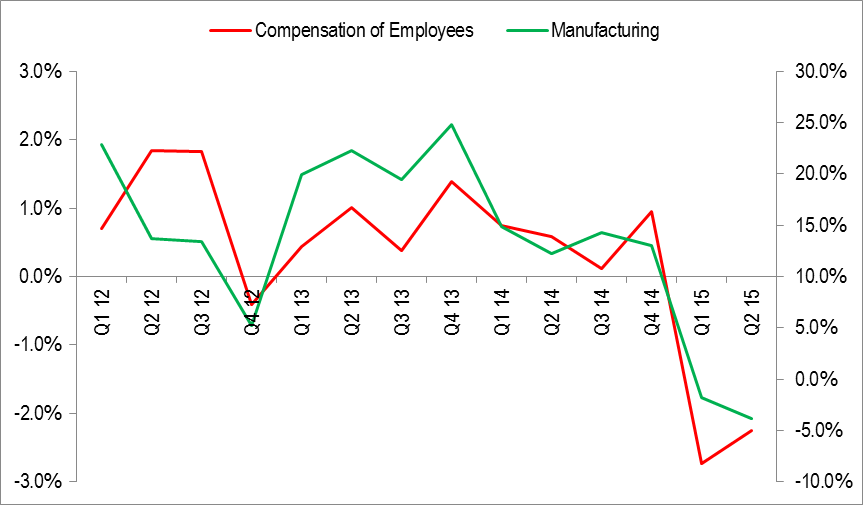

Having skirted around the issue the focus really should be a pivot to manufacturing. Ironically, manufacturing is in a recession, unlike some who are quick to point to FX issues, the present problems are driven by aggregate demand weakness. As can be seen in the chart below, real wage growth, which in 2015 was negative, shows strong co-movement with manufacturing under the rebased NBS series. Therefore, to raise wages to boost consumer spending that will get the manufacturing sector out of the current rut, the fiscal stance should be Keynesian, which to be fair to Buhari government, they’ve gotten spot on. To fund this plan, government needs to be very innovative about funding sources. Current plans revolve around leveraging the economy to high levels in both dollars and naira. Whilst we should fully explore all concessionary means, especially from Asia, we can bolster our ‘equity’ contribution by exchanging our dollar receipts at a lower naira level. We spend naira anyway and if we do not want to go to IMF slavery why not take the flexible route.

Nairametrics Research

In a similar but related note, the import of the foregoing is that the central goal of monetary policy is fiscal accommodation. Monetary policy should ignore the talk about tightening to stave off inflation and entice FPI flows. Firstly, claims about hawkish monetary policy to fight inflation display shallow understanding of Nigeria’s CPI basket which is dominated by food, in particular farm produce. The Nigerian basket responds more to supply side shocks that to demand driven sentiment which study after study has proven to be statistically agnostic to monetary policy. More importantly given the already deflationary impact of negative wage growth, who exactly are you tightening for on the demand side? Protagonists of the tightening argument lastly cling to the dubious claim of loss of CBN credibility as inflation breaches the 6-9% threshold. The trend average of inflation in Nigeria is 12-13%, thus if you ask me the CBN should simply move adjust the dubious threshold. Janet Yellen shifted goal post by US rate lift-off in September 2015 while Mark Carney did a 360 degree turnaround over UK rate tightening. Not the end of the world? Quite frankly the CBN should dismiss these notions and commence full scale easing to support the expansionist fiscal posture.

On the argument for FPI investments, which immediately raises discussions over the capital account, my thoughts are that we liberalised at a pace our capital markets and FX markets were not mature to handle. As in 2009, reversing portfolio flows leave our markets unable to cope. Some form of capital controls should come back on the table in the form of either minimum holding periods for foreign investors or a tax on repatriations in less than desired time. Focus should be on boosting FDI via measures that reduce the cost of doing business in Nigeria.

