FMCG profits have declined sharply as the firms reel from the impact of macro-headwinds and plunge in purchasing power.

Nigerian FMCG firms are having a very difficult year, going by first quarter results released thus far. The hardship in the FMCG sector is a carryover from the previous year, when a combo of macro-economic headwinds decimated investor value in the financial markets, and plunged firms’ bottom-lines.

The first of the headwinds was the slump in oil price, which the government depends on for its spending power. Following was the attrition in foreign reserves, as the CBN deployed it to shore up the value of the Naira which was fast weakening on accelerated sell-off by foreign investors. Then, the devaluation followed, leading to a spike in input costs from imported raw materials.

The woes in the FMCG sector can be linked to these, (at the very least). Prior to this FMCG firms faltered on high energy costs and challenges of insecurity in the north.

Nigerian FMCG firms are reeling hard from these factors, as shown by the plunge in their net profit for both 2014 year end and the first quarter of 2015.

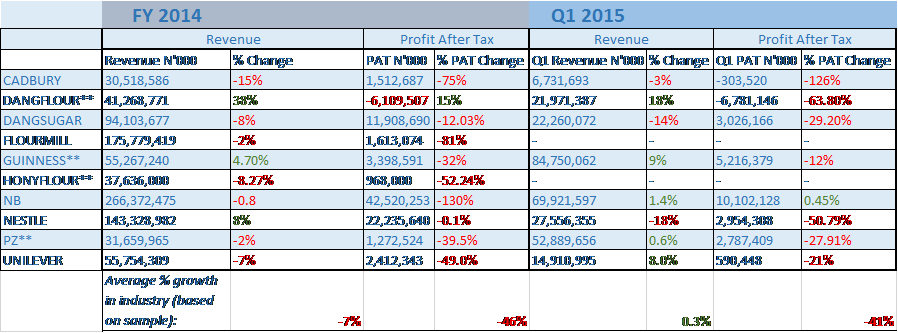

Cadbury Nigeria posted the largest quarterly fall in after-tax profit of the 10 companies (out of 15 listed FMCG companies) surveyed. Its profit after tax fell by 126 percent as it booked Q1 losses of N303 million compared to the corresponding quarter of the previous year. Dangote flour also booked losses of N6.7 billion in the first quarter of the year, as its PAT plunged by 64 percent. Nestle, whose Q1 revenue decline of -17.6% to N27.6 billion (from N33.4 billion), is its lowest top-line in 13 quarters, also saw its Q1 PAT fall by 51 percent from the corresponding quarter of last year.

Dangote sugar’s Q1 PAT fell by 29 percent, PZ fell by 27 percent, and Unilever Nigeria fell by 21 percent.

Shares in the consumer goods sector have also not performed poorly. The NSE Consumer goods index is down -3.47 percent year-to-date, compared with the All Share Index, which has returned 1.39 percent during the same period.

So what is the reason for this cliff-drop in the performance of the sector?

The performance of FMCG firms is inextricably linked to the aggregate spending power in the economy, and with the Nigerian economy hit by these factors, FMCG firms have particularly been hurt bad.

The first and most important reason for their dismal performance is weaker aggregate demand, which is indicated by their weaker sales. Looking at the 10 companies analysed (as a proxy for the total 15 listed FMCG companies), the average revenue growth in the industry was -7 percent. This means that FMCG industry sales in the country declined by 7 percent in FY 2014. For the first quarter of 2015, average sales growth has been up by a paltry 0.3 percent, showing that recovery is still weak. (This can arguably be attributed to the seasonal factors).

Nigeria’s inflation rate has been inching higher, clocking 8.7 percent in April as against 8.5 percent in the preceding month. GDP growth also declined to 3.8 percent in the first quarter of the year, compared to 5.9 percent in the previous quarter. The implication of this will be reduced spending power, which will hurt demand for fast moving consumer goods.

Other factors responsible for this trend dovetail into the first factor:

The devaluation, which has increased the cost of imports, has translated to higher production cost for firms, and higher consumer prices, as evidenced in the steady but gradual uptick in the consumer price index.

The oil price fall, has also affected the spending power of thousands of civil servants across the 36 states of the federation and the capital, as the various governments struggle to foot their wage bill. The fall in consumption of the affected civil servants is very significant.

More so, if the new government executes on mooted austerity measures, consumer spending will plunge further.

The markets will be counting on better consumer sentiment after the handover at the end of May. Whether the improved sentiment will lead to higher spending is still to be seen.

Edozie Ifebi

Well put together write-up. considering the assumed change of fortune for the Nigeria state, can this narratives expressed in your write-up still reflect FMCG companies struggles in 2018