In summary, my advice to Nigerian policy makers is to adopt a strategic approach which reflects a holistic thinking to address the current economic quagmire the low oil price has brought on the economy. Now is not the time for unsure budget proposals, constantly changing FX policy manoeuvres, dogmatic body language and appeals to nationalistic rhetoric. Now is the time to target government spending at putting in place critical economic infrastructure to boost manufacturing exports, ease domestic monetary policy, tackle bureaucratic inefficiencies that make it difficult for small businesses to set up and liberalise the capital markets at the pace of development of our domestic financial markets. For so long our economy has relied on crude oil, which makes use of only a little helping of our numerous human resources like Foreman relied on strength. Ali knew he could not match Foreman pound for pound so his despite publicly claiming to use speed and movement to outwit his opponent, he invented rope-a-dope a tactic that basically wore out his opponent while waiting for an opening. In the eighth round, the window came, after swinging several jabs, Ali connected with a left hook which sent Foreman reeling into Ali’s waiting right fist sending him down. From dominating the fight to facing the 10-second countdown. General Muhammadu Buhari is not naïve, as a soldier in turbulent days of the late 1960s, his survival owed much to reading the times correctly and acting tactfully like Mohammed Ali. Mr President use those guiles now, your nation awaits.

Follow Walle on twitter @Walesmit

This writer analysis on buharinomic is neither wrong or right This,serviced growth in nigeria economy, being in control of the most percentage of Nigerian economy,displacing oil.Now can you tell me, which country in our world. that one group of any thing controls another..politics is about power, and power is about interest and it is about control and the controlling of this fear,but on another hand I do not think this walle smith is an African,not to talk being as a nigeriaYou can give a dog a bad name, and you kill the dog and when the owner of the dog is asked “why did killed your dog,i thought you like this dog,he is your companion”,all the owner can say” this dog is bad from it’s mother womb and the dog is bad”.

This is the stage of Nigerian economy now,THE POPULATION IS GROWING BUT STUNTED,AND WEALTH GROWTH IS NOT MATCHING ANY THING (1) PERSONAL FREEDOM (2)FACILITIES/AMENITIES/.INFRASTRUCTUAL/ITILITIES which would have matched the new growing young population,and this is the causes of (1) unrest in niger delta (2)boko haram terrorism (3) this agitation for Biafra, when a new president is elected,HE FACES A NEW CHALLENGES WHICH ARE LIFE-THREATENING. when this young Nigerians see their leaders sees accumulates wealths beyond their needs,and with proper investigation,you finds this leaders do not acquired this wealth legitimately,and those young Nigerians are not stupid ,so religion and ethnic grouping offers this escapism.there was a northern Nigerian politicans that warned Chief Obasanjo that Nigeria was ripe for revolution(I have forgotten his name,and he said it a couple months with the coming of democracy) and his words is becoming true wether,you ‘re righteous or wrong,rich or poor.

Now any man in the street in Nigeria knows the problem in Nigeria and the causes of this problem in Nigeria socially,politically and the formost the economy.This so called serviced growth is driven by by knowledge,this knowledge is piloted by fresh Nigerian graduate and the causes of this is THEY LACKS ACCESS TO CREDIT TO FINANCES THEIR INVESTMENT MANUFACTURING TO MATERIALIZES THEIR THEORICAL KNOWLEDGE IN A REALITITES,AND THE CA– USES OF THIS MAJOR PROBLEM LIES WITH THE CENTRAL BANK OF NIGERIA, and the reason are this (1) the central bank of Nigeria failed to formulates a programe/system to controls inflation regardless how the nation finances it.s fisical deficit by any means (2) the C.B.N monopolizes everything,instead of regulating,where they should conrols,they allows it to flows.where it will allows freedom.they controls,and THIS UNJUSTIFIED PRESENT OF THE NIGERIAN CENTRAL BANK USUAGE OF FOREX AND IT’S MONOPOLY AND IT’S ALLOCATION OF FOREX TO NIGERIAN BANKS.

who uses forex for personal uses or for business,are? Nigerian,.it is an easy system,any money-missed road businessman can be rich overnight in Nigeria without using 5 % of their intellects or brain,and this is feasting and parasiting Nigerian economy,when any Nigerian govt formulate an economic system in action,it does not work.we have an inflation that is going accumulating to more than 3000 % since 1986,and nobody have NOT ASKED THE PROPER QUESTIONS IN NIGERIA SINCE 1986 AND HOW TO MOVE FORWARD